Exam 6: Risk, Return, and the Capital Asset Pricing Model

Exam 1: An Overview of Financial Management and the Financial Environment46 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes74 Questions

Exam 3: Analysis of Financial Statements103 Questions

Exam 4: Time Value of Money159 Questions

Exam 5: Bonds, Bond Valuation, and Interest Rates100 Questions

Exam 6: Risk, Return, and the Capital Asset Pricing Model137 Questions

Exam 7: Stocks, Stock Valuation, and Stock Market Equilibrium66 Questions

Exam 8: Financial Options and Applications in Corporate Finance26 Questions

Exam 9: The Cost of Capital90 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows104 Questions

Exam 11: Cash Flow Estimation and Risk Analysis70 Questions

Exam 12: Financial Planning and Forecasting Financial Statements47 Questions

Exam 13: Corporate Valuation, Value-Based Management and Corporate Governance24 Questions

Exam 15: Capital Structure Decisions70 Questions

Exam 16: Working Capital Management128 Questions

Exam 17: Multinational Financial Management47 Questions

Exam 18: Lease Financing22 Questions

Exam 19: Hybrid Financing: Preferred Stock, Warrants, and Convertibles30 Questions

Exam 20: Initial Public Offerings, Investment Banking, and Financial Restructuring25 Questions

Exam 21: Mergers, Lbos, Divestitures, and Holding Companies48 Questions

Exam 22: Bankruptcy, Reorganization, and Liquidation10 Questions

Exam 23: Derivatives and Risk Management14 Questions

Exam 24: Portfolio Theory, Asset Pricing Models, and Behavioral Finance31 Questions

Exam 25: Real Options19 Questions

Exam 26: Analysis of Capital Structure Theory31 Questions

Exam 27: Providing and Obtaining Credit35 Questions

Exam 28: Advanced Issues in Cash Management and Inventory Control24 Questions

Exam 29: Pension Plan Management10 Questions

Exam 30: Financial Management in Not-For-Profit Businesses10 Questions

Select questions type

Company A has a beta of 0.70, while Company B's beta is 1.20. The required return on the stock market is 11.00%, and the risk-free rate is 4.25%. What is the difference between A's and B's required rates of return? (Hint: First find the market risk premium, then find the required returns on the stocks.)

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

E

For markets to be in equilibrium, that is, for there to be no strong pressure for prices to depart from their current levels,

Free

(Multiple Choice)

4.9/5  (44)

(44)

Correct Answer:

A

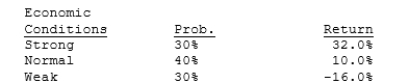

Magee Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns? (Hint: Use the formula for the standard deviation of a population, not a sample.)

Free

(Multiple Choice)

4.8/5  (47)

(47)

Correct Answer:

B

A stock with a beta equal to -1.0 has zero systematic (or market) risk.

(True/False)

4.8/5  (32)

(32)

Generally, the SML is used to find the required return, but on occasion the required return is given and we must solve for one of the other variables. We warn our students before the test that to answer a number of the questions they will have to transform the SML equation to solve for beta, the market risk premium, the risk-free rate, or the market return.

-Preston Inc.'s stock has a 25% chance of producing a 30% return, a 50% chance of producing a 12% return, and a 25% chance of producing a -18% return. What is the firm's expected rate of return?

(Multiple Choice)

4.7/5  (35)

(35)

You have the following data on (1) the average annual returns of the market for the past 5 years and (2) similar information on Stocks A and B. Which of the possible answers best describes the historical betas for A and B?

(Multiple Choice)

4.9/5  (38)

(38)

Even if the correlation between the returns on two securities is +1.0, if the securities are combined in the correct proportions, the resulting 2-asset portfolio will have less risk than either security held alone.

(True/False)

4.8/5  (34)

(34)

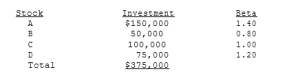

Bruce Niendorf holds the following portfolio:  Bruce plans to sell Stock A and replace it with Stock E, which has a beta of 0.75. By how much will the portfolio beta change?

Bruce plans to sell Stock A and replace it with Stock E, which has a beta of 0.75. By how much will the portfolio beta change?

(Multiple Choice)

4.8/5  (31)

(31)

Bad managerial judgments or unforeseen negative events that happen to a firm are defined as "company-specific," or "unsystematic," events, and their effects on investment risk can in theory be diversified away.

(True/False)

4.8/5  (41)

(41)

Stock A has a beta of 0.8, Stock B has a beta of 1.0, and Stock C has a beta of 1.2. Portfolio P has equal amounts invested in each of the three stocks. Each of the stocks has a standard deviation of 25%. The returns on the three stocks are independent of one another (i.e., the correlation coefficients all equal zero). Assume that there is an increase in the market risk premium, but the risk-free rate remains unchanged. Which of the following statements is CORRECT?

(Multiple Choice)

4.9/5  (33)

(33)

Assume that two investors each hold a portfolio, and that portfolio is their only asset. Investor A's portfolio has a beta of minus 2.0, while Investor B's portfolio has a beta of plus 2.0. Assuming that the unsystematic risks of the stocks in the two portfolios are the same, then the two investors face the same amount of risk. However, the holders of either portfolio could lower their risks, and by exactly the same amount, by adding some "normal" stocks with beta = 1.0.

(True/False)

4.8/5  (39)

(39)

Assume that you manage a $10.00 million mutual fund that has a beta of 1.05 and a 9.50% required return. The risk-free rate is 4.20%. You now receive another $5.00 million, which you invest in stocks with an average beta of 0.65. What is the required rate of return on the new portfolio? (Hint: You must first find the market risk premium, then find the new portfolio beta.)

(Multiple Choice)

4.9/5  (37)

(37)

Your portfolio consists of $50,000 invested in Stock X and $50,000 invested in Stock Y. Both stocks have an expected return of 15%, betas of 1.6, and standard deviations of 30%. The returns of the two stocks are independent, so the correlation coefficient between them, rXY, is zero. Which of the following statements best describes the characteristics of your 2-stock portfolio?

(Multiple Choice)

5.0/5  (35)

(35)

"Risk aversion" implies that investors require higher expected returns on riskier than on less risky securities.

(True/False)

4.8/5  (42)

(42)

The CAPM is built on historic conditions, although in most cases we use expected future data in applying it. Because betas used in the CAPM are calculated using expected future data, they are not subject to changes in future volatility. This is one of the strengths of the CAPM.

(True/False)

4.7/5  (44)

(44)

You hold a diversified $100,000 portfolio consisting of 20 stocks with $5,000 invested in each. The portfolio's beta is 1.12. You plan to sell a stock with b = 0.90 and use the proceeds to buy a new stock with b = 1.80. What will the portfolio's new beta be?

(Multiple Choice)

4.8/5  (37)

(37)

Wei Inc. is considering a capital budgeting project that has an expected return of 25% and a standard deviation of 30%. What is the project's coefficient of variation?

(Multiple Choice)

4.8/5  (44)

(44)

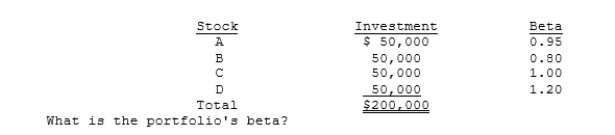

Jim Angel holds a $200,000 portfolio consisting of the following stocks:

(Multiple Choice)

4.8/5  (36)

(36)

Other things held constant, if the expected inflation rate decreases and investors also become more risk averse, the Security Market Line would be affected as follows:

(Multiple Choice)

4.9/5  (36)

(36)

Showing 1 - 20 of 137

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)