Exam 2: The Accounting Equation and Transaction Analysis

Exam 1: Welcome to Accounting158 Questions

Exam 2: The Accounting Equation and Transaction Analysis155 Questions

Exam 3: The Recording Process: Debits and Credits222 Questions

Exam 4: The Recording Process: the Journal, the Ledger, and the Trial Balance176 Questions

Exam 5: Adjusting the Accounts and Preparing an Adjusted Trial Balance180 Questions

Exam 6: Completing a Worksheet and Completing the Accounting Cycle186 Questions

Exam 7: Merchandising Companies: Purchases Perpetual153 Questions

Exam 8: Merchandising Companies: Sales Perpetual122 Questions

Exam 9: Merchandising Companies: Worksheets and Financial Statements Perpetual163 Questions

Exam 10: Special Journals153 Questions

Exam 11: Inventory205 Questions

Exam 12: Cash, Banking, and Internal Controls268 Questions

Exam 13: Payroll Accounting: Employee Taxes and Records101 Questions

Exam 14: Payroll Accounting: Employer Taxes and Records79 Questions

Select questions type

If Haircut 101 pays its utility bill on the day it is received, then

(Multiple Choice)

4.7/5  (37)

(37)

Jessica Chute, the owner of Watauga Home Health Services, withdrew cash from the business for personal use. The drawing

(Multiple Choice)

4.8/5  (36)

(36)

If Miller's Plumbing provides services and sends the customer a bill, then Miller's

(Multiple Choice)

4.8/5  (30)

(30)

The withdrawal of cash from the business by the owner decreases assets and owner's equity.

(True/False)

4.9/5  (41)

(41)

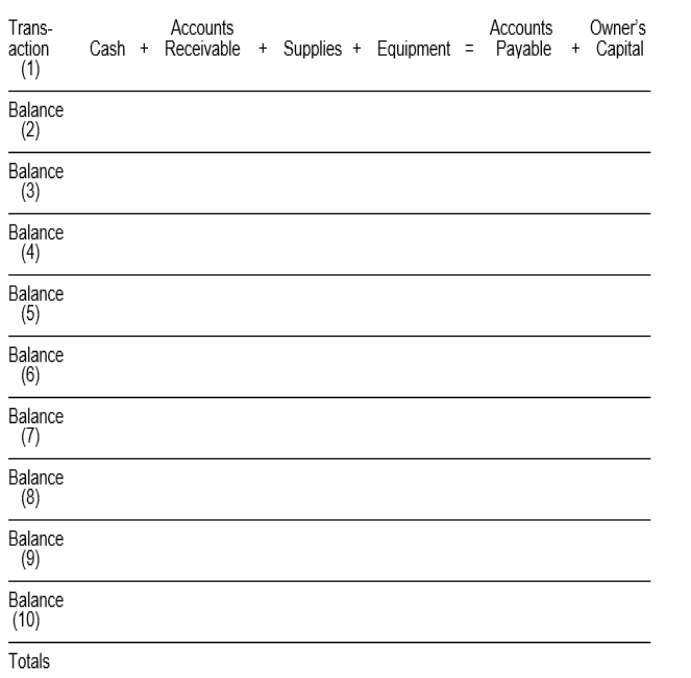

Maria Martinez decides to open a cleaning and laundry service near the local college campus that will operate as a sole proprietorship. Analyze the following transactions for the month of June in terms of their effect on the basic accounting equation. Record each transaction by increasing (+) or decreasing (-) the dollar amount of each item affected. Indicate the new balance of each item after a transaction is recorded. It is not necessary to identify the cause of changes in owner's equity.

Transactions

(1) Maria Martinez invests $25,000 in cash to start a cleaning and laundry business on June 1.

(2) Purchased equipment for $5,000 paying $3,500 in cash and the remainder due in 30 days.

(3) Purchased supplies for $1,200 cash.

(4) Received a bill from College Clarion for $200 for advertising in the campus newspaper.

(5) Cash receipts from customers for cleaning and laundry amounted to $2,600.

(6) Paid salaries of $600 to student workers.

(7) Billed the Tiger Tennis Team $480 for cleaning and laundry services.

(8) Paid $200 to College Clarion for advertising that was previously billed in Transaction 4.

(9) Maria Martinez withdrew $1,300 from the business for living expenses.

(10) Incurred utility expenses for month on account, $500.

(Essay)

4.7/5  (29)

(29)

Both owner investments and revenues increase total assets and owner's equity.

(True/False)

4.9/5  (33)

(33)

Transactions are the ______________ events of a business that are recorded by accountants.

(Essay)

4.8/5  (40)

(40)

The purchase of office equipment on credit increases total assets and total liabilities.

(True/False)

4.8/5  (32)

(32)

The expanded accounting equation adds _______________, __________________, and ______________ to the basic accounting equation.

(Essay)

4.9/5  (37)

(37)

If Miller's Plumbing receives a bill for repair of one of its trucks, then

(Multiple Choice)

4.8/5  (42)

(42)

For each of the following, indicate whether the transaction increased (+), decreased (-), or had no effect (NE) on assets, liabilities, and owner's equity using the following format.

Assets = Liabilities + Owner's Equity

1. Made an investment to start the business.

2. Billed customers for services performed.

3. Purchased equipment on account.

4. Withdrew cash for personal use.

5. Paid for equipment purchased in number 3 above.

(Essay)

4.8/5  (45)

(45)

Expenses are the costs incurred in the process generating revenue.

(True/False)

4.9/5  (46)

(46)

Internal transactions do not affect the basic accounting equation because they are economic events that occur entirely within one company.

(True/False)

4.9/5  (37)

(37)

Showing 61 - 80 of 155

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)