Exam 21: Gst-Hst

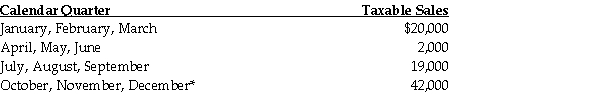

Ms. Jesse Holt begins her business on January 1 of the current year. Her quarterly sales of fully taxable items are as follows:  *Consists of a sale of $28,000 on October 15 and a sale of $14,000 on November 27.

At what point in time will Ms. Holt have to begin collecting GST? At what point will she be required to register?

*Consists of a sale of $28,000 on October 15 and a sale of $14,000 on November 27.

At what point in time will Ms. Holt have to begin collecting GST? At what point will she be required to register?

As Ms. Holt's sales accumulate to more than $30,000 by the end of the third quarter, she will have to begin collecting GST on November 1, one month after the end of the quarter. (The fourth quarter sales are not relevant.)She will be required to register by December 26, within 29 days of the November 27 sale.

Describe two factors that have been influential in the increased use of transaction taxes in various countries around the world.

The required two factors can be selected from the following:

• Simplicity - Transaction taxes are easy to administer and collect. No forms are required from individuals paying the tax and, if the individual wishes to acquire a particular good or service, it is difficult to evade payment.

• Incentives To Work - An often cited disadvantage of income taxes is that they can discourage individual initiative to work and invest. Transaction taxes do not have this characteristic.

• Consistency - Transaction taxes avoid the fluctuating income and family unit problems that are associated with progressive income tax systems.

• Keeping The Tax Revenues In Canada - While some types of income can be moved out of Canada, resulting in the related taxes being paid in a different jurisdiction, taxes on Canadian transactions remain in Canadian hands.

Kenichi Tajima operates a small clothing store in Saskatchewan, a non-participating province. The provincial sales tax is 6 percent. This store uses the simplified method of accounting for input tax credits. The store had fully taxable purchases of $180,000 and purchased capital items (not including real property)with a cost of $5,000. Both amounts include PST and GST. What amount of input tax credit is Mr. Tajima able to claim?

Briefly describe the advantages, from the point of view of business organizations, of an HST system as compared to a combined GST/PST system.

When the quick method is used, input tax credits on capital expenditures are tracked and dealt with in the same manner as when the regular method is used.

Under what circumstances would an entity choose to file a GST or HST return more frequently than required by the Excise Tax Act?

Certain qualifying registrants can use the Quick Method of accounting for GST/HST. What are the advantages of using this method?

Describe the "place of supply" rules as they apply to (1)tangible goods other than real property, and (2)services.

Describe the GST/HST consequences related to the sale of:

• fully taxable goods and services;

• zero-rated goods and services; and

• exempt goods and services.

George Black lives in Manitoba, a non-participating province that has an 8 percent provincial sales tax. During the current year, he purchases a new Lexus for $82,000. He receives a trade in allowance of $36,000 for his old vehicle. The GST/HST charged on his new vehicle would be equal to:

Provide two examples of expenditures where available input tax credits are restricted, even when the expenditures involved commercial activity.

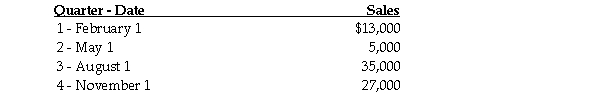

Elfassy Art Dealers is a new business which started operating on January 1 of the current year. It had four sales on the following dates during its first year of operation:  On what date will Elfassy Art Dealers have to begin collecting GST?

On what date will Elfassy Art Dealers have to begin collecting GST?

In April of the current year, Bryan Lord purchases a new home at a cost of $610,000, plus GST of $30,500. Bryan is a resident of Manitoba, a province that does not participate in the HST program. Bryan will be eligible for a new housing GST rebate of:

Which of the following transactions related to the operation of a trust are subject to GST/HST?

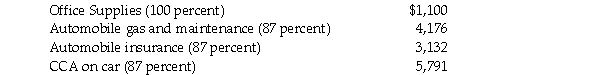

Tamara Soccorro is a real estate agent. She lives in a province that participates in the HST program at 13 percent. She earns commission income, and pays her employment related expenses herself. Tamara has claimed the following expenses on her T777 - Statement of Employment Expenses:  Where applicable, the amounts include the HST. What is Tamara's Employee HST Rebate?

Where applicable, the amounts include the HST. What is Tamara's Employee HST Rebate?

If a newly acquired capital real property is used more than 50 percent for the provision of taxable supplies, the acquirer can claim 100 percent of the GST paid as an input tax credit.

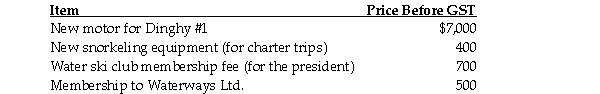

Underwater World Ltd., is located in Alberta. Alberta does not participate in the HST program and does not have a provincial sales tax. Among the purchases Underwater World Ltd. made during December were the following items:  Waterways Ltd. carries supplies for charter boat operators and requires the payment of a membership to use their services. The input tax credits that Underwater World Ltd. can claim for the above items for December are:

Waterways Ltd. carries supplies for charter boat operators and requires the payment of a membership to use their services. The input tax credits that Underwater World Ltd. can claim for the above items for December are:

John is a resident of Ontario where a 13 percent HST rate is in effect. He is acquiring a new car from a car dealer and is being given a trade-in allowance for his old vehicle. Explain how the HST will apply to John's purchase.

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)