Exam 4: Banking

Exam 1: Whole Numbers: How to Dissect and Solve Word Problems140 Questions

Exam 2: Fractions135 Questions

Exam 3: Decimals145 Questions

Exam 4: Banking99 Questions

Exam 5: Solving for the Unknown: a How-To Approach for Solving Equations122 Questions

Exam 6: Percents and Their Applications152 Questions

Exam 7: Discounts: Trade and Cash137 Questions

Exam 8: Markups and Markdowns: Perishables and Breakeven Analysis123 Questions

Exam 9: Payroll109 Questions

Exam 10: Simple Interest99 Questions

Exam 11: Promissory Notes, Simple Discount Notes, and the Discount Process106 Questions

Exam 12: Compound Interest and Present Value112 Questions

Exam 13: Annuities and Sinking Funds103 Questions

Exam 14: Installment Buying76 Questions

Exam 15: The Cost of Home Ownership96 Questions

Exam 16: How to Read, Analyze, and Interpret Financial Reports118 Questions

Exam 17: Depreciation89 Questions

Exam 18: Inventory and Overhead106 Questions

Exam 19: Sales, Excise, and Property Taxes106 Questions

Exam 20: Life, Fire, and Auto Insurance121 Questions

Exam 21: Stocks, Bonds, and Mutual Funds152 Questions

Exam 22: Business Statistics99 Questions

Select questions type

Jane Co.'s checkbook currently has a balance of $295.10. The bank statement shows a balance of $205.10. The statement revealed interest income of $10.03 along with check charges of $2.95. Jane recorded a $200 check as $150. Deposits in transit were $402.80. Check numbers 85, 88, and 92 for $90.80, $108.10, and $156.82 were not returned with the statement. The reconciled balance is:

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

D

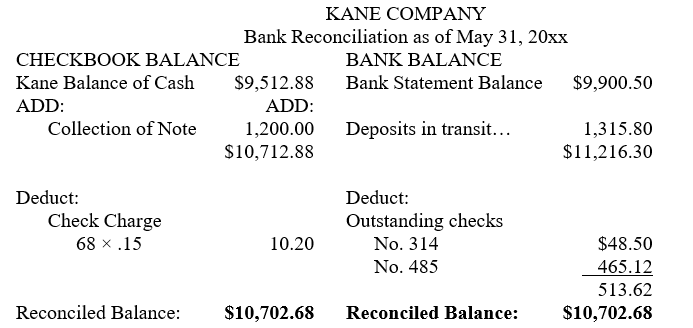

On May 31, 20xx, Kane Company's bank statement showed a $9,900.50 bank balance. The bank statement also showed that it collected a $1,200 note for Kane Company. A $1,315.80 deposit made on May 31 was in transit. Check number 314 for $48.50 and check number 485 for $465.12 were outstanding. Kane's bank charges $.15 per processed check. This month Kane wrote 68 checks. Kane has a $9,512.88 checkbook balance. Prepare a reconciled balance.

Free

(Essay)

4.9/5  (30)

(30)

Correct Answer:

Match the following terms with their definitions.

-Endorsements

Free

(Multiple Choice)

4.9/5  (23)

(23)

Correct Answer:

Q

The bank statement for Mat Co. revealed a balance of $900, and the checkbook balance showed $1,420. Checks outstanding totaled $35. A check printing charge for $5 was on the bank statement. There was a $50 NSF shown on the bank statement. There was a $500 deposit in transit. What is the reconciled balance?

(Multiple Choice)

4.7/5  (36)

(36)

Crediting an account by the bank means a decrease to that account.

(True/False)

4.9/5  (30)

(30)

Mia Wong's checking account had a balance of $3,100.55 on July 1. After looking at her bank statement, she noticed an NSF for $60.50, a service charge of $12.55, and a note collected for $600. There was one deposit in transit for $400 and no checks outstanding. What is the reconciled checkbook balance?

(Multiple Choice)

4.8/5  (33)

(33)

On December 31, 20xx, Brown Company's checkbook showed an $8,195.32 balance. Brown's bank statement showed a balance of $8,400.50. Check number 311 for $395.10 and check number 418 for $115.46 were outstanding. A $310.30 deposit was in transit. The bank charged a $10 service charge. The statement showed a $14.92 earned interest income. Complete Brown's bank reconciliation.

(Essay)

4.9/5  (32)

(32)

Andy Finn received a bank statement from Jon Bank indicating a balance of $3,000. Based on Andy's check stubs, the ending checkbook balance was $3,600. Checks outstanding were number 110 for $150, number 115 for $90, and number 118 for $75. Andy noticed a deposit in transit for $900 as well as a bank service charge for $15. Complete the reconciliation for Andy.

(Essay)

4.8/5  (37)

(37)

Match the following terms with their definitions.

-Electronic funds transfer

(Multiple Choice)

4.8/5  (35)

(35)

Match the following terms with their definitions.

-Smartphone

(Multiple Choice)

4.8/5  (35)

(35)

Calculate the statement balance:

Balance of last Statement Checks Processed Deposits Received Service Charge Balance this Statement \ 910.11 \ 615.30 \ 291.88 \ 12.10 ?

(Short Answer)

4.7/5  (33)

(33)

Match the following terms with their definitions.

-Full endorsements

(Multiple Choice)

4.9/5  (41)

(41)

Roger Ran's checkbook balance on April 30, was $1,498, and his bank statement balance for same period was $1,210.88. He discovered from his canceled checks that a check for $30 had been recorded in the check register for $20. The bank deducted a service charge of $12.55 from Roger's account. A deposit mailed on April 29, for $310.99 did not appear on the statement. Roger noticed that checks number 110 and number 118 for $16.88 and $29.54 were not returned with the canceled checks. What is the adjusted reconciled balance?

(Short Answer)

4.9/5  (29)

(29)

The bank statement of Ali Co. indicated a current balance of $32,900.10. The current checkbook balance indicated a balance of $34,509.11. In the reconciliation process a deposit in transit for $6,821.11 was discovered. Check number 600 for $3,988.33 was outstanding. The statement also revealed an NSF of $110.11 along with interest earned by Ali of $1,333.88. The reconciled balance is:

(Multiple Choice)

4.7/5  (36)

(36)

Valdez Company opened a special checking account. The charge for each check written was $.55 or a $6 a month minimum service charge (whichever is greater). At the beginning of the month, the company checkbook balance was $695.18. Valdez Company wrote 14 checks totaling $312.88. Deposits of $188.10 and $195.10 were made during the month. What is Valdez's checkbook balance to start the next month (include cost of check writing)?

(Short Answer)

4.8/5  (34)

(34)

Showing 1 - 20 of 99

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)