Exam 9: Plant Assets, Natural Resources, and Intangible Assets

Exam 1: Accounting in Action222 Questions

Exam 2: The Recording Process170 Questions

Exam 3: Adjusting the Accounts207 Questions

Exam 4: Completing the Accounting Cycle167 Questions

Exam 5: Accounting for Merchandising Operations201 Questions

Exam 6: Inventories156 Questions

Exam 7: Fraud, Internal Control, and Cash176 Questions

Exam 8: Accounting for Receivables206 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets261 Questions

Exam 10: Liabilities141 Questions

Exam 12: Investments119 Questions

Exam 13: Statement of Cash Flows130 Questions

Exam 14: Financial Statement Analysis120 Questions

Exam 15: Payroll Accounting27 Questions

Exam 16: Other Significant Liabilities31 Questions

Select questions type

On January 1, 2011, Cooper Tree Company (CTC) purchases a copper mine for €10,000,000.The mine is estimated to have 20 million tons of copper and no residual value.CTC estimates that it will take 10 years to extract all the copper contained in the mine.CTC spends an additional €2,000,000 during the early part of 2011 preparing the mine.During 2011, CTC extracts 3 million tons of copper; however due to price fluctuations none of the copper is sold during 2011.On CTC's financial statement for 2011, how would the depletion associated with the extracted copper be reported?

(Multiple Choice)

4.9/5  (42)

(42)

When constructing a building, a company is permitted to include the acquisition cost and certain interest costs incurred in financing the project.

(True/False)

4.8/5  (35)

(35)

The units-of-activity method is generally not suitable for

(Multiple Choice)

4.8/5  (37)

(37)

Which depreciation method is most frequently used in businesses today?

(Multiple Choice)

4.8/5  (40)

(40)

Equipment was purchased for $17,000 on January 1, 2010.Freight charges amounted to $700 and there was a cost of $2,000 for building a foundation and installing the equipment.It is estimated that the equipment will have a $3,000 residual value at the end of its 5-year useful life.What is the amount of accumulated depreciation at December 31, 2011, if the straight-line method of depreciation is used?

(Multiple Choice)

4.9/5  (38)

(38)

IFRS allows companies to revalue plant assets to fair value at the reporting date.

(True/False)

4.8/5  (37)

(37)

Land improvements should be depreciated over the useful life of the

(Multiple Choice)

5.0/5  (36)

(36)

Which of the following is not disclosed in the statement of financial position or the notes to the financial statements?

(Multiple Choice)

4.9/5  (35)

(35)

A company sells a plant asset which originally cost ¥210,000 for ¥70,000 on December 31, 2011.The Accumulated Depreciation account had a balance of ¥84,000 after the current year's depreciation of ¥21,000 had been recorded.The company should recognize a

(Multiple Choice)

4.9/5  (40)

(40)

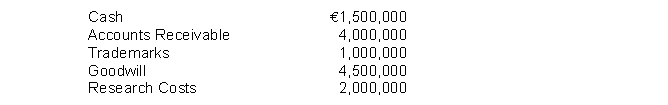

Given the following account balances at year end, compute the total intangible assets on the balance sheet of Kepler Enterprises.

(Multiple Choice)

5.0/5  (41)

(41)

A characteristic of capital expenditures is that the expenditures occur frequently during the period of ownership.

(True/False)

4.7/5  (45)

(45)

Franchises can be classified as a property, plant, and equipment item or as an intangible asset.

(True/False)

4.9/5  (42)

(42)

Depletion expense for a period is only recognized on natural resources that have been extracted and sold during the period.

(True/False)

4.7/5  (33)

(33)

A truck costing $132,000 was destroyed when its engine caught fire.At the date of the fire, the accumulated depreciation on the truck was $60,000.An insurance check for $150,000 was received based on the replacement cost of the truck.The entry to record the insurance proceeds and the disposition of the truck will include a

(Multiple Choice)

4.7/5  (42)

(42)

The entry to record patent amortization usually includes a credit to

(Multiple Choice)

4.7/5  (34)

(34)

Orr Corporation sold equipment for $12,000.The equipment had an original cost of $36,000 and accumulated depreciation of $18,000.As a result of the sale,

(Multiple Choice)

4.9/5  (35)

(35)

Showing 221 - 240 of 261

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)