Exam 8: Variable Costing and the Costs of Quality and Sustainability

Exam 1: The Changing Role of Managerial Accounting in a Dynamic Business Environment100 Questions

Exam 2: Basic Cost Management Concepts127 Questions

Exam 3: Product Costing and Cost Accumulation in a Batch Production Environment107 Questions

Exam 4: Process Costing and Hybrid Product-Costing Systems93 Questions

Exam 5: Activity-Based Costing and Management125 Questions

Exam 6: Activity Analysis, Cost Behavior, and Cost Estimation117 Questions

Exam 7: Cost-Volume-Profit Analysis125 Questions

Exam 8: Variable Costing and the Costs of Quality and Sustainability88 Questions

Exam 9: Financial Planning and Analysis: the Master Budget122 Questions

Exam 10: Standard Costing and Analysis of Direct Costs78 Questions

Exam 11: Flexible Budgeting and Analysis of Overhead Costs101 Questions

Exam 12: Responsibility Accounting, Operational Performance Measures, and the Balanced Scorecard84 Questions

Exam 13: Inventory Management and Economic Order Quantity (EOQ) Analysis71 Questions

Select questions type

Cost-volume-profit analysis and break-even calculations account for fixed manufacturing overhead as a lump sum.

Free

(True/False)

4.7/5  (43)

(43)

Correct Answer:

True

Under absorption costing, which of the following is not considered a product cost?

Free

(Multiple Choice)

4.9/5  (43)

(43)

Correct Answer:

D

Income reported under absorption costing and variable costing is:

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

B

Assuming the number of units sold and produced are the same, which of the following statements is true when comparing net income using absorption and variable costing?

(Multiple Choice)

4.7/5  (35)

(35)

What are three strategies of environmental cost management? Define each strategy.

(Essay)

4.8/5  (32)

(32)

On an absorption-costing income statement, fixed overhead costs are period costs.

(True/False)

4.8/5  (35)

(35)

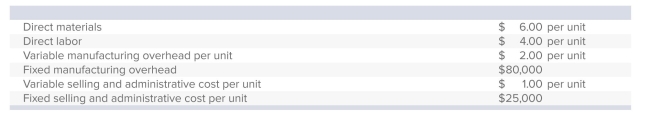

Jordan Manufacturing has the following cost information for year 20X9:  During 20X9, Jordan produced 12,500 units, out of which 11,000 were sold for $60 each. What is Jordan's net income assuming the company uses variable costing:

During 20X9, Jordan produced 12,500 units, out of which 11,000 were sold for $60 each. What is Jordan's net income assuming the company uses variable costing:

(Multiple Choice)

4.8/5  (32)

(32)

All of the following are inventoried under variable costing except:

(Multiple Choice)

4.8/5  (38)

(38)

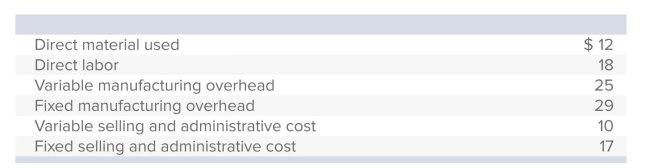

Vega Enterprises has computed the following unit costs for the year just ended:  Under variable costing, each unit of the company's inventory would be carried at:

Under variable costing, each unit of the company's inventory would be carried at:

(Multiple Choice)

4.8/5  (36)

(36)

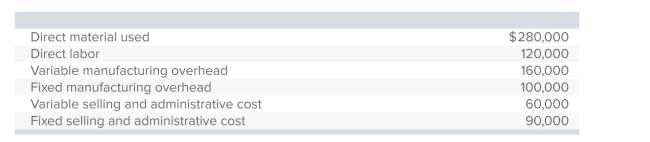

Fort Smith Technologies incurred the following costs during the past year when planned production and actual production each totaled 20,000 units:  If Fort Smith uses absorption costing, the total inventoriable costs for the year would be:

If Fort Smith uses absorption costing, the total inventoriable costs for the year would be:

(Multiple Choice)

4.8/5  (35)

(35)

Riverton Corp., which began business at the start of the current year, had the following data: Planned and actual production: 40,000 units Sales: 37,000 units at $15 per unit Production costs: Variable: $4 per unit Fixed: $260,000 Selling and administrative costs: Variable: $1 per unit Fixed: $32,000 The contribution margin that the company would disclose on a variable-costing income statement is:

(Multiple Choice)

4.8/5  (38)

(38)

On a global scale, there are four primary environmental agreements addressing the atmosphere, hazardous substances, the marine environment, nature conservation, and nuclear power issues.

(True/False)

4.8/5  (46)

(46)

Which of the following situations would cause variable-costing income to be higher than absorption-costing income?

(Multiple Choice)

4.8/5  (35)

(35)

Income reported under absorption and variable costing can be reconciled by focusing on the effects of the five places where the two statements differ.

(True/False)

4.9/5  (40)

(40)

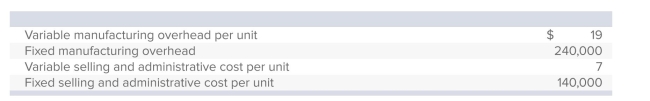

ProTech began business at the start of the current year.The company planned to produce 40,000 units, and actual production conformed to expectations.Sales totaled 37,000 units at $42 each.Costs incurred were:  If there were no variances, the company's absorption-costing income would be:

If there were no variances, the company's absorption-costing income would be:

(Multiple Choice)

4.7/5  (33)

(33)

What is the difference between a product's quality of design and its quality of conformance?

(Essay)

4.9/5  (48)

(48)

Which of the following statements is false regarding absorption costing?

(Multiple Choice)

4.9/5  (37)

(37)

Foxtrot reported $65,000 of income for the year by using absorption costing.The company had no beginning inventory, planned and actual production of 20,000 units, and sales of 18,000 units.Standard variable manufacturing costs were $20 per unit, and total budgeted fixed manufacturing overhead was $100,000.If there were no variances, income under variable costing would be:

(Multiple Choice)

4.7/5  (32)

(32)

Showing 1 - 20 of 88

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)