Exam 7: Reporting and Analyzing Liabilities and Stockholders Equity

Exam 1: Introduction to Financial Statements183 Questions

Exam 2: A Further Look at Financial Statements99 Questions

Exam 3: The Accounting Information System163 Questions

Exam 4: Accrual Accounting Concepts213 Questions

Exam 5: Fraud, Internal Control, and Cash196 Questions

Exam 6: Reporting and Analyzing Long-Lived Assets195 Questions

Exam 7: Reporting and Analyzing Liabilities and Stockholders Equity220 Questions

Exam 8: Financial Analysis: the Big Picture247 Questions

Exam 9: Managerial Accounting205 Questions

Exam 10: Cost-Volume-Profit149 Questions

Exam 11: Incremental Analysis150 Questions

Exam 12: Budgetary Planning156 Questions

Exam 13: Budgetary Control and Responsibility Accounting166 Questions

Exam 14: Standard Costs and Balanced Scorecard135 Questions

Exam 15: Planning for Capital Investments127 Questions

Exam 16: Activity Based Costing155 Questions

Exam 17: Cost-Volume Profit Analysis: Additional Issues111 Questions

Select questions type

When a change in estimate is made there is no correction of previously recorded depreciation expense.

(True/False)

4.8/5  (47)

(47)

Machinery was purchased for $340000.Freight charges amounted to $14000 and there was a cost of $40000 for building a foundation and installing the machinery.It is estimated that the machinery will have a $60000 salvage value at the end of its 5-year useful life.Depreciation expense each year using the straight-line method will be

(Multiple Choice)

5.0/5  (40)

(40)

The return on assets can be computed from the profit margin ratio and the asset turnover ratio.

(True/False)

4.8/5  (37)

(37)

Additions and improvements to a plant asset that increase the asset's operating efficiency productive capacity or expected useful life are generally expensed in the period incurred.

(True/False)

4.7/5  (42)

(42)

Stine Company purchased machinery with a list price of $96000.The company was given a 10% discount by the manufacturer.They paid $600 for shipping and sales tax of $4500.Stine estimates that the machinery will have a useful life of 10 years and a residual value of $30000.If Stine uses straight-line depreciation annual depreciation will be

(Multiple Choice)

4.8/5  (37)

(37)

Intangible assets are rights privileges and competitive advantages that result from ownership of long-lived assets without physical substance.

(True/False)

4.9/5  (26)

(26)

The depreciable cost of a plant asset is its original cost minus obsolescence.

(True/False)

4.9/5  (42)

(42)

Equipment with a cost of $300000 has an estimated salvage value of $20000 and an estimated life of 4 years or 10000 hours.It is to be depreciated by the straight-line method.What is the amount of depreciation for the first full year during which the equipment was used 2700 hours?

(Multiple Choice)

4.9/5  (39)

(39)

Expenditures to maintain the operating efficiency and expected productive life of a plant asset are

(Multiple Choice)

4.9/5  (34)

(34)

A machine was purchased for $180000 and it was estimated to have an $12000 salvage value at the end of its useful life.Monthly depreciation expense of $1750 was recorded using the straight-line method.The annual depreciation rate is

(Multiple Choice)

5.0/5  (34)

(34)

The book value of a plant asset is the difference between the

(Multiple Choice)

4.8/5  (28)

(28)

Using the units-of-activity method of depreciating factory equipment will generally result in more depreciation expense being recorded over the life of the asset than if the straight-line method had been used.

(True/False)

4.9/5  (39)

(39)

Which of the following methods of computing depreciation is production based?

(Multiple Choice)

4.9/5  (36)

(36)

On October 1 2022 Mann Company places a new asset into service.The cost of the asset is $120000 with an estimated 5-year life and $30000 salvage value at the end of its useful life.What is the depreciation expense for 2022 if Mann Company uses the straight-line method of depreciation?

(Multiple Choice)

4.9/5  (37)

(37)

Newell Company purchased a machine with a list price of $160000.The company was given a 10% discount by the manufacturer and paid $1000 for shipping and sales tax of $7500.Newell estimates that the machine will have a useful life of 10 years and a salvage value of $50000.If Newell uses straight-line depreciation annual depreciation will be

(Multiple Choice)

5.0/5  (29)

(29)

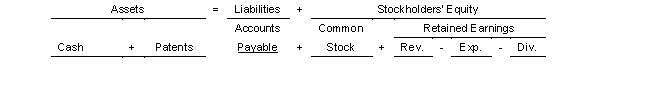

During 2022 Hernandez Company incurred $1900000 of research and development costs in its laboratory to develop a new product and $220000 in legal fees to patent the product.Use the following tabular analysis to record these costs assuming that the payments were made in cash

(Multiple Choice)

4.9/5  (38)

(38)

A change in the estimated salvage value of a plant asset requires a restatement of prior years' depreciation.

(True/False)

4.8/5  (27)

(27)

Machinery was purchased for $340000 on January 1 2022.Freight charges amounted to $14000 and there was a cost of $40000 for building a foundation and installing the machinery.It is estimated that the machinery will have a $60000 salvage value at the end of its 5-year useful life.What is the amount of accumulated depreciation at December 31 2023 if the straight-line method of depreciation is used?

(Multiple Choice)

4.9/5  (42)

(42)

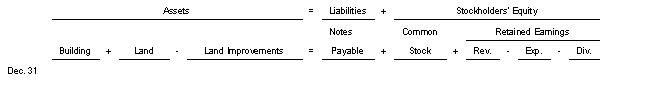

On August 7 Gideon Ridge Restaurant purchased a building in exchange for a note with a face amount of $1660000.The cost of the land was $600000.The building cost $900000 and the parking lot was valued at $160000.Use the following tabular analysis to record the transaction.

(Multiple Choice)

4.9/5  (34)

(34)

Showing 121 - 140 of 220

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)