Exam 10: Risk and Return: the Capital Asset Pricing Model

Exam 1: Introduction to Corporate Finance50 Questions

Exam 2: Corporate Governance24 Questions

Exam 3: Financial Statement Analysis86 Questions

Exam 4: Discounted Cash Flow Valuation128 Questions

Exam 5: Bond, Equity and Firm Valuation107 Questions

Exam 6: Net Present Value and Other Investment Rules110 Questions

Exam 7: Making Capital Investment Decisions83 Questions

Exam 8: Risk Analysis, Real Options and Capital Budgeting81 Questions

Exam 9: Risk and Return: Lessons From Market History57 Questions

Exam 10: Risk and Return: the Capital Asset Pricing Model118 Questions

Exam 11: Factor Models and the Arbitrage Pricing Theory48 Questions

Exam 12: Risk, Cost of Capital and Capital Budgeting48 Questions

Exam 13: Efficient Capital Markets and Behavioural Finance49 Questions

Exam 14: Long-Term Financing: an Introduction37 Questions

Exam 15: Capital Structure: Basic Concepts80 Questions

Exam 16: Capital Structure: Limits to the Use of Debt66 Questions

Exam 17: Valuation and Capital Budgeting for the Levered Firm56 Questions

Exam 18: Dividends and Other Payouts80 Questions

Exam 19: Equity Financing66 Questions

Exam 20: Debt Financing57 Questions

Exam 21: Leasing41 Questions

Exam 22: Options and Corporate Finance86 Questions

Exam 23: Options and Corporate Finance: Extensions and Applications42 Questions

Exam 24: Warrants and Convertibles50 Questions

Exam 25: Financial Risk Management With Derivatives68 Questions

Exam 26: Short-Term Finance and Planning116 Questions

Exam 27: Short-Term Capital Management111 Questions

Exam 28: Mergers and Acquisitions89 Questions

Exam 29: Financial Distress36 Questions

Exam 30: International Corporate Finance81 Questions

Select questions type

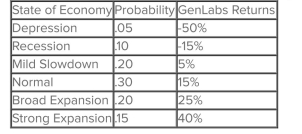

GenLabs has been a hot share the last few years, but is risky. The expected returns for GenLabs are highly dependent on the state of the economy as follows:

The expected return on GenLabs is:

The expected return on GenLabs is:

Free

(Multiple Choice)

4.8/5  (42)

(42)

Correct Answer:

C

The total number of variance and covariance terms in portfolio is N2.How many of these would be (including non-unique) covariance's?

Free

(Multiple Choice)

4.9/5  (40)

(40)

Correct Answer:

C

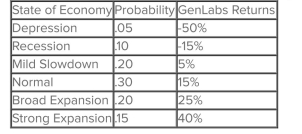

GenLabs has been a hot share the last few years, but is risky. The expected returns for GenLabs are highly dependent on the state of the economy as follows:

The standard deviation of GenLabs returns is

The standard deviation of GenLabs returns is

(Multiple Choice)

4.9/5  (44)

(44)

The elements in the off-diagonal positions of the variance/covariance matrix are:

(Multiple Choice)

4.9/5  (39)

(39)

You are considering purchasing share S.This share has an expected return of 8% if the economy booms and 3% if the economy goes into a recessionary period.The overall expected rate of return

On this share will:

(Multiple Choice)

4.8/5  (37)

(37)

A portfolio is made up of 75% of share 1, and 25% of share 2.Share 1 has a variance of .08, and share 2 has a variance of .035.The covariance between the shares is -.001.Calculate both the variance and the standard deviation of the portfolio.

(Essay)

4.8/5  (40)

(40)

The _____ tells us that the expected return on a risky asset depends only on that asset's nondiversifiable risk.

(Multiple Choice)

4.7/5  (38)

(38)

The linear relation between an asset's expected return and its beta coefficient is the:

(Multiple Choice)

4.7/5  (29)

(29)

A portfolio has 50% of its funds invested in Security One and 50% of its funds invested in Security Two.Security One has a standard deviation of 6%.Security Two has a standard deviation of 12%.

The securities have a coefficient of correlation of 0.5.Which of the following values is the portfolio

Variance?

(Multiple Choice)

4.9/5  (40)

(40)

Risk that affects a large number of assets, each to a greater or lesser degree, is called _____ risk.

(Multiple Choice)

4.8/5  (28)

(28)

What is the standard deviation of a portfolio which is invested 20% in share A, 30% in share B and 50% in share C?

\multicolumn 3 |l| Returns if State Occurs State of Economy Probability of State of Economy Share A Share B Share C Boom 10\% 15\% 10\% 5\% Normal 70\% 9\% 6\% 7\% Recession 20\% 14\% 2\% 8\%

(Multiple Choice)

4.9/5  (25)

(25)

You own the following portfolio of shares. what is the portfolio weight of share C?

Share Number of Shares Price per Share A 100 22 B 600 C17 C 400 46 D 200 38

(Multiple Choice)

4.8/5  (44)

(44)

You have plotted the data for two securities over time on the same graph, i.e., the month return of each security for the last 5 years.If the pattern of the movements of the two securities rose and fell

As the other did, these two securities would have:

(Multiple Choice)

4.9/5  (41)

(41)

In previous chapters, it was stated that financial managers should act to maximize shareholder wealth.Why are the efficient markets hypothesis (EMH), the CAPM, and the SML so important in the accomplishment of this objective?

(Essay)

4.8/5  (29)

(29)

Which one of the following is an example of a nondiversifiable risk?

(Multiple Choice)

4.8/5  (31)

(31)

The expected return on HiLo equity is 13.69% while the expected return on the market is 11.5%.The beta of HiLo is 1.3.What is the risk-free rate of return?

(Multiple Choice)

4.9/5  (39)

(39)

Showing 1 - 20 of 118

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)