Exam 1: An Introduction to Accounting

Exam 1: An Introduction to Accounting173 Questions

Exam 2: Accounting for Accruals150 Questions

Exam 3: Accounting for Deferrals136 Questions

Exam 4: Accounting for Merchandising Businesses187 Questions

Exam 5: Accounting for Inventories169 Questions

Exam 6: Internal Control and Accounting for Cash132 Questions

Exam 7: Accounting for Receivables174 Questions

Exam 8: Accounting for Long-Term Operational Assets200 Questions

Exam 9: Accounting for Current Liabilities and Payroll146 Questions

Exam 10: Accounting for Long-Term Debt171 Questions

Exam 11: Proprietorships, Partnerships, and Corporations144 Questions

Exam 12: Statement of Cash Flows159 Questions

Exam 13: The Double-Entry Accounting System167 Questions

Exam 14: Financial Statement Analysis Available Online in Connect170 Questions

Select questions type

Lexington Company engaged in the following transactions during Year 1, its first year in operation: (Assume all transactions are cash transactions.) Acquired $3,100 cash from issuing common stock.Borrowed $2,250 from a bank.Earned $3,150 of revenues.Incurred $2,410 in expenses.Paid dividends of $410.

Lexington Company engaged in the following transactions during Year 2: (Assume all transactions are cash transactions.)

Acquired an additional $550 cash from the issue of common stock.Repaid $1,335 of its debt to the bank.Earned revenues, $4,550.Incurred expenses of $2,770.Paid dividends of $700.

What was the amount of retained earnings that will be reported on Lexington's balance sheet at the end of Year 1?

(Multiple Choice)

4.9/5  (38)

(38)

Liabilities are obligations of a business to relinquish assets, provide services, or accept other obligations.

(True/False)

4.8/5  (42)

(42)

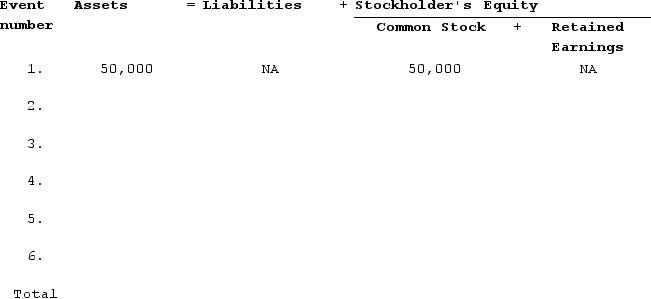

Ramirez Company experienced the following events during Year 1:

Acquired $50,000 cash by issuing common stockBorrowed $25,000 cash from a creditorProvided services to customers for $38,000 cashPaid $32,000 cash for operating expensesPaid a cash dividend of $2,500 to stockholdersPurchased land with cash, $20,000Required:a)Show how each of these events affects the accounting equation. Enter "NA" for elements of the accounting equation that are not affected by the transaction. If one element of the accounting equation is affected by an increase and also by a decrease, enter each part on a separate line (i.e. asset exchange transaction where one asset increases and another asset decreases). (The effects of the first event are shown below.)b)Calculate the total amount of assets, liabilities, common stock, and retained earnings at the end of the period.

(Essay)

4.9/5  (28)

(28)

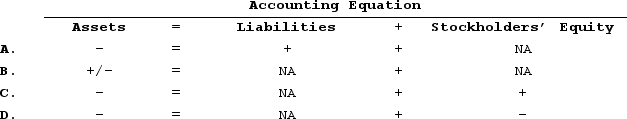

Which of the following shows the effects of paying a cash dividend on the accounting equation?

(Multiple Choice)

4.8/5  (33)

(33)

Robertson Company paid $1,850 cash for rent expense. What happened as a result of this business event?

(Multiple Choice)

4.8/5  (46)

(46)

At the beginning of Year 2, Jones Company had a balance in common stock of $300,000 and a balance of retained earnings of $15,000. During Year 2, the following transactions occurred:Issued common stock for $90,000Earned net income of $50,000Paid dividends of $8,000Issued a note payable for $20,000 Based on the information provided, what is the total stockholders' equity on December 31, Year 2?

(Multiple Choice)

4.8/5  (30)

(30)

As of December 31, Year 2, Bristol Company had $100,000 of assets, $40,000 of liabilities and $25,000 of retained earnings. What percentage of Bristol's assets were obtained through investors?

(Multiple Choice)

4.8/5  (44)

(44)

Rosemont Company began operations on January 1, Year 1, and on that date issued stock for $60,000 cash. In addition, Rosemont borrowed $50,000 cash from the local bank. The company provided services to its customers during Year 1 and received $35,000. It purchased land for $70,000. During the year, it paid $10,000 cash for salaries. Stockholders were paid cash dividends of $8,000 during the year.

Required:a)List the transactions from the information above (for example, issued common stock for $60,000)and indicate in which section of the statement of cash flows each transaction would be reported.b)What would the amount be for net cash flows from operating activities?c)What would be the end-of-year balance for the cash account?d)What would be the amount of the total assets for the Rosemont Company at the end of Year 1?e)What would be the end-of-year balance for the Retained Earnings account?

(Essay)

4.9/5  (35)

(35)

Financial accounting standards are known collectively as GAAP. What does that acronym stand for?

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following would be reported in the cash flow from financing activities section of a statement of cash flows?

(Multiple Choice)

4.9/5  (28)

(28)

Which financial statement matches asset increases from operating a business with asset decreases from operating the business?

(Multiple Choice)

4.7/5  (30)

(30)

Lexington Company engaged in the following transactions during Year 1, its first year in operation: (Assume all transactions are cash transactions.) Acquired $4,200 cash from issuing common stock.Borrowed $2,800 from a bank.Earned $3,700 of revenues.Incurred $2,520 in expenses.Paid dividends of $520.

Lexington Company engaged in the following transactions during Year 2: (Assume all transactions are cash transactions.)

Acquired an additional $1,100 cash from the issue of common stock.Repaid $1,720 of its debt to the bank.Earned revenues, $5,100.Incurred expenses of $2,990.Paid dividends of $1,360.

What was the amount of liabilities on Lexington's balance sheet at the end of Year 2?

(Multiple Choice)

4.8/5  (43)

(43)

Jackson Company had a net increase in cash from operating activities of $9,700 and a net decrease in cash from financing activities of $3,550. If the beginning and ending cash balances for the company were $4,700 and $14,400, what was the net cash change from investing activities?

(Multiple Choice)

4.9/5  (37)

(37)

Indicate how each of the following transactions affects assets by entering "+" for increase, "−" for decrease, or "+/− " if an event increases one asset account and decreases another asset account. Enter only one item for each answer.

________ 1)Issued stock to investors.________ 2)Borrowed cash from the bank.________ 3)Provided services for cash.________ 4)Paid operating expenses.________ 5)Purchased land for cash.________ 6)Paid cash dividend to the stockholders.________ 7)Repaid the bank loan.

(Essay)

4.7/5  (39)

(39)

Finn Company reported assets of $1,000 and stockholders' equity of $600. What amount will Finn report for liabilities?

(Multiple Choice)

4.9/5  (36)

(36)

A company's total assets increased during the period while its liabilities and common stock were unchanged. No dividends were declared or paid during the period. Which of the following would explain this situation?

(Multiple Choice)

4.8/5  (42)

(42)

In a market, a company that manufactures cars would be referred to as a business.

(True/False)

4.8/5  (36)

(36)

Glavine Company repaid a bank loan with cash. The cash flow from this event should be reported as:

(Multiple Choice)

4.9/5  (33)

(33)

Showing 141 - 160 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)