Exam 14: Price Discrimination and Pricing Strategy

Exam 1: The Big Ideas in Economics103 Questions

Exam 2: The Power of Trade and Comparative Advantage169 Questions

Exam 3: Business Fluctuations: Aggregate Demand and Supply114 Questions

Exam 4: Equilibrium: How Supply and Demand Determine Prices105 Questions

Exam 5: Elasticity and Its Applications153 Questions

Exam 6: Taxes and Subsidies100 Questions

Exam 7: The Price System: Signals, Speculation, and Prediction149 Questions

Exam 8: Price Ceilings and Floors199 Questions

Exam 9: International Trade78 Questions

Exam 10: Externalities: When the Price Is Not Right146 Questions

Exam 11: Costs and Profit Maximization Under Competition126 Questions

Exam 12: Competition and the Invisible Hand29 Questions

Exam 13: Monopoly144 Questions

Exam 14: Price Discrimination and Pricing Strategy152 Questions

Exam 15: Oligopoly and Game Theory127 Questions

Exam 16: Competing for Monopoly: the Economics of Network Goods51 Questions

Exam 17: Monopolistic Competition and Advertising143 Questions

Exam 18: Labor Markets148 Questions

Exam 19: Public Goods and the Tragedy of the Commons153 Questions

Exam 20: Political Economy and Public Choice151 Questions

Exam 21: Economics, Ethics, and Public Policy143 Questions

Exam 22: Managing Incentives140 Questions

Exam 23: Stock Markets and Personal Finance53 Questions

Exam 24: Asymmetric Information: Moral Hazard and Adverse Selection133 Questions

Exam 25: Consumer Choice141 Questions

Exam 26: Gdp and the Measurement of Progress135 Questions

Exam 27: The Wealth of Nations and Economic Growth155 Questions

Exam 28: Growth, Capital Accumulation, and the Economics of Ideas: Catching up Vs the Cutting Edge145 Questions

Exam 29: Saving, Investment, and the Financial System146 Questions

Exam 30: Supply and Demand183 Questions

Exam 31: Unemployment and Labor Force Participation96 Questions

Exam 32: Inflation and the Quantity Theory of Money165 Questions

Exam 33: Transmission and Amplification Mechanisms133 Questions

Exam 34: The Federal Reserve System and Open Market Operations144 Questions

Exam 35: Monetary Policy139 Questions

Exam 36: The Federal Budget: Taxes and Spending158 Questions

Select questions type

Bundling is expected to provide greater profits when the two bundled goods are: I. substitutes. II. goods that have high fixed costs and low marginal costs. III. very close complements.

(Multiple Choice)

4.9/5  (35)

(35)

What conditions are necessary for a firm to practice price discrimination?

(Essay)

4.8/5  (43)

(43)

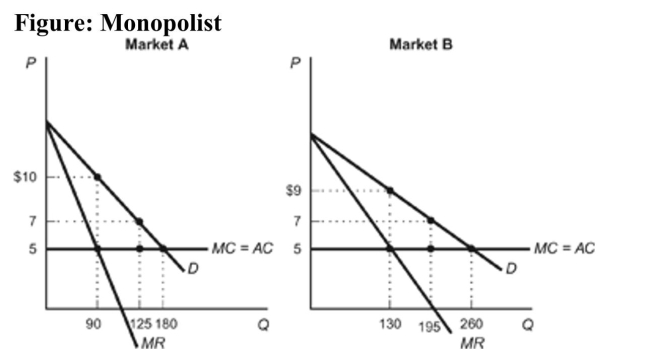

Reference: Ref 14-1 (Figure: Monopolist) Refer to the figure. Based on the demand curves for a monopolist's product in two different markets- Market A and Market B-if the monopolist were to charge a uniform price of $10 in both markets, how much profit would the monopolist lose?

Reference: Ref 14-1 (Figure: Monopolist) Refer to the figure. Based on the demand curves for a monopolist's product in two different markets- Market A and Market B-if the monopolist were to charge a uniform price of $10 in both markets, how much profit would the monopolist lose?

(Multiple Choice)

4.9/5  (39)

(39)

Perfect price discrimination causes the demand curve to become the marginal revenue curve.

(True/False)

4.8/5  (36)

(36)

Although price discrimination may increase the profits of drug companies, it reduces the incentive for drug companies to develop new drugs.

(True/False)

4.8/5  (36)

(36)

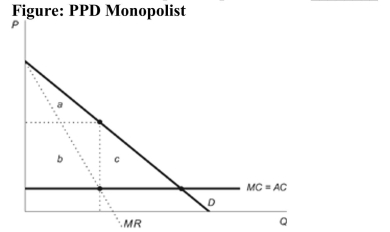

(Figure: PPD Monopolist) Refer to the figure. A monopolist who cannot price discriminate earns profit equal to area(s) ________, and a monopolist practicing perfect price discrimination earns profit equal to areas ________.

(Multiple Choice)

4.7/5  (47)

(47)

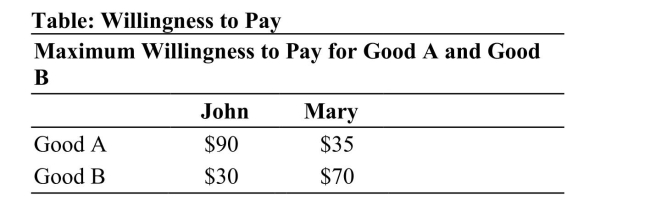

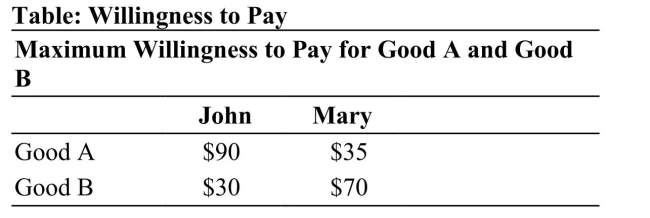

Reference: Ref 14-6 (Table: Willingness to Pay) Refer to the table. Assume the firm has zero costs. If the firm were to set individual prices for each of the two goods, how much total profit does it earn from Good A?

Reference: Ref 14-6 (Table: Willingness to Pay) Refer to the table. Assume the firm has zero costs. If the firm were to set individual prices for each of the two goods, how much total profit does it earn from Good A?

(Multiple Choice)

4.8/5  (29)

(29)

Arbitrage is ________ in one market and ________ in another market.

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following statements is FALSE? I. If the demand curves are different, it is more profitable to set a single price than different prices in markets. II. To maximize profit the firm should set a lower price in markets with more elastic demand. III. The presence of arbitrage makes it easy for a firm to price discriminate.

(Multiple Choice)

4.9/5  (38)

(38)

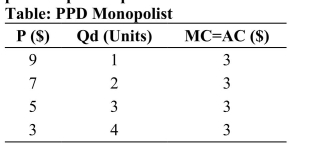

(Table: PPD Monopolist) The table that shows demand and cost data for a monopolist to answer the following questions. Assume the monopolist is able to practice perfect price discrimination.  a. What quantity does the monopolist produce? b. What is the dollar amount of consumer surplus in the market? c. How does this compare with the case of a firm in a competitive industry?

a. What quantity does the monopolist produce? b. What is the dollar amount of consumer surplus in the market? c. How does this compare with the case of a firm in a competitive industry?

(Essay)

4.9/5  (31)

(31)

Explain how firms practice tying and bundling, and specify the difference between the two pricing schemes.

(Essay)

4.8/5  (34)

(34)

Reference: Ref 14-6 (Table: Willingness to Pay) Refer to the table. If the firm were to engage in bundling, its profits would increase by how much relative to setting individual prices for each good?

Reference: Ref 14-6 (Table: Willingness to Pay) Refer to the table. If the firm were to engage in bundling, its profits would increase by how much relative to setting individual prices for each good?

(Multiple Choice)

4.7/5  (39)

(39)

Mark has a maximum willingness to pay for Word and Excel of $200 and $30, respectively. Beth has a maximum willingness to pay of $50 and $190, respectively. At a bundle price of $230, Mark and Beth receive total consumer surplus of $10.

(True/False)

5.0/5  (34)

(34)

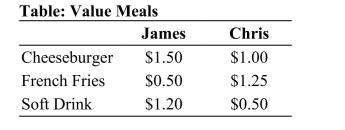

(Table: Value Meals) The table shows James and Chris' willingness to pay at a local fast-food restaurant. Use this information to answer the following questions:  a. If the fast-food restaurant is trying to maximize profits by pricing separately, what price will they charge for a cheeseburger? French fries? Soft drink? b. Assuming that it costs the restaurant only $0.10 to produce a cheeseburger, $0.15 to produce one order of french fries, and $0.05 to produce a soft drink, what will be their total profits if they price separately using the prices determined above? c. Suppose the restaurant is trying to decide whether or not to offer a value meal, which would include a cheeseburger, french fries, and a soft drink. What price should they charge for this value meal? Would profits be higher or lower than if the restaurant sets prices individually? Explain.

a. If the fast-food restaurant is trying to maximize profits by pricing separately, what price will they charge for a cheeseburger? French fries? Soft drink? b. Assuming that it costs the restaurant only $0.10 to produce a cheeseburger, $0.15 to produce one order of french fries, and $0.05 to produce a soft drink, what will be their total profits if they price separately using the prices determined above? c. Suppose the restaurant is trying to decide whether or not to offer a value meal, which would include a cheeseburger, french fries, and a soft drink. What price should they charge for this value meal? Would profits be higher or lower than if the restaurant sets prices individually? Explain.

(Essay)

5.0/5  (35)

(35)

Charging each customer his or her maximum willingness to pay is:

(Multiple Choice)

4.7/5  (37)

(37)

Which of the following lists of products and services would be the most resistant to arbitrage?

(Multiple Choice)

4.8/5  (38)

(38)

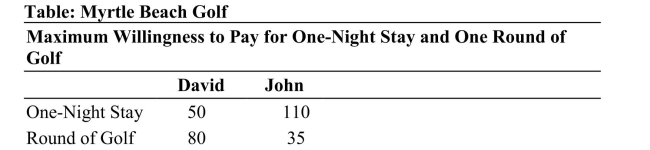

Reference: Ref 14-5 (Table: Myrtle Beach Golf) Refer to the table. Assume that marginal costs of production are zero. If the resort bundles a one-night stay with a round of golf, how much profit will it make on David and John?

Reference: Ref 14-5 (Table: Myrtle Beach Golf) Refer to the table. Assume that marginal costs of production are zero. If the resort bundles a one-night stay with a round of golf, how much profit will it make on David and John?

(Multiple Choice)

4.8/5  (43)

(43)

A firm that spends extra money to practice tying does so to:

(Multiple Choice)

4.8/5  (44)

(44)

Why is it important for firms practicing price discrimination to prevent arbitrage of their product?

(Multiple Choice)

4.8/5  (40)

(40)

Showing 101 - 120 of 152

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)