Exam 14: Financial Statement Analysis Available Online in Connect

Exam 1: An Introduction to Accounting173 Questions

Exam 2: Accounting for Accruals150 Questions

Exam 3: Accounting for Deferrals136 Questions

Exam 4: Accounting for Merchandising Businesses187 Questions

Exam 5: Accounting for Inventories169 Questions

Exam 6: Internal Control and Accounting for Cash132 Questions

Exam 7: Accounting for Receivables174 Questions

Exam 8: Accounting for Long-Term Operational Assets200 Questions

Exam 9: Accounting for Current Liabilities and Payroll146 Questions

Exam 10: Accounting for Long-Term Debt171 Questions

Exam 11: Proprietorships, Partnerships, and Corporations144 Questions

Exam 12: Statement of Cash Flows159 Questions

Exam 13: The Double-Entry Accounting System167 Questions

Exam 14: Financial Statement Analysis Available Online in Connect170 Questions

Select questions type

Discuss the limitations that affect financial statement analysis.

Free

(Essay)

4.8/5  (46)

(46)

Correct Answer:

Answers will vary.

The results of financial statement analysis can be difficult to interpret and explain because of differences among industries, changing economic conditions, and the varying accounting principles and estimates made by different companies. Financial statement analysis is useful in giving an overview of a company. Studying a company's financial statements over a period of years and comparing the results to other companies in the same industry can help to reduce the ambiguity associated with the analysis results.

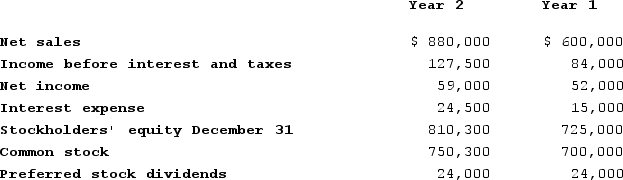

The following information applies to Acorn Construction Company (ACC):

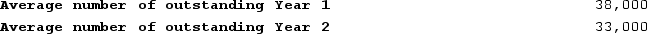

Information on the number of shares outstanding is provided below:

Information on the number of shares outstanding is provided below:

Required:Compute the following ratios for ACC for Year 2 and Year 1:(a)Number of times interest is earned(b)Earnings per share(c)Price-earnings ratio (Market prices: Year 2 $17.50 per share, Year 1 $15.00 per share)(d)Return on equity(e)Net margin

Required:Compute the following ratios for ACC for Year 2 and Year 1:(a)Number of times interest is earned(b)Earnings per share(c)Price-earnings ratio (Market prices: Year 2 $17.50 per share, Year 1 $15.00 per share)(d)Return on equity(e)Net margin

Free

(Essay)

4.8/5  (43)

(43)

Correct Answer:

a)5.2 and 5.6b)$1.06 and $0.74c)16.51 and 20.27d)7.3% and 7.2%e)6.7% and 8.7%

Short-term creditors are usually most interested in assessing:

Free

(Multiple Choice)

4.8/5  (30)

(30)

Correct Answer:

A

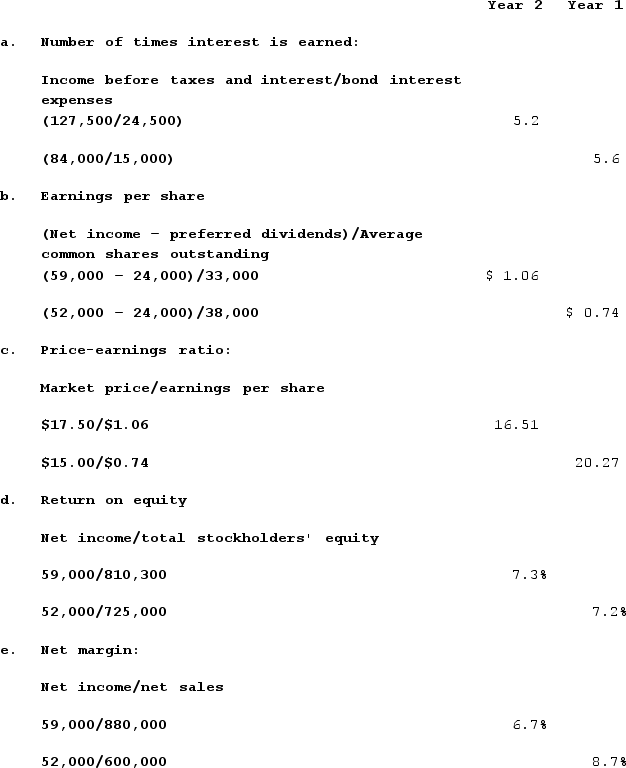

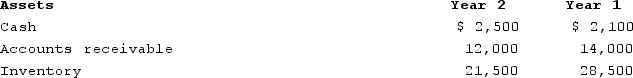

The following information applies to Markham Company:

Additional information: Net credit sales equal $220,000 and beginning accounts receivable were $11,000.Required:Compute Markham's:(a)Quick ratio(b)Current ratio(c)Working capital(d)Accounts receivable turnover(e)Average days to collect receivables

Round your answers to two decimal places.

Additional information: Net credit sales equal $220,000 and beginning accounts receivable were $11,000.Required:Compute Markham's:(a)Quick ratio(b)Current ratio(c)Working capital(d)Accounts receivable turnover(e)Average days to collect receivables

Round your answers to two decimal places.

(Essay)

4.8/5  (38)

(38)

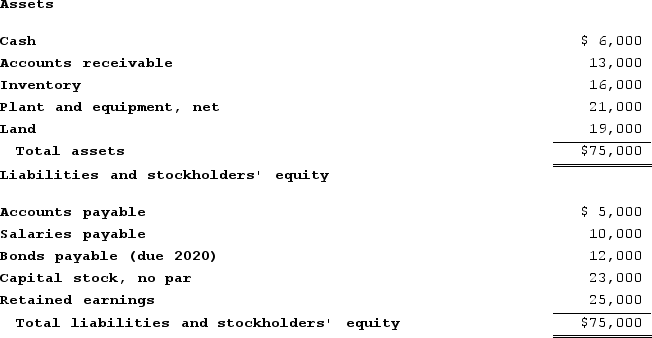

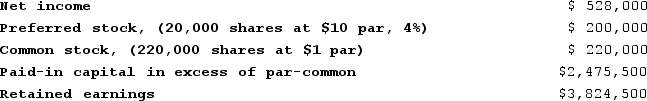

The following information was provided by Joseph Company as of December 31, Year 2:

On the most recent trading date, Joseph's common shares sold at $36 and the preferred shares sold at $14.

The following information on industry averages is provided:

Earnings per share $2.06

Price-earnings ratio 13.2:1

Required: 1)Calculate Joseph Company's (a)earnings per share and (b)price-earnings ratios. Round your answer to two decimal places.2)Discuss whether you would invest in this company.

On the most recent trading date, Joseph's common shares sold at $36 and the preferred shares sold at $14.

The following information on industry averages is provided:

Earnings per share $2.06

Price-earnings ratio 13.2:1

Required: 1)Calculate Joseph Company's (a)earnings per share and (b)price-earnings ratios. Round your answer to two decimal places.2)Discuss whether you would invest in this company.

(Essay)

4.9/5  (37)

(37)

When debt is used to finance the purchase of assets, the term or time span of the debt should always be shorter than the lifespan of the assets.

(True/False)

4.8/5  (34)

(34)

In vertical analysis of a balance sheet, each item is expressed as a percentage of:

(Multiple Choice)

4.9/5  (39)

(39)

A limitation of financial statement analysis stems from the discretion of management to choose accounting procedures that cast the best light on the firm's performance.

(True/False)

4.8/5  (40)

(40)

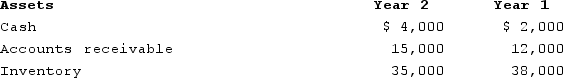

The following balance sheet information was provided by Western Company:  Assuming Year 2 net credit sales totaled $365,000, what was the company's average days to collect receivables? (Use 365 days in a year. Do not round your intermediate calculations. Round your answer to 2 decimal places.)

Assuming Year 2 net credit sales totaled $365,000, what was the company's average days to collect receivables? (Use 365 days in a year. Do not round your intermediate calculations. Round your answer to 2 decimal places.)

(Multiple Choice)

4.9/5  (29)

(29)

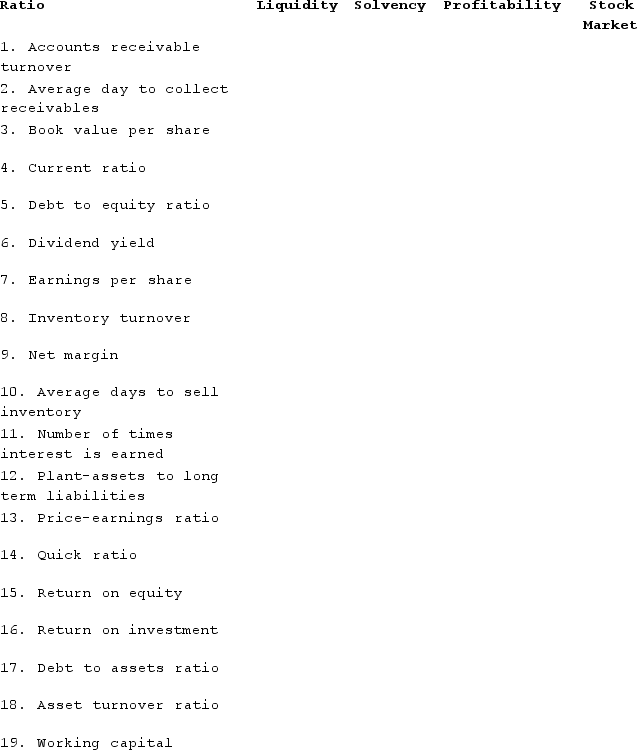

Various ratios are computed to assess different aspects of a company's financial condition and (or)strength.Required:In the table below, indicate which aspect of financial condition each specified ratio is designed to assess:

(Essay)

5.0/5  (42)

(42)

The following balance sheet information is provided for Gaynor Company:  Assuming Year 2 cost of goods sold is $153,300, what is the company's inventory turnover?

Assuming Year 2 cost of goods sold is $153,300, what is the company's inventory turnover?

(Multiple Choice)

4.9/5  (41)

(41)

Which of the following statements regarding horizontal analysis is not true?

(Multiple Choice)

4.8/5  (34)

(34)

Financial ratios can be used to assess which of the following aspects of a firm's performance?

(Multiple Choice)

4.8/5  (42)

(42)

Financial analysis typically involves some form of comparison such as changes in the same item over a number of years.

(True/False)

4.8/5  (38)

(38)

Which of the following statements regarding the analysis of absolute amounts of various accounts reported on the financial statements is not true?

(Multiple Choice)

4.8/5  (39)

(39)

Explain the difference between horizontal analysis and vertical analysis of a company's financial statements.

(Essay)

4.9/5  (32)

(32)

Which of the following statements is generally not true from an investor's perspective?

(Multiple Choice)

4.8/5  (38)

(38)

Indicate whether each of the following statements about financial statement analysis is true or false.________ a)Working capital is a measure of the amount of current assets a company would have left after paying its current liabilities.________ b)If a transaction causes a company's working capital to increase, the transaction caused the company to become less liquid.________ c)Interpretation of a company's current ratio can be difficult because it is an absolute amount.________ d)The quick ratio is a more conservative variation of the current ratio.________ e)The quick ratio is usually calculated by using the following equation: (cash + receivables + current marketable securities)÷ current liabilities.

(True/False)

4.9/5  (40)

(40)

Which of the following is a potential limitation of financial statement analysis?

(Multiple Choice)

4.7/5  (30)

(30)

Which of the following statements about financial statements is not true?

(Multiple Choice)

4.9/5  (34)

(34)

Showing 1 - 20 of 170

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)