Exam 4: Activity Based Costing

Exam 1: Introduction to Managerial Accounting191 Questions

Exam 2: Job Order Costing178 Questions

Exam 3: Process Cost Systems182 Questions

Exam 4: Activity Based Costing110 Questions

Exam 5: Cost Volume Profit Analysis210 Questions

Exam 6: Variable Costing for Management Analysis153 Questions

Exam 7: Budgeting182 Questions

Exam 8: Evaluating Variances From Standard Costs166 Questions

Exam 9: Evaluating Decentralized Operations204 Questions

Exam 10: Differential Analysis and Product Pricing165 Questions

Exam 11: Capital Investment Analysis177 Questions

Exam 12: Lean Manufacturing and Activity Analysis123 Questions

Exam 13: Statement of Cash Flows171 Questions

Exam 14: Financial Statement Analysis183 Questions

Select questions type

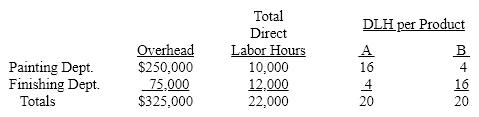

Adirondak Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead.  Calculate the overhead rate per unit for Product A in the painting department of Adirondack Marketing Inc.

Calculate the overhead rate per unit for Product A in the painting department of Adirondack Marketing Inc.

(Multiple Choice)

4.8/5  (33)

(33)

Condelezza Co. manufactures two products, A and B, in two production departments, Assembly and Finishing. Condelezza Co. expects to produce 10,000 units of Product A and 20,000 units of Product B in the coming year. Budgeted factory overhead costs for the coming year are:  The machine hours expected to be used in the coming year are as follows:

The machine hours expected to be used in the coming year are as follows:  (a) Compute the plantwide factory overhead rate.

Compute the production department factory overhead rates.

(b) Compute the factory overhead per unit for each product using (1) the single plantwide rate and (2) production department factory overhead rates.

(c) Which method is better (plantwide or department)? Why?

(a) Compute the plantwide factory overhead rate.

Compute the production department factory overhead rates.

(b) Compute the factory overhead per unit for each product using (1) the single plantwide rate and (2) production department factory overhead rates.

(c) Which method is better (plantwide or department)? Why?

(Short Answer)

4.9/5  (35)

(35)

When a plantwide factory overhead rate is used, the total overhead costs allocated to all products are the same.

(True/False)

4.7/5  (36)

(36)

Shanghai Company sells glasses, fine china, and everyday dinnerware. They use activity-based costing to determine the cost of the shipping and handling activity. The shipping and handling activity has an activity rate of $14 per pound. A box of glasses weighs 2 lbs, the box of china weighs 4 lbs, and a box of everyday dinnerware weighs 6 lbs. (a) Determine the shipping and handling activity for each product and (b) determine the total shipping and receiving costs for the china if 3,500 boxes are shipped.

(Short Answer)

4.9/5  (35)

(35)

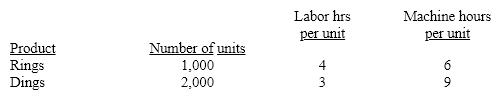

The Aleutian Company produces two products, Rings and Dings. They are manufactured in two departments-Fabrication and Assembly. Data for the products and departments are listed below.  All of the machine hours take place in the Fabrication Department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly Department, which has an estimated total overhead of $105,000.

The Aleutian Company uses departmental overhead rates. The Fabrication Department uses machine hours for an allocation base, and the Assembly Department uses labor hours.

What is the Fabrication Department overhead rate per machine hour?

All of the machine hours take place in the Fabrication Department, which has an estimated overhead of $90,000. All of the labor hours take place in the Assembly Department, which has an estimated total overhead of $105,000.

The Aleutian Company uses departmental overhead rates. The Fabrication Department uses machine hours for an allocation base, and the Assembly Department uses labor hours.

What is the Fabrication Department overhead rate per machine hour?

(Multiple Choice)

4.9/5  (38)

(38)

Multiple production department factory overhead rates are less accurate than are plantwide factory overhead rates.

(True/False)

4.8/5  (29)

(29)

Challenger Factory produces two similar products - regular widgets and deluxe widgets. The total plant overhead budget is $675,000 with 300,000 estimated direct labor hours. It is further estimated that deluxe widget production will need 3 direct labor hours for each unit and regular widget production will require 2 direct labor hours for each unit.

Using the single plantwide factory overhead rate with an allocation base of direct labor hours, how much factory overhead will Challenger Factory allocate to regular widget production if budgeted production for the period is 75,000 units and actual production for the period is 72,000 units?

(Multiple Choice)

4.9/5  (29)

(29)

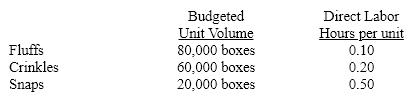

Bugaboo Co. manufactures three types of cookies: Fluffs, Crinkles, and Snaps. The production process is relatively simple, and factory overhead costs are allocated to products using a single plantwide factory rate based on direct labor hours. Information for the month of May, Bugaboo's first month of operations, follows:  Bugaboo has budgeted direct labor costs for May at $8.50 per hour. Budgeted direct materials costs for May are: Fluffs, $0.75/unit; Crinkles $0.40/unit; and Snaps $0.30/unit.

Bugaboo's budgeted overhead costs for May are:

Bugaboo has budgeted direct labor costs for May at $8.50 per hour. Budgeted direct materials costs for May are: Fluffs, $0.75/unit; Crinkles $0.40/unit; and Snaps $0.30/unit.

Bugaboo's budgeted overhead costs for May are:  Assume that Bugaboo sells all the boxes it produces in May.

(a) Compute Bugaboo's plantwide factory overhead rate for May.

(b) Compute the product cost in May for each type of cookie.

(c) Does Bugaboo's use of a plantwide factory overhead rate in any way distort the product costs for May?

Assume that Bugaboo sells all the boxes it produces in May.

(a) Compute Bugaboo's plantwide factory overhead rate for May.

(b) Compute the product cost in May for each type of cookie.

(c) Does Bugaboo's use of a plantwide factory overhead rate in any way distort the product costs for May?

(Short Answer)

4.9/5  (38)

(38)

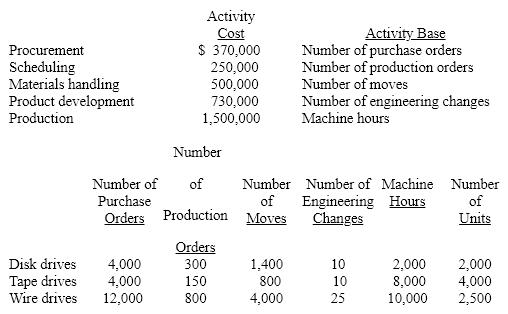

Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below.  Determine the activity rate per production order for scheduling.

Determine the activity rate per production order for scheduling.

(Multiple Choice)

4.8/5  (39)

(39)

The Roget Factory has determined that its budgeted factory overhead budget for the year is $15,500,000. They plan to produce 2,000,000 units. Budgeted direct labor hours are 1,050,000 and budgeted machine hours are 750,000. Using the single plantwide factory overhead rate based on direct labor hours, calculate the factory overhead rate for the year.

(Multiple Choice)

4.9/5  (34)

(34)

Showing 101 - 110 of 110

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)