Exam 10: Public Sector Decision Making

Exam 1: Engineering Decision Making42 Questions

Exam 2: Time Value of Money67 Questions

Exam 3: Cash Flow Analysis66 Questions

Exam 4: Comparison Methods: Part I51 Questions

Exam 5: Comparison Methods: Part Ii50 Questions

Exam 6: Financial Accounting and Business Plans42 Questions

Exam 7: Replacement Decisions52 Questions

Exam 8: Taxes49 Questions

Exam 9: Inflation52 Questions

Exam 10: Public Sector Decision Making49 Questions

Exam 11: Project Management50 Questions

Exam 12: Dealing With Uncertainty and Risk48 Questions

Select questions type

Which of the following requires the use of BCA instead of financial analysis?

Free

(Multiple Choice)

5.0/5  (31)

(31)

Correct Answer:

A

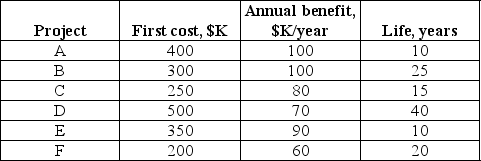

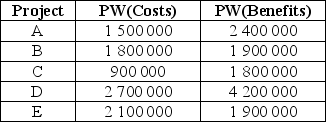

The Department of Public Works has $1.1 million to allocate amongst several public projects. Data on these projects are presented in the following table:

Using a MARR of 15%, rank the projects by their BCR, and comment on the most efficient way to allocate $1.1 million.

Using a MARR of 15%, rank the projects by their BCR, and comment on the most efficient way to allocate $1.1 million.

Free

(Essay)

4.8/5  (38)

(38)

Correct Answer:

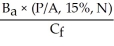

In this case, the benefit-cost ratio BCR of any project can be calculated as follows:

BCR =  where Ba is the annual benefit, and Cf is the first cost of a project. The results of calculations are presented below:

where Ba is the annual benefit, and Cf is the first cost of a project. The results of calculations are presented below:

According to the BCR, the projects should be ranked as follows:

According to the BCR, the projects should be ranked as follows:

1. B with first cost of $300K

2. F with first cost of $200K

3. C with first cost of $250K

4. E with first cost of $350K

5. A with first cost of $400K

6. D with first cost of $500K

The first four projects-B, F, C and E-have a combined first cost of exactly $1.1 million. Therefore, the money should be assigned to these projects.

The hedonic price method is a way of setting a value on a social good based on

Free

(Multiple Choice)

4.7/5  (29)

(29)

Correct Answer:

E

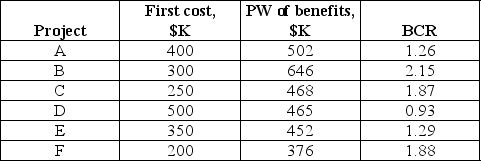

The City of Angels is considering two transportation projects to address its traffic congestion. The first one is a light-rail system while the second one is a new highway. Some economic data on both are presented below:

In addition, the expected benefits from reduction in air pollution are $20 million per year in the case of the light-rail system and $21 million per year in the case of the highway. Service lives of the two alternatives are 50 years. Assuming a 10% MARR as suggested by the Canadian Treasury Board for public projects, which project is preferred? Does your conclusion change under 5% and 15% MARR?

In addition, the expected benefits from reduction in air pollution are $20 million per year in the case of the light-rail system and $21 million per year in the case of the highway. Service lives of the two alternatives are 50 years. Assuming a 10% MARR as suggested by the Canadian Treasury Board for public projects, which project is preferred? Does your conclusion change under 5% and 15% MARR?

(Essay)

4.9/5  (27)

(27)

One of the following is a fundamental limitation of BCA. Which one?

(Multiple Choice)

4.9/5  (22)

(22)

A municipality has just spent $8 million to build a second bridge across the city river to handle the increased traffic between two sides of the river. City engineer calculated that the bridge construction would allow a reduction in the travel time for the road users over the 25-year period of the bridge's service life with a present value of $15.5 million. The construction would lead to a decrease in the present value of surrounding property by $6.4 million over the bridge's service life. The present worth of the operation and maintenance of the bridge over its service life is $3.5 million. What is the benefit-cost ratio of the project?

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following is an advantage of the modified benefit-cost ratio as compared with the conventional benefit-cost ratio?

(Multiple Choice)

4.8/5  (40)

(40)

What is the name for a market dominated by a single provider?

(Multiple Choice)

4.9/5  (34)

(34)

A provincial government's Department of Tourism has estimated that initial investment into a new permanent recreational park in the province is $2 million, and annual upkeep costs are $100 000. As well, a survey of potential visitors detected a $330 000 annual value of the park via willingness to pay measure. However, an increased inflow of tourists into the area will cause $40 000 per year of extra air pollution. Assuming a social discount rate of 10% per year, calculate (a)the conventional BCR and (b)the modified BCR.

(Essay)

4.9/5  (33)

(33)

A city council is planning to build a new bridge across a creek. This will require an immediate expenditure of $50 000, but will save citizens an estimated $5 000 in travel costs every year over the next twenty years. Alternatively, they could renovate an existing bridge. This would only cost $20 000, but the saving in travel costs would only be $2 000 every year. If the council's MARR is 5%, what is the BCR for upgrading from the renovated bridge to the new bridge?

(Multiple Choice)

4.8/5  (38)

(38)

In cost-benefit analysis associated with public projects, all costs and benefits should be evaluated in terms of

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following is an example of a remedy for a market failure?

(Multiple Choice)

4.9/5  (31)

(31)

A new public arena costs $60 million. The largest portion of this amount, $40 million, is for the land acquisition and major earthworks with infinite service life. The remaining $20 million is for the arena itself, which will be in operation for 20 years. Maintenance of the arena requires $2 million per year. Assuming a 5% MARR, what annual benefit is required for the benefit cost ratio to be greater than 1?

(Essay)

4.8/5  (44)

(44)

The following mutually exclusive projects are available. Which should be chosen?

(Multiple Choice)

4.9/5  (36)

(36)

A bridge costs $450 000 to build and $12 000 per year to maintain. The bridge is repaved every 10 years for $300 000. Assume that the bridge will last for 60 years and that the annual interest rate is 8%. How many crossings are needed daily to justify the bridge if each user's willingness to pay for the crossing is $2?

(Essay)

5.0/5  (35)

(35)

Showing 1 - 20 of 49

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)