Exam 12: Performance Evaluation Revisited: a Balanced Approach

Exam 1: Accounting As a Tool for Management161 Questions

Exam 2: Cost Behavior and Cost Estimation170 Questions

Exam 3: Costvolumeprofit Analysis and Pricing Decisions206 Questions

Exam 4: Product Costs and Job Order Costing183 Questions

Exam 5: Planning and Forecasting in a Manufacturing Setting195 Questions

Exam 6: Performance Evaluation: Variance Analysis194 Questions

Exam 7: Activity-Based Costing and Activity-Based Management171 Questions

Exam 8: Using Accounting Information to Make Managerial Decisions172 Questions

Exam 9: Using Accounting Information to Make Managerial Decisions168 Questions

Exam 10: Capital Budgeting192 Questions

Exam 11: Decentralization and Performance Evaluation169 Questions

Exam 12: Performance Evaluation Revisited: a Balanced Approach164 Questions

Exam 13: Financial Statement Analysis159 Questions

Select questions type

Assume you have prepared a horizontal analysis of your company's balance sheet and income statement and have found some account balances you believe need to be investigated.What would be a cause of each of the following changes in account balances?

a.Decrease in accrued salaries

b.Sales increased by a greater percentage than cost of goods sold

c.Accounts receivable decreased

d.Significant drop in long-term debt

e.Decrease in retained earnings

(Essay)

4.8/5  (36)

(36)

The 2021 and 2022 partial balance sheets for Ottoman Manufacturing Company appear below:  What is the debt-to-equity ratio for 2022?

What is the debt-to-equity ratio for 2022?

(Multiple Choice)

4.7/5  (29)

(29)

In interpreting common-size financial statements denominated in a foreign currency, a word of caution is that there may be differences in the

(Multiple Choice)

4.8/5  (32)

(32)

The formula used in preparing a common-size balance sheet is

(Multiple Choice)

4.8/5  (26)

(26)

On a common-size income statement, interest expense is shown as a percentage of

(Multiple Choice)

4.7/5  (42)

(42)

Barber Industries reported net income of $32,000, earnings per share of $1.20 and paid dividends of $0.30 per share.What is the dividend payout ratio?

(Multiple Choice)

4.7/5  (31)

(31)

The type of analysis that looks at the changes in the account balances over time is referred to as horizontal analysis.

(True/False)

4.9/5  (31)

(31)

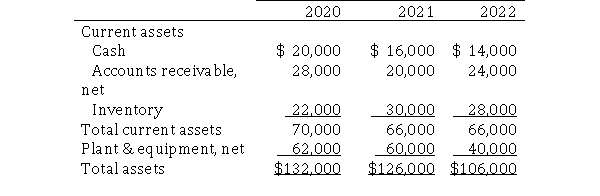

The 2020, 2021, and 2022 partial balance sheets for Ottoman Manufacturing Company appear below.  Net credit sales for Ottoman were $126,000 for 2020, $120,000 for 2021 and $114,000 for 2022, while cost of goods sold was $84,000 for 2020, $82,400 for 2021 and $72,500 for 2022. What is the average collection period for 2022?

Net credit sales for Ottoman were $126,000 for 2020, $120,000 for 2021 and $114,000 for 2022, while cost of goods sold was $84,000 for 2020, $82,400 for 2021 and $72,500 for 2022. What is the average collection period for 2022?

(Multiple Choice)

4.8/5  (41)

(41)

YZ Corporation reported net income of $75,700 last year.The company incurred interest expense of $5,000.Assets on January 1st were $640,000 and on December 31st, had increased by $40,000.The income tax rate was 30%.What is XYZ's return on total assets?

(Essay)

4.9/5  (46)

(46)

A firm's ability to convert non-cash assets into cash is referred to as liquidity.

(True/False)

4.8/5  (44)

(44)

Managers look at the financial statement to see how well a company is doing, but the account balances alone do not tell managers enough.Horizontal and trend analyses are commonly used by managers to help assess the company's financial strengths and weaknesses.

Required:

Explain what horizontal analysis and trend analysis are and how amounts are used in their calculations.What are the steps in preparing horizontal and trend analysis?

(Essay)

4.8/5  (31)

(31)

A high accounts receivable turnover rate may indicate all of the following except

(Multiple Choice)

4.9/5  (34)

(34)

Two measures of liquidity are the accounts receivable turnover and the inventory turnover.What do each of these measures show and how are they each calculated?

(Essay)

4.8/5  (39)

(39)

A helpful approach to examine changes in the relative size of account balances within a single statement is referred to as horizontal analysis.

(True/False)

4.7/5  (32)

(32)

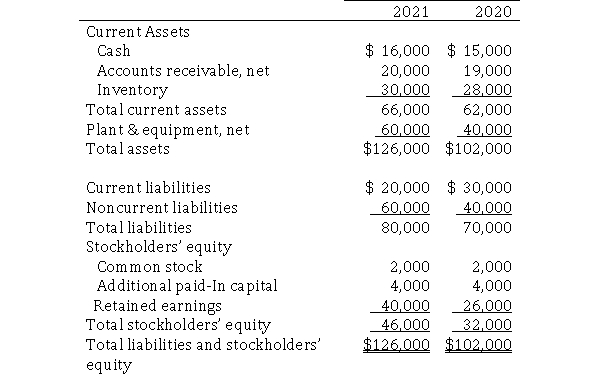

The 2020 and 2021 balance sheets for Ottoman Manufacturing Company appear below along with selected financial information.Ottoman declared no dividends during either year, and had 1,000 shares of stock outstanding throughout each year.  Required:

a.Calculate the acid-test ratio for 2020.

b.Calculate the working capital for 2021.

c.Calculate earnings per share for 2021.

Required:

a.Calculate the acid-test ratio for 2020.

b.Calculate the working capital for 2021.

c.Calculate earnings per share for 2021.

(Essay)

4.9/5  (38)

(38)

A problem with the current and acid test ratios is that, although they provide information about liquidity, they do not indicate

(Multiple Choice)

4.8/5  (38)

(38)

Showing 61 - 80 of 164

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)