Exam 8: Accounting for Selected Assets

Exam 1: Introduction to Accounting48 Questions

Exam 2: Types of Organisations and the Financial Reporting Framework102 Questions

Exam 3: Ethics and Corporate Governance33 Questions

Exam 4: Wealth and the Measurement of Profit43 Questions

Exam 5: Presentation of Financial Position and the Worksheet77 Questions

Exam 6: Presentation of Financial Performance and the Worksheet74 Questions

Exam 7: Presentation of Cash Flows59 Questions

Exam 8: Accounting for Selected Assets126 Questions

Exam 9: Liabilities and Sources of Financing82 Questions

Exam 10: Financial Statement Analysis86 Questions

Exam 11: Worksheet to Debits and Credits27 Questions

Exam 12: An Introduction to Management Accounting: a Strategic Perspective54 Questions

Exam 13: Performance Measurement and the Balanced Scorecard49 Questions

Exam 14: Costs and Cost Behaviour63 Questions

Exam 15: Budgets55 Questions

Exam 16: Cost-Volume-Profit Analysis43 Questions

Exam 17: Accounting for Decision Making: With and Without Resource Constraints56 Questions

Exam 18: Capital Investment Decisions62 Questions

Select questions type

ABC Ltd purchased an item inventory at a cost of $27 000. The item was damaged during storage. The company could sell the item in its damaged state for $23 000, and in doing so incur selling costs of $1000. The net realisable value of the item of inventory is $23 000.

Free

(True/False)

4.9/5  (31)

(31)

Correct Answer:

False

On 15 July Sammy Corporation's Gross Accounts Receivable had a balance of $2300 and the Allowance for Doubtful Debts had a balance of ($220). A specific account of $80 was written off on 16 July. If no other relevant transactions had taken place, what is the amount of net receivables after the write-off?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

C

Assuming that there are inflationary trends in the economy, the inventory amount shown in the balance sheet, if based on LIFO, would normally be:

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

A

Using the weighted-average-cost method, the value of closing inventory is (to the nearest whole $):

(Multiple Choice)

4.8/5  (29)

(29)

On 1 January two years' ago, the local Red Cross affiliate acquired new blood-processing equipment costing $400 000. The equipment has an estimated useful life of 10 years and an estimated residual value of $50 000. After making all necessary calculations and entries on 31 December, what are the accumulated depreciation to date and carrying value of the equipment? (Assume that the straight-line method is used) Accumulated depreciation Carrying value as of

As of 31 December 31 December

(Multiple Choice)

4.9/5  (41)

(41)

The cost of non-current assets recognised as being consumed during a fiscal period is:

(Multiple Choice)

4.8/5  (36)

(36)

The time spent by a barrister briefing a client prior to a court hearing would constitute 'work in progress' for the law firm.

(True/False)

4.8/5  (35)

(35)

Goods that have been through the complete production or assembly cycle and are ready for resale to the customer are finished goods.

(True/False)

4.8/5  (38)

(38)

Consumable goods for use within the production process are not classified as inventory under current assets in the balance sheet.

(True/False)

4.8/5  (25)

(25)

A credit sale of a business where the revenue is not collected due to the customer not paying is a bad debt.

(True/False)

4.9/5  (38)

(38)

On 1 July, Gumi Company purchased equipment at a cost of $22 000. The equipment has an estimated residual value of $3000 and is being depreciated over an estimated useful life of eight years under the reducing-balance method of depreciation, at a rate equal to one-and-a-half times the straight-line depreciation rate. For the six months ended 31 December, Gumi Company had recorded one-half year's depreciation. One full year later, what would be the depreciation expense (rounded to the nearest dollar) on the equipment for the year and what is the written-down book value after this depreciation expense has been charged?

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following methods results in the higher value for cost of goods sold in times of rising inventory prices?

(Multiple Choice)

4.8/5  (42)

(42)

Residual value can be defined as the estimated disposal (sale) value of an asset when it is no longer useful to the entity.

(True/False)

4.9/5  (34)

(34)

The balance of the accounts receivable balance of XYZ Pty Ltd was $23 000 at the beginning of the financial year ended 30 June and $27 000 at the end of the period. The total credit sales for the company for the financial year was $132 000. Bad debts write-off totalled $5500. What was the total of the cash received from accounts receivable during the year?

(Multiple Choice)

4.8/5  (31)

(31)

The direct write-off method can mean that assets may be overstated in one year and understated the next.

(True/False)

4.8/5  (31)

(31)

Which inventory measurement method would have the most recent costs in cost of goods sold?

(Multiple Choice)

4.8/5  (36)

(36)

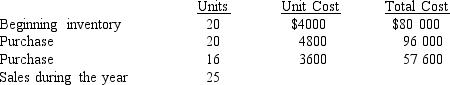

Gamma Bomber Parts uses the FIFO periodic costing method. The following data are available:  The cost of goods sold should be:

The cost of goods sold should be:

(Multiple Choice)

4.7/5  (32)

(32)

When technology is changing rapidly, depreciation of an asset will help maintain an entity's operating capacity.

(True/False)

4.9/5  (45)

(45)

Depreciation affects profit in which of the following ways?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 1 - 20 of 126

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)