Exam 15: Exchange Rate Systems and Currency Crises

Exam 1: The International Economy and Globalization71 Questions

Exam 2: Foundations of Modern Trade Theory: Comparative Advantage215 Questions

Exam 3: Sources of Comparative Advantage143 Questions

Exam 4: Tariffs162 Questions

Exam 5: Nontariff Trade Barriers164 Questions

Exam 6: Trade Regulations and Industrial Policies187 Questions

Exam 7: Trade Policies for the Developing Nations305 Questions

Exam 8: Regional Trading Arrangements164 Questions

Exam 9: International Factor Movements and Multinational Enterprises123 Questions

Exam 10: The Balance-of-payments156 Questions

Exam 11: Foreign Exchange206 Questions

Exam 12: Exchange Rate Determination199 Questions

Exam 13: Mechanisms of International Adjustment107 Questions

Exam 14: Exchange Rate Adjustments and the Balance-of-payments122 Questions

Exam 15: Exchange Rate Systems and Currency Crises168 Questions

Exam 16: Macroeconomic Policy in an Open-economy72 Questions

Exam 17: International Banking: Reserves, Debt, and Risk96 Questions

Select questions type

By maintaining a strong commitment to fixed exchange rates,a currency board hopes that domestic inflation will slow down and the possibility of a speculative attack against its currency will be reduced.

(True/False)

4.8/5  (40)

(40)

Under the historic adjustable pegged exchange-rate system,member countries were permitted to correct persistent and sizable payment deficits (i.e.,fundamental disequilibrium) by:

(Multiple Choice)

4.8/5  (39)

(39)

Suppose that Japan maintains a pegged exchange rate that overvalues the yen.This would likely result in:

(Multiple Choice)

4.8/5  (34)

(34)

In 1973,the reform of the international monetary system resulted in the change from:

(Multiple Choice)

4.8/5  (43)

(43)

A market-determined increase in the dollar price of the pound is associated with:

(Multiple Choice)

4.8/5  (42)

(42)

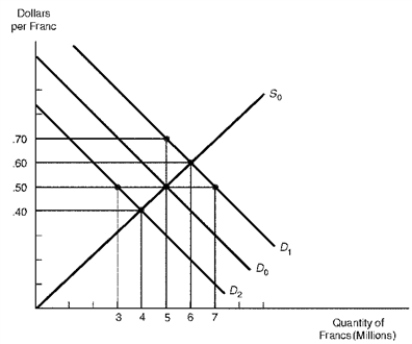

Figure 15.1 shows the market for the Swiss franc.In the figure,the initial demand for marks and supply of marks are depicted by D0 and S0 respectively.

Figure 15.1.The Market for the Swiss Franc

-Refer to Figure 15.1.Suppose the United States decreases investment spending in Switzerland,thus reducing the demand for francs from D0 to D2.Under a floating exchange rate system,the new equilibrium exchange rate would be:

-Refer to Figure 15.1.Suppose the United States decreases investment spending in Switzerland,thus reducing the demand for francs from D0 to D2.Under a floating exchange rate system,the new equilibrium exchange rate would be:

(Multiple Choice)

4.9/5  (41)

(41)

Under a floating exchange-rate system,if the U.S.dollar depreciates against the Swiss franc:

(Multiple Choice)

4.9/5  (32)

(32)

The revenue that a government received by issuing money is called a fiscal dividend.

(True/False)

4.9/5  (39)

(39)

Small nations (e.g.,the Ivory Coast) whose trade and financial relationships are mainly with a single partner tend to utilize:

(Multiple Choice)

4.8/5  (34)

(34)

The central bank of the United Kingdom could prevent the pound from appreciating by:

(Multiple Choice)

4.8/5  (33)

(33)

In recent years,members of the International Monetary Fund have adopted exchange rate systems including

(Multiple Choice)

4.8/5  (33)

(33)

Hong Kong provides an example of a country that has maintained a currency board.The purposes of its currency board is to

(Multiple Choice)

4.8/5  (32)

(32)

Under a system of fixed exchange rates,if the international reserves of a country's central bank become exhausted,it can no longer prevent its currency from

(Multiple Choice)

4.8/5  (33)

(33)

If the Federal Reserve wants to see the dollar's exchange value depreciate,it could pursue a contractionary monetary policy.

(True/False)

4.9/5  (41)

(41)

Smaller nations with relatively undiversified economies and large trade sectors tend to peg their currencies to one of the world's key currencies.

(True/False)

4.7/5  (30)

(30)

The special drawing right is a currency basket of five major industrial country currencies.

(True/False)

4.9/5  (31)

(31)

Showing 61 - 80 of 168

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)