Exam 15: Performance Evaluation

Exam 1: An Introduction to Accounting204 Questions

Exam 2: Accounting for Accruals and Deferrals157 Questions

Exam 3: Accounting for Merchandising Businesses38 Questions

Exam 4: Internal Controls, Accounting for Cash, and Ethics38 Questions

Exam 5: Accounting for Receivables and Inventory Cost Flow57 Questions

Exam 6: Accounting for Long-Term Operational Assets157 Questions

Exam 7: Accounting for Liabilities208 Questions

Exam 8: Proprietorships, Partnerships, and Corporations144 Questions

Exam 9: Financial Statement Analysis172 Questions

Exam 10: An Introduction to Management Accounting155 Questions

Exam 11: Cost Behavior, Operating Leverage, and Profitability Analysis43 Questions

Exam 12: Cost Accumulation, Tracing, and Allocation211 Questions

Exam 13: Relevant Information for Special Decisions137 Questions

Exam 14: Planning for Profit and Cost Control156 Questions

Exam 15: Performance Evaluation162 Questions

Exam 16: Planning for Capital Investments172 Questions

Select questions type

The New Products Division of Testar Company, had operating income of $9,800,000 and operating assets of $46,600,000 during the current year. The New Products Division has developed a potential new product that would require $10,300,000 in operating assets and would be expected to provide $3,200,000 in operating income each year. Testar has set a target return on investment (ROI) of 22% for each of its divisions. Assuming that the new product is put into production, calculate the residual income for the division.

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

B

For performance evaluation, the amount of costs actually incurred should be compared to the costs that would have been incurred at the actual volume of activity rather than at the planned volume of activity.

Free

(True/False)

4.8/5  (29)

(29)

Correct Answer:

True

An important disadvantage of decentralization is that managers may engage in suboptimal behavior.

Free

(True/False)

4.8/5  (42)

(42)

Correct Answer:

True

Select the incorrect statement concerning the application of the controllability concept to responsibility accounting.

(Multiple Choice)

4.8/5  (37)

(37)

Brookings Company evaluates its managers on the basis of return on investment. Division Three has a return on investment (ROI) of 15% while the company as a whole has an ROI of only 10%. Which of the following performance measures will motivate the manager of Division Three to accept a project earning a 12% return?

(Multiple Choice)

4.8/5  (29)

(29)

A restaurant that is part of a retail store and managed by the retail manager would most likely be classified as a cost center.

(True/False)

4.8/5  (32)

(32)

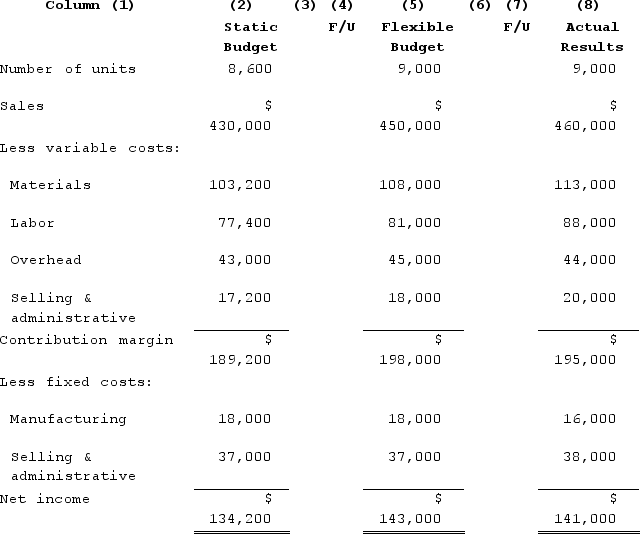

The Broaddus Company has requested a performance report that reports both sales activity variances and flexible budget variances. The following table of information is provided:

Required:Compute and enter variances in columns 3 and 6. In column 3, enter the variance (difference) between column 2 and column 5; in column 4, label the variance as favorable (F) or unfavorable (U). In column 6, enter the variance between columns 5 and 8, and in column 7 indicate whether this variance is favorable or unfavorable.Which column contains sales volume variances, and which column contains flexible budget variances?Comment on this company's performance.

Required:Compute and enter variances in columns 3 and 6. In column 3, enter the variance (difference) between column 2 and column 5; in column 4, label the variance as favorable (F) or unfavorable (U). In column 6, enter the variance between columns 5 and 8, and in column 7 indicate whether this variance is favorable or unfavorable.Which column contains sales volume variances, and which column contains flexible budget variances?Comment on this company's performance.

(Not Answered)

This question doesn't have any answer yet

Delegating authority and responsibility throughout an organization is known as:

(Multiple Choice)

4.8/5  (27)

(27)

Payne Company reported the following information for the current year: Sales \1 ,600,000 Average operating assets \5 00,000 Desired ROI 14\% Operating income \8 5,000

The company's residual income was:

(Multiple Choice)

4.9/5  (26)

(26)

Indicate whether each of the following statements is true or false.Use of residual income to evaluate managers of an investment center may avoid some of the suboptimization that can occur with use of return on investment as a performance measure.Residual income is stated as a ratio or percentage.One disadvantage with residual income as a measure of performance is that it causes smaller divisions to appear to do better than larger divisions.A balanced score card includes various non-financial performance measures as well as financial performance measures.The balanced scorecard is a holistic approach to evaluating management and division performance.

(Not Answered)

This question doesn't have any answer yet

All of the following are characteristics that are required for effective responsibility accounting except:

(Multiple Choice)

4.8/5  (32)

(32)

If the master budget prepared at a volume level of 10,000 units includes direct materials of $40,000, a flexible budget based on a volume of 12,000 units would include direct materials of $48,000.

(True/False)

4.7/5  (36)

(36)

The New Products Division of Testar Company, has developed a potential new product that would require $8,500,000 in operating assets and would be expected to provide $1,400,000 in operating income each year. Testar has set a target return on investment (ROI) of 16% for each of its divisions. Which of the following statements is accurate?

(Multiple Choice)

4.7/5  (34)

(34)

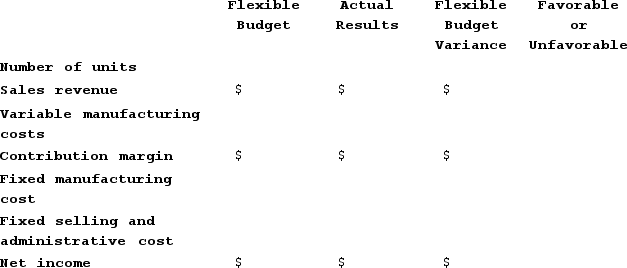

Douglas Company provided the following budgeted information for the current year.

Sales price \ 50 per unit Variable manufacturing cost \ 32 per unit Fixed manufacturing cost \ 100,000 total Fixed selling and administrative cost \ 40,000 total

Douglas predicted that sales would be 20,000 units, but the sales actually were 22,000 units. The actual sales price was $48.50 per unit, and the actual variable manufacturing cost was $33 per unit. Actual fixed manufacturing cost and fixed selling and administrative cost were $104,000 and $39,000, respectively.

Required:Using the form below, prepare a flexible budget; show actual results; calculate the flexible budget variances; and indicate whether the variances are favorable (F) or unfavorable (U).

(Essay)

4.8/5  (28)

(28)

Which of the following reason(s) cause flexible budgets to be useful planning tools?

(Multiple Choice)

4.8/5  (28)

(28)

The cellular phone division of Stegall Company had budgeted sales of $950,000 and actual sales of $900,000. Budgeted expenses were $600,000 while actual expenses were $550,000. Based on this information, a report prepared for the manager of this profit center would show:

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following statements regarding cost centers is incorrect?

(Multiple Choice)

4.8/5  (30)

(30)

Flexible budget amounts for variable costs and revenues come from multiplying standard per unit amounts by the planned volume of production.

(True/False)

4.8/5  (33)

(33)

The Consumer Services Division is one part of Vargas Corporation. The Consumer Services Division reported income of $112,000 on an investment in operating assets of $800,000 for Year 1. The division expects this level of performance to continue for Year 2. Senior management of Vargas Corporation has asked the Consumer Services Division to consider adding a new service line that would result in the following revenues and costs:

Revenues \2 40,000 Variable expenses 110,000 Direct fixed expenses 70,000 Average operating assets 500,000

Required:Compute the ROI that would be generated by the new product line.Compute the ROI for the Consumer Services Division without the new product line.Compute the Consumer Services Division's residual income without the new product line and with the new product line. The target ROI is 11%.Would the new product line benefit the company as a whole? ROI for the company as a whole is 10%. Will the Consumer Services Division likely add the new product line given the company's use of ROI as a performance measure? Why or why not? Which performance evaluation measure will more likely motivate the division manager to do what is best for the company as a whole?

(Essay)

4.9/5  (34)

(34)

Unfavorable flexible budget variances are those that are the result of lower than expected sales volume.

(True/False)

4.7/5  (31)

(31)

Showing 1 - 20 of 162

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)