Exam 8: Inventories: Measurement

Exam 1: Environment and Theoretical Structure of Financial Accounting181 Questions

Exam 2: Review of the Accounting Process 139 Questions

Exam 3: The Balance Sheet and Financial Disclosures168 Questions

Exam 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows178 Questions

Exam 5: Revenue Recognition316 Questions

Exam 6: Time Value of Money Concepts126 Questions

Exam 7: Cash and Receivables187 Questions

Exam 8: Inventories: Measurement182 Questions

Exam 9: Inventories: Additional Issues153 Questions

Exam 10: Property, Plant, and Equipment and Intangible Assets: Acquisition149 Questions

Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Disposition223 Questions

Exam 12: Investments183 Questions

Exam 13: Current Liabilities and Contingencies155 Questions

Exam 14: Bonds and Long-Term Notes256 Questions

Exam 15: Leases262 Questions

Exam 16: Accounting for Income Taxes176 Questions

Exam 17: Pensions and Other Postretirement Benefits246 Questions

Exam 20: Accounting Changes and Error Corrections152 Questions

Exam 21: The Statement of Cash Flows Revisited192 Questions

Select questions type

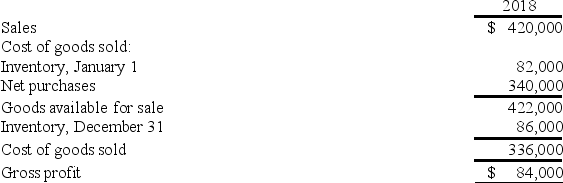

Thompson TV and Appliance reported the following in its 2018 financial statements:  -Thompson's 2018 gross profit ratio is:

-Thompson's 2018 gross profit ratio is:

(Multiple Choice)

4.7/5  (38)

(38)

A company's estimate of merchandise that will be returned by customers should be:

(Multiple Choice)

4.7/5  (46)

(46)

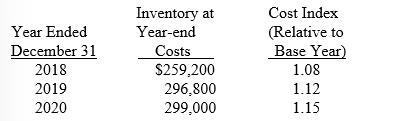

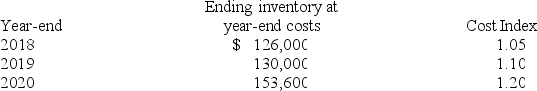

On January 1, 2018, the National Furniture Company adopted the dollar-value LIFO method of computing inventory. An internal cost index is used to convert ending inventory to base year. Inventory on January 1 was $200,000. Year-end inventories at year-end costs and cost indexes for its one inventory pool were as follows:

Required:

Compute inventory amounts at the end of each year.

Required:

Compute inventory amounts at the end of each year.

(Essay)

4.9/5  (30)

(30)

Bunker Auto Supply purchased merchandise on January 4, 2018, at a price of $70,000, subject to credit terms of 2/10, n/30. Bunker uses the gross method for recording purchases and uses a periodic inventory system.

Required:

1. Prepare the journal entry to record the purchase.

2. Prepare the journal entry to record the payment of one-half the invoice amount on January 11, 2018.

3. Prepare the journal entry to record the balance of the amount due on February 2, 2018.

(Essay)

4.8/5  (41)

(41)

In a period when costs are rising and inventory quantities are stable, the inventory method that would result in the highest ending inventory is:

(Multiple Choice)

4.9/5  (25)

(25)

Shipping charges on outgoing goods are included in either cost of goods sold or selling expenses.

(True/False)

4.8/5  (38)

(38)

Listed below are 5 terms followed by a list of phrases that describe or characterize each of the terms. Match each phrase with the correct term.

-LIFO

(Multiple Choice)

4.8/5  (38)

(38)

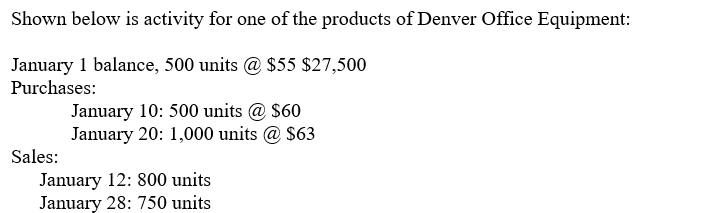

-Required: Compute the January 31 ending inventory and cost of goods sold for January, assuming Denver uses average cost and a perpetual inventory system.

-Required: Compute the January 31 ending inventory and cost of goods sold for January, assuming Denver uses average cost and a perpetual inventory system.

(Essay)

4.8/5  (39)

(39)

Meteor Co. purchased merchandise on March 4, 2018, at a price of $30,000, subject to credit terms of 2/10, n/30. Meteor uses the net method for recording purchases and uses a periodic inventory system.

Required:

1. Prepare the journal entry to record the purchase.

2. Prepare the journal entry to record the appropriate payment if the entire invoice is paid on March 11, 2018.

3. Prepare the journal entry to record the appropriate payment if the entire invoice is paid on April 2, 2018.

(Essay)

4.9/5  (39)

(39)

Alison's dress shop buys dresses from McGuire Manufacturing. Alison purchased dresses from McGuire on July 17 and received an invoice with a list price amount of $6,000 and payment terms of 2/10, n/30. Alison uses the net method to record purchases. Alison should record the purchase at:

(Multiple Choice)

4.8/5  (30)

(30)

FIFO periodic and FIFO perpetual always produce the same dollar amounts for cost of goods sold.

(True/False)

4.9/5  (45)

(45)

In a perpetual inventory system, which of the following is recorded at the time of the sale?

(Multiple Choice)

4.9/5  (33)

(33)

Northwest Fur Co. started 2018 with $94,000 of merchandise inventory on hand. During 2018, $400,000 in merchandise was purchased on account with credit terms of 1/15, n/45. All discounts were taken. Purchases were all made f.o.b. shipping point. Northwest paid freight charges of $7,500. Merchandise with an invoice amount of $5,000 was returned for credit. Cost of goods sold for the year was $380,000. Northwest uses a perpetual inventory system.

-Assuming Northwest uses the gross method to record purchases, what is the cost of goods available for sale?

(Multiple Choice)

4.8/5  (35)

(35)

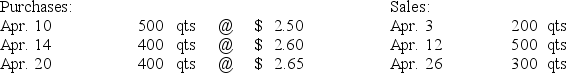

Texas Petrochemical reported the following April activity for its VC-30 lubricant, which had a balance of 300 qts. @ $2.40 on April 1.  The ending inventory assuming LIFO and a periodic inventory system is:

The ending inventory assuming LIFO and a periodic inventory system is:

(Multiple Choice)

4.8/5  (35)

(35)

GG Inc. uses LIFO. GG disclosed that if FIFO had been used, inventory at the end of 2018 would have been $15 million higher than the difference between LIFO and FIFO at the end of 2017. Assuming GG has a 40% income tax rate:

(Multiple Choice)

4.8/5  (39)

(39)

LIFO periodic and LIFO perpetual always produce the same dollar amounts for ending inventory.

(True/False)

4.9/5  (35)

(35)

On January 1, 2018, Badger Inc. adopted the dollar-value LIFO method. The inventory cost on this date was $100,000. The ending inventory, valued at year-end costs, and the relative cost index for each of the next three years is below:  - What inventory balance would Badger report on its 12/31/2020 balance sheet?

- What inventory balance would Badger report on its 12/31/2020 balance sheet?

(Multiple Choice)

4.8/5  (35)

(35)

Showing 81 - 100 of 182

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)