Exam 7: Consumer Mathematics

Exam 1: Problem Solving35 Questions

Exam 2: Sets73 Questions

Exam 3: Logic86 Questions

Exam 4: Numeration Systems89 Questions

Exam 5: The Real Number System151 Questions

Exam 6: Topics in Algebra97 Questions

Exam 7: Consumer Mathematics130 Questions

Exam 8: Measurement60 Questions

Exam 9: Geometry98 Questions

Exam 10: Probability and Counting Techniques120 Questions

Exam 11: Statistics174 Questions

Exam 12: Voting Methods58 Questions

Exam 13: Graph Theory33 Questions

Exam 14: Available Online: Other Mathematical Systems37 Questions

Select questions type

In many cases, property taxes when you own a home are paid every six months, homeowner's

Insurance is paid once per year, and car insurance is paid every six months. One homeowner pays

$1,450 in property taxes twice a year, $946 in homeowner's insurance annually, and makes car

Insurance payments of $294.32 and $335.40 every six months. If this homeowner wants to spread

These expenses out by putting some money each month into a savings account, how much should she

Put aside per month?

Free

(Multiple Choice)

5.0/5  (29)

(29)

Correct Answer:

C

Leslie's monthly income is $1,871.04 and has fixed expenses of $912.46. Leslie treats her

Roommates to salads and pizzas from Papa Antonio's every Monday and Thursday, at a cost of $30,

Including delivery and tip. What percentage of her budget after fixed expenses goes toward these

Semiweekly gatherings on average?

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

C

Find the interest on the loan using the Banker's rule.

P = $2,000, r = 11%, t = 90 days

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

D

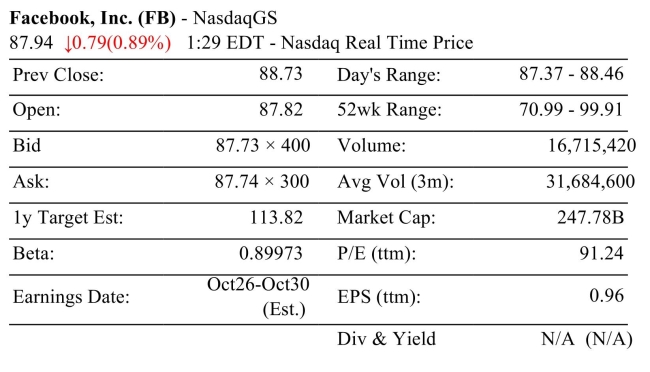

Use the information in the stock table below.

a. Calculate the P/E ratio by hand, and compare to the P/E ratio in the table. If your result is

different, discuss why you think that may be the case.

b. If a competitor has a P/E ratio of 90.33 and a market price of $85.30, calculate the earning per

share.

(Essay)

4.8/5  (30)

(30)

Marlene works full-time as an executive assistant, and she has a check for $1,820.36

direct-deposited into her checking account every other Friday. How much money does Marlene

make per year? There are different approaches to calculating this amount, so make sure that you

describe how you arrived at your answer.

(Short Answer)

4.7/5  (40)

(40)

A is a long-term loan where the lender has the right to seize the property purchased if the

payments are not made.

(Short Answer)

4.8/5  (34)

(34)

Find (a)the discount, (b)the amount of money received, and (c)the true interest rate.

P = $13,000, r = 3.5%, t = 9 years

(Multiple Choice)

4.7/5  (34)

(34)

Max borrows $15,500 for her last 2 years of college, acquiring a federal student loan at 8% interest.

Find the amount of interest accrues if she acquires the loan in August, graduates 2 years later, and

Payments begin 3 months later.

(Multiple Choice)

4.7/5  (41)

(41)

Suppose you bought 600 shares of a stock at $38.34 using a broker that charged a 1% commission.

A. Find the total cost of buying the stock.

B. If you sold them later at $38.97 using an online brokerage with a $9.95 flat fee, would you have

Made or lost money? How much?

(Multiple Choice)

4.9/5  (34)

(34)

Rashard bought four bonds with face values of $1,000 each, a simple interest rate of 5.4% per year,

And a maturity date 10 years after they were issued. He paid $4,725 three years after the bonds were

Issued. If he keeps the bonds until maturity, find his total profit, and his percent return per year.

(Multiple Choice)

4.9/5  (29)

(29)

A student loan is taken out for $8,700 at 6.2%. Find the interest that accrues in a 30-day month.

(Multiple Choice)

4.8/5  (39)

(39)

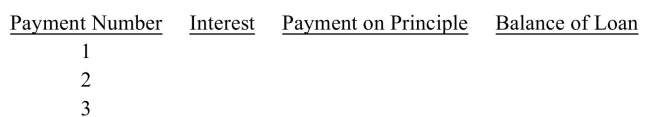

Compute an amortization schedule for the first three months for a $59,000 mortgage with an interest

rate of 7% and a monthly payment of $530.41.

(Essay)

4.8/5  (27)

(27)

With a mortgage, the rate of interest remains the same for the entire term of the loan. The

payments (usually monthly)stay the same.

(Short Answer)

4.8/5  (36)

(36)

Ellen has maxed out her credit card at $11,500 and vows not to make any other credit card

Purchases. Her credit card company charges 1.23% interest per month, and the minimum monthly

Payment is all interest due plus 4% of the principal balance. How much of the balance can Ellen pay

Down if she pays the minimum payment only for 4 months?

(Multiple Choice)

4.7/5  (32)

(32)

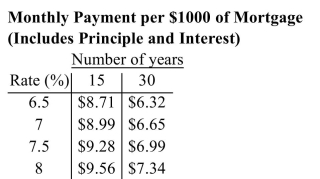

A house sells for $268,500 and a 40% down payment is made. A 30-year mortgage at 7% was

obtained.

(i)Find the down payment.

(ii)Find the amount of the mortgage.

(iii)Find the monthly payment.

(iv)Find the total interest paid.

(Essay)

4.9/5  (33)

(33)

Showing 1 - 20 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)