Exam 2: The Accounting Equation and Transaction Analysis

Exam 1: Welcome to Accounting158 Questions

Exam 2: The Accounting Equation and Transaction Analysis155 Questions

Exam 3: The Recording Process: Debits and Credits222 Questions

Exam 4: The Recording Process: the Journal, the Ledger, and the Trial Balance176 Questions

Exam 5: Adjusting the Accounts and Preparing an Adjusted Trial Balance180 Questions

Exam 6: Completing a Worksheet and Completing the Accounting Cycle186 Questions

Exam 7: Merchandising Companies: Purchases Perpetual153 Questions

Exam 8: Merchandising Companies: Sales Perpetual122 Questions

Exam 9: Merchandising Companies: Worksheets and Financial Statements Perpetual163 Questions

Exam 10: Special Journals153 Questions

Exam 11: Inventory205 Questions

Exam 12: Cash, Banking, and Internal Controls268 Questions

Exam 13: Payroll Accounting: Employee Taxes and Records101 Questions

Exam 14: Payroll Accounting: Employer Taxes and Records79 Questions

Select questions type

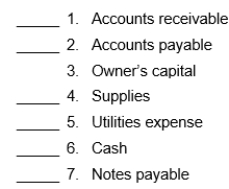

Classify each of these items as an asset (A), liability (L), or owner's equity (OE).

(Essay)

4.9/5  (33)

(33)

Alicia Keyes Company began the year with owner's equity of $280,000. During the year, the company recorded revenues of $375,000, expenses of $265,000, and had owner drawings of $30,000. What was Alicia Keyes' owner's equity at the end of the year?

(Multiple Choice)

4.9/5  (35)

(35)

Revenues result from the delivery of goods, the performance of services and owner investments.

(True/False)

4.8/5  (39)

(39)

If total liabilities increased by $9,000 during a period of time and owner's equity decreased by $25,000 during the same period, then the amount and direction (increase or decrease) of the period's change in total assets is a(n)

(Multiple Choice)

4.8/5  (34)

(34)

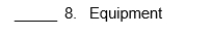

An analysis of the transactions made by R&H Blacke Co., a tax firm, for the month of July is shown below. Each increase and decrease in owner's equity is explained.  Instructions

Describe each transaction

Instructions

Describe each transaction

(Essay)

4.7/5  (37)

(37)

Accounts Receivable Notes Payable Accounts Payable Owner's Capital Cash Owner's Drawing Supplies Equipment Identify which items are (1) Assets (2) Liabilities (3) Owner's Equity

(Essay)

4.8/5  (40)

(40)

For each of the following, indicate whether the transaction affects revenue (R), expense (E), owner's drawing (D), owner's investment (I), or no effect on owner's equity (NOE).

1. Made an investment to start the business.

2. Billed customers for services performed.

3. Purchased equipment on account.

4. Paid monthly rent.

5. Withdrew cash for personal use.

(Essay)

4.7/5  (31)

(31)

Michelle Boisclair Company compiled the following financial information as of December 31, 2020: Revenues \ 440,000 Owner's Capital (1/1/20) 140,000 Equipment 180,000 Expenses 340,000 Cash 100,000 Owner's Drawings 20,000 Supplies 20,000 Accounts payable 60,000 Notes payable 100,000 Accounts receivable 80,000 Michelle Boisclair's liabilities on December 31, 2020 are

(Multiple Choice)

4.8/5  (28)

(28)

The accounting equation for Cineo Enterprises is as follows: If Cineo purchases office equipment on account for , the accounting equation will change to

(Short Answer)

4.8/5  (36)

(36)

Ed Nygma is opening a pub. Explain to Ed what items will increase or decrease owner's equity for his new business.

(Essay)

4.8/5  (33)

(33)

Loya Company entered into the following transactions during March 2020.

1. Purchased office equipment for $25,000 from Office Equipment, Inc. on account.

2. Paid $3,000 cash for March rent on office furniture.

3. Received $18,000 cash from customers for services billed in February.

4. Provided legal services to Miguel Construction Company for $3,500 cash.

5. Paid Western States Power Co. $2,500 cash for electric usage in March.

6. F. Loya invested an additional $32,000 in the business.

7. Paid Office Equipment, Inc. for the office equipment purchased in (1) above.

8. Incurred advertising expense for March of $1,600 on account.

Instructions

Indicate with the appropriate letter whether each of the transactions above results in:

(a) an increase in assets and a decrease in assets.

(b) an increase in assets and an increase in owner's equity.

(c) an increase in assets and an increase in liabilities.

(d) a decrease in assets and a decrease in owner's equity.

(e) a decrease in assets and a decrease in liabilities.

(f) an increase in liabilities and a decrease in owner's equity.

(g) an increase in owner's equity and a decrease in liabilities.

(Essay)

4.7/5  (28)

(28)

Lucius Fox opens a sports consulting office on July 1, 2020. During the first month of operations, the following transactions occurred.

1. Lucius invested $15,000 in cash in the business.

2. Paid $900 for July rent on office space.

3. Purchased equipment on account $4,000.

4. Performed consulting services to clients for cash $3,500.

5. Paid $1,000 toward equipment purchased in #3.

6. Performed consulting services for client for cash $5,000.

7. Paid monthly expenses: salaries and wages $700, utilities $400, and advertising $200.

8. Lucius withdrew $1,800 cash for personal use.

Prepare a tabular analysis, which shows the effects of these transactions on the expanded accounting equation, with owner's equity columns for Capital, Drawings, Revenues, and Expenses

(Essay)

4.8/5  (32)

(32)

Showing 21 - 40 of 155

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)