Exam 11: Monetary Policy and the Fed

Exam 1: Economics: the Study of Choice136 Questions

Exam 2: Confronting Scarcity: Choices in Production189 Questions

Exam 3: Demand and Supply243 Questions

Exam 4: Applications of Supply and Demand104 Questions

Exam 5: Macroeconomics: the Big Picture141 Questions

Exam 6: Measuring Total Output and Income156 Questions

Exam 7: Aggregate Demand and Aggregate Supply162 Questions

Exam 8: Economic Growth131 Questions

Exam 9: The Nature and Creation of Money219 Questions

Exam 10: Financial Markets and the Economy169 Questions

Exam 11: Monetary Policy and the Fed173 Questions

Exam 12: Government and Fiscal Policy170 Questions

Exam 13: Consumption and the Aggregate Expenditures Model214 Questions

Exam 14: Investment and Economic Activity135 Questions

Exam 15: Net Exports and International Finance194 Questions

Exam 16: Inflation and Unemployment128 Questions

Exam 17: A Brief History of Macroeconomic Thought and Policy120 Questions

Exam 18: Inequality, Poverty, and Discrimination135 Questions

Select questions type

The federal funds rate is determined by demand and supply of bank reserves.

(True/False)

4.7/5  (30)

(30)

The Fed is structured as an agency of the executive branch, with the Chairman of the Fed answering directly to the President.

(True/False)

4.9/5  (35)

(35)

Following the U.S.financial crisis in 2008, some observers assert that the policies of Fed Chairman Greenspan contributed to the crisis.Which of the following is a criticism of Greenspan's policies?

I.The very low interest rates used to fight the 2001 recession were maintained for too long, leading to the real estate bubble.

II.The Fed provided real estate developers with liquidity to encourage property development and offered tax breaks to first-time home buyers, which in turn fueled the real estate bubble.

III.The Fed did not promote appropriate regulations to deal with the new financial instruments that were created in the early 2000s.

(Multiple Choice)

4.8/5  (31)

(31)

If the velocity of money is constant, then nominal GDP can change only if there is a change in the money supply.

(True/False)

4.7/5  (35)

(35)

Let M = money supply; P = price level; V = velocity; Y = real GDP.The equation of exchange is given by:

(Multiple Choice)

5.0/5  (49)

(49)

If velocity is constant in the long run, which of the following results flow from the quantity theory of money?

(Multiple Choice)

5.0/5  (46)

(46)

Assume that velocity is constant in the long run.Which of the following equations correctly describes the quantity equation in terms of percentage rate of change? ∆ means "change in."

(Multiple Choice)

4.8/5  (36)

(36)

When the Fed sells bonds in the open market, in the product market (the aggregate demand- aggregate supply model)

,

(Multiple Choice)

4.9/5  (38)

(38)

In December 2008, the Federal Reserve announced that it would take extraordinary measures to address the financial crisis in the economy.These measures include all of the following except

(Multiple Choice)

4.7/5  (35)

(35)

Possible targets for monetary policy include all of the following except

(Multiple Choice)

4.8/5  (39)

(39)

What are the two policy-making bodies of the Federal Reserve?

(Multiple Choice)

4.8/5  (40)

(40)

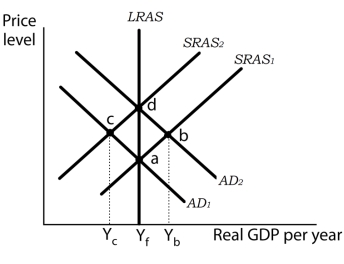

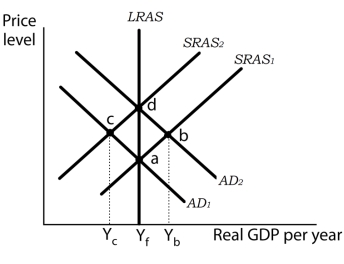

Use the following to answer questions

Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply  -(Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply)

If the economy is at point a,

-(Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply)

If the economy is at point a,

(Multiple Choice)

4.8/5  (36)

(36)

Suppose the economy experiences a recessionary gap.Expansionary monetary policy will

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following is an interest rate that the Fed has targeted in the last several years?

(Multiple Choice)

4.9/5  (42)

(42)

Use the following to answer questions

Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply  -(Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply)

If the economy is at point c, an open market purchase would cause

-(Exhibit: Monetary Policy and Long-Run Aggregate Demand and Aggregate Supply)

If the economy is at point c, an open market purchase would cause

(Multiple Choice)

4.7/5  (39)

(39)

If the Fed's primary goal is price stability which macroeconomic variable should it target?

(Multiple Choice)

4.8/5  (35)

(35)

If the Fed buys government bonds through open-market operations, it will

(Multiple Choice)

4.7/5  (44)

(44)

When the Fed lowers the target rate of interest for federal funds, it

(Multiple Choice)

4.9/5  (36)

(36)

Showing 61 - 80 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)