Exam 11: Diversification and Risky Asset Allocation

Exam 1: A Brief History of Risk and Return107 Questions

Exam 2: The Investment Process104 Questions

Exam 3: Overview of Security Tips98 Questions

Exam 4: Mutual Funds and Other Investment Companies112 Questions

Exam 5: The Stock Market109 Questions

Exam 6: Common Stock Valuation116 Questions

Exam 7: Stock Price Behavior and Market Efficiency86 Questions

Exam 8: Behavioral Finance and the Psychology of Investing89 Questions

Exam 9: Interest Rates108 Questions

Exam 10: Bond Prices and Yields104 Questions

Exam 11: Diversification and Risky Asset Allocation93 Questions

Exam 12: Return, Risk, and the Security Market Line92 Questions

Exam 13: Performance Evaluation and Risk Management102 Questions

Exam 14: Futures Contracts106 Questions

Exam 15: Stock Options109 Questions

Exam 16: Option Valuation78 Questions

Exam 17: Alternative Investments74 Questions

Exam 18: Corporate and Government Bonds114 Questions

Exam 19: Projecting Cash Flow and Earnings111 Questions

Exam 20: Global Economic Activity and Industry Analysis77 Questions

Exam 21: Mortgage-Backed Securities96 Questions

Select questions type

What is the expected return on this stock given the following information?

State of the Economy Probability of Rate of Return if State of Economy state occurs Boom .15 22\% Normal .60 11\% Recession .25 -14\%

(Multiple Choice)

4.8/5  (40)

(40)

An efficient portfolio is one that does which of the following?

(Multiple Choice)

4.8/5  (34)

(34)

What is the variance of the expected returns on this stock?

State of the Economy Erobability E(R) Eoom .70 24\% Recegaion .30 6\%

(Multiple Choice)

4.7/5  (39)

(39)

A stock fund has a standard deviation of 16% and a bond fund has a standard deviation of 4%. The correlation of the two funds is .11. What is the weight of the stock fund in the minimum variance portfolio?

(Multiple Choice)

4.8/5  (41)

(41)

What is the expected return on this stock given the following information?

State of the Economy Probability of Rate of Return if State of Economy state occurs Boom .05 16\% Normal .45 7\% Recession .50 -12\%

(Multiple Choice)

4.9/5  (44)

(44)

Rosita owns a stock with an overall expected return of 14.40%. The economy is expected to either boom or be normal. There is a 52% chance the economy will boom. If the economy booms, this stock is expected to return 15%. What is the expected return on the stock if the economy is normal?

(Multiple Choice)

4.9/5  (36)

(36)

The risk-free rate is 2.05%. What is the expected risk premium on this stock given the following information?

State of the Economy Probability of Rate of Return if State of Economy state occurs Boom .35 16\% Normal .65 6\%

(Multiple Choice)

4.9/5  (28)

(28)

You are graphing the investment opportunity set for a portfolio of two securities with the expected return on the vertical axis and the standard deviation on the horizontal axis. If the correlation coefficient of the two securities is +1, the opportunity set will appear as which one of the following shapes?

(Multiple Choice)

4.9/5  (35)

(35)

You are graphing the portfolio expected return against the portfolio standard deviation for a portfolio consisting of two securities. Which one of the following statements is correct regarding this graph?

(Multiple Choice)

4.7/5  (41)

(41)

You currently have a portfolio comprised of 70% stocks and 30% bonds. Which one of the following must be true if you change the asset allocation?

(Multiple Choice)

4.8/5  (35)

(35)

To reduce risk as much as possible, you should combine assets which have one of the following correlation relationships?

(Multiple Choice)

4.9/5  (41)

(41)

You have a portfolio which is comprised of 40% of Stock A and 60% of Stock B. What is the standard deviation of this portfolio?

State of the Economy Probability A B Boom .15 22\% 19\% Normal .80 12\% 10\% Recession .05 -26\% -4\%

(Multiple Choice)

4.8/5  (42)

(42)

An investor owns a security that is expected to return 12% in a booming economy and 4% in a normal economy. The overall expected return on the security is 7.80%. Given there are only two states of the economy, what is the probability that the economy will boom?

(Multiple Choice)

4.9/5  (43)

(43)

What is the variance of the returns on a security given the following information?

State of the Economy Probability E(R) Boom .25 16\% Normal .45 10\% Recession .30 -8\%

(Multiple Choice)

4.9/5  (35)

(35)

Which one of the following distinguishes a minimum variance portfolio?

(Multiple Choice)

4.7/5  (40)

(40)

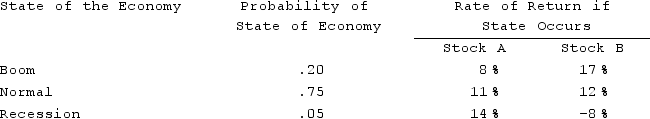

You have a portfolio which is comprised of 48% of Stock A and 52% of Stock B. What is the standard deviation of this portfolio?

(Multiple Choice)

4.7/5  (41)

(41)

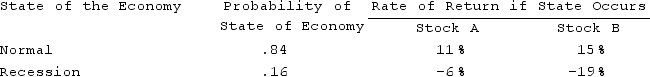

Roger has a portfolio comprised of $8,000 of Stock A and $12,000 of Stock B. What is the standard deviation of this portfolio?

(Multiple Choice)

4.8/5  (36)

(36)

As the number of individual stocks in a portfolio increases, the portfolio standard deviation:

(Multiple Choice)

4.8/5  (34)

(34)

A portfolio consists of the following securities. What is the portfolio weight of Stock X?

Stock Number of Price per Share Shares X 600 \ 17 Y 900 \ 23 Z 400 \ 49

(Multiple Choice)

4.7/5  (33)

(33)

How will the returns on two assets react if those returns have a perfect positive correlation?

I. move in the same direction

II. move in opposite directions

III. move by the same amount

IV. move by either equal or unequal amounts

(Multiple Choice)

4.7/5  (45)

(45)

Showing 41 - 60 of 93

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)