Exam 9: Using Accounting Information to Make Managerial Decisions

Exam 1: Accounting As a Tool for Management161 Questions

Exam 2: Cost Behavior and Cost Estimation170 Questions

Exam 3: Costvolumeprofit Analysis and Pricing Decisions206 Questions

Exam 4: Product Costs and Job Order Costing183 Questions

Exam 5: Planning and Forecasting in a Manufacturing Setting195 Questions

Exam 6: Performance Evaluation: Variance Analysis194 Questions

Exam 7: Activity-Based Costing and Activity-Based Management171 Questions

Exam 8: Using Accounting Information to Make Managerial Decisions172 Questions

Exam 9: Using Accounting Information to Make Managerial Decisions168 Questions

Exam 10: Capital Budgeting192 Questions

Exam 11: Decentralization and Performance Evaluation169 Questions

Exam 12: Performance Evaluation Revisited: a Balanced Approach164 Questions

Exam 13: Financial Statement Analysis159 Questions

Select questions type

Jodi Jarvis won a $10 million lottery and elected to receive her winnings in 20 equal undiscounted annual installments.After receiving the first 10 installments, Jodi and her husband divorced, and the remaining 10 payments became part of the property settlement.The judge who presided over the divorce proceedings awarded one-half interest in the future lottery payments to Jodi and the other half to her ex-husband.Following the divorce, Jodi decided to sell her interest in the 10 remaining lottery payments to raise the cash needed to open a bakery.An investor has offered Jodi $1,677,520.

Required

a.What discount rate did the investor use in calculating the purchase price?

b.If Jodi can invest the money she gets at 6%, which is the better option, keeping the annuity or accepting the investor's offer? Why?

c.What needs might Jodi have that would make the investor's offer the preferable option, no matter what the interest rate (within reason)?

Free

(Essay)

4.9/5  (28)

(28)

Correct Answer:

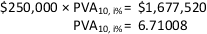

a.The original lottery payments were $500,000 per year ($10,000,000 ÷ 20), so Jodi's share is $250,000 per year.

Row 10 of the present value of an annuity table 6.71008 as the factor for 8%.

Row 10 of the present value of an annuity table 6.71008 as the factor for 8%.

b.PV = $250,000 × PVA10, 6%

PV = $1,840,025

At a 6% discount rate, the annuity is worth $1,840,025, so the investor's offer is too low.Jodi should keep the annuity.

c.After the divorce, Jodi may need cash immediately to make living arrangements.Additionally, she will incur up-front costs to open the bakery that will require cash payments in the near future.

Which of the following is not a step in the net present value approach to capital budgeting?

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

C

Lorman Manufacturing purchases equipment with an expected life of 10 years for $50,000.The equipment has an estimated salvage value of $2,000.Lorman expects the new equipment to generate annual cost savings of $8,000.What is the payback period of the equipment?

Free

(Multiple Choice)

4.9/5  (41)

(41)

Correct Answer:

B

Which of the following is not a step in the net present value approach to capital budgeting?

(Multiple Choice)

4.8/5  (40)

(40)

Birch manufacturing is considering the addition of another product line to its offerings.Equipment needed to produce the new line will cost $200,000.Birch estimates that the net annual cash inflows from the new product line will be as follows:  Required:

a.What is the payback period for the new product line?

b.If the company can establish a steady customer base before production starts and the cash inflows will be $15,000 per year for years 1 - 15, with years 16 through 20 remaining at $2,000 annually, what will be the payback period?

Required:

a.What is the payback period for the new product line?

b.If the company can establish a steady customer base before production starts and the cash inflows will be $15,000 per year for years 1 - 15, with years 16 through 20 remaining at $2,000 annually, what will be the payback period?

(Essay)

4.9/5  (35)

(35)

Using the payback method to evaluate capital projects is a simpler method than either net present value or internal rate of return.Answer the following questions relating to the payback method.

Required:

a.What does the payback period measure?

b.How is the payback period calculated when the annual cash flows are equal?

c.How is the payback period calculated when the annual cash flows are not equal?

(Essay)

4.9/5  (47)

(47)

Welcher, Inc.plans to purchase equipment with a cost of $142,500.The company expects annual net cash inflows from the equipment of $30,000.The equipment has an estimated life of 8 years, no estimated salvage life, and a required rate of return is 6%.The payback period for the equipment is closest to

(Multiple Choice)

4.8/5  (34)

(34)

The payback period is the time it takes, in years, for a company to recover the original amount of invested capital.

(True/False)

4.8/5  (38)

(38)

The payback period is used most often as a screening tool, by companies that have established a maximum acceptable payback period.

(True/False)

4.8/5  (36)

(36)

Mauldin Welding Shop is considering the purchase of new high-tech welding equipment.If the equipment is purchased, Mauldin can avoid the cost of updating the old equipment estimated to be $3,000.In determining the cash flows associated with the new equipment, the cost of updating the old equipment is

(Multiple Choice)

4.8/5  (31)

(31)

Any return a company receives over and above the original investment in a capital asset is called return on investment.

(True/False)

4.9/5  (35)

(35)

Identify which of the following items is classified as part of capital assets.

a.Pollution prevention technology

b.Direct material

c.Computer-generated manufacturing system

d.Office supplies

e.Delivery van

(Short Answer)

5.0/5  (36)

(36)

The original purchase price of an old machine that is being replaced must be considered in capital budgeting decisions.

(True/False)

5.0/5  (37)

(37)

Which of the following is a cash flow that might occur when new equipment is purchased?

(Multiple Choice)

4.7/5  (32)

(32)

A stream of equal cash flows received at set time intervals is called

(Multiple Choice)

4.8/5  (43)

(43)

Capital budgeting decisions involve both outflows of cash at one or more times and inflows of cash at other times.

(True/False)

4.9/5  (34)

(34)

Which of the following is not an assumption of the internal rate of return model?

(Multiple Choice)

4.8/5  (26)

(26)

Which of the following is a reason capital budget requests should be reviewed and approved by executive management?

(Multiple Choice)

4.7/5  (38)

(38)

Showing 1 - 20 of 168

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)