Exam 9: Plant Assets, Natural Resources, and Intangible Assets

Exam 1: Accounting in Action222 Questions

Exam 2: The Recording Process170 Questions

Exam 3: Adjusting the Accounts207 Questions

Exam 4: Completing the Accounting Cycle167 Questions

Exam 5: Accounting for Merchandising Operations201 Questions

Exam 6: Inventories156 Questions

Exam 7: Fraud, Internal Control, and Cash176 Questions

Exam 8: Accounting for Receivables206 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets261 Questions

Exam 10: Liabilities141 Questions

Exam 12: Investments119 Questions

Exam 13: Statement of Cash Flows130 Questions

Exam 14: Financial Statement Analysis120 Questions

Exam 15: Payroll Accounting27 Questions

Exam 16: Other Significant Liabilities31 Questions

Select questions type

253

Hadicke Company purchased a delivery truck for $40,000 on January 1, 2011.The truck was assigned an estimated useful life of 5 years and has a residual value of $10,000.Compute depreciation expense using the double-declining-balance method for the years 2011 and 2012.

(Essay)

4.8/5  (37)

(37)

If a plant asset is retired before it is fully depreciated, and no residual or scrap value is received,

(Multiple Choice)

4.9/5  (40)

(40)

Grimwood Trucking purchased a tractor trailer for $147,000.Grimwood uses the units-of-activity method for depreciating its trucks and expects to drive the truck 1,000,000 miles over its 12-year useful life.Residual value is estimated to be $21,000.If the truck is driven 90,000 miles in its first year, how much depreciation expense should Grimwood record?

(Multiple Choice)

4.8/5  (40)

(40)

The book value of a plant asset is the amount originally paid for the asset less anticipated residual value.

(True/False)

4.8/5  (34)

(34)

A plant asset was purchased on January 1 for $40,000 with an estimated residual value of $8,000 at the end of its useful life.The current year's Depreciation Expense is $4,000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $20,000.The remaining useful life of the plant asset is

(Multiple Choice)

4.8/5  (31)

(31)

Depreciation is the process of allocating the cost of a plant asset over its useful life in

(Multiple Choice)

4.9/5  (40)

(40)

Tax laws often do not require the taxpayer to use the same depreciation method on the tax return that is used in preparing financial statements.

(True/False)

4.7/5  (32)

(32)

A machine with a cost of $160,000 has an estimated residual value of $10,000 and an estimated useful life of 5 years or 15,000 hours.It is to be depreciated using the units-of-activity method of depreciation.What is the amount of depreciation for the second full year, during which the machine was used 5,000 hours?

(Multiple Choice)

4.8/5  (35)

(35)

Salem Company hired Kirk Construction to construct an office building for ₤8,000,000 on land costing ₤2,000,000, which Salem Company owned.The building was complete and ready to be used on January 1, 2011 and it has a useful life of 40 years.The price of the building included land improvements costing ₤600,000 and personal property costing ₤750,000.The useful lives of the land improvements and the personal property are 10 years and 5 years, respectively.Salem Company uses component depreciation, and the company uses straight-line depreciation for other similar assets.What total amount of depreciation expense would Salem Company report on its income statement for the year ended December 31, 2011?

(Multiple Choice)

4.9/5  (36)

(36)

A plant asset must be fully depreciated before it can be removed from the books.

(True/False)

4.8/5  (30)

(30)

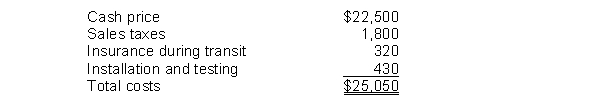

Presto Company purchased equipment and these costs were incurred:  Presto will record the acquisition cost of the equipment as

Presto will record the acquisition cost of the equipment as

(Multiple Choice)

4.8/5  (41)

(41)

Recording depreciation each period is an application of the expense recognition principle.

(True/False)

4.8/5  (44)

(44)

The cost of successfully defending a patent in an infringement suit should be

(Multiple Choice)

4.8/5  (24)

(24)

A gain on sale of a plant asset occurs when the proceeds of the sale are greater than the

(Multiple Choice)

4.8/5  (41)

(41)

A truck that cost $21,000 and on which $10,000 of accumulated depreciation has been recorded was disposed of for $9,000 cash.The entry to record this event would include a

(Multiple Choice)

4.8/5  (39)

(39)

The "Revaluation Surplus" account that results from a revaluation of plant assets to fair value is reported on the statement of financial position as a contra account to the plant asset that was revalued.

(True/False)

4.8/5  (41)

(41)

Under the double-declining-balance method, the depreciation rate used each year remains constant.

(True/False)

4.8/5  (38)

(38)

Showing 201 - 220 of 261

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)