Exam 8: Completing the Operating Cycle

Exam 1: Accounting Information: Users and Uses47 Questions

Exam 2: Financial Statements: An Overview118 Questions

Exam 3: The Accounting Cycle: The Mechanics of Accounting109 Questions

Exam 4: Completing the Accounting Cycle112 Questions

Exam 5: Internal Controls: Ensuring the Integrity of Financial Information108 Questions

Exam 6: Receivables: Selling a Product or a Service115 Questions

Exam 7: Inventory and the Cost of Sales148 Questions

Exam 8: Completing the Operating Cycle93 Questions

Exam 9: Investments: Property, Plant, and Equipment and Intangible Assets130 Questions

Exam 10: Financing: Long-Term Liabilities113 Questions

Exam 11: Financing: Equity86 Questions

Exam 12: Investments: Debt and Equity Securities89 Questions

Exam 13: Statement of Cash Flows97 Questions

Exam 14: Analyzing Financial Statements91 Questions

Exam 15: Management Accounting and Cost Concepts104 Questions

Exam 16: Cost Flows and Business Organizations136 Questions

Exam 17: Activity-Based Costing64 Questions

Exam 18: Budgeting and Control128 Questions

Exam 19: Controlling Cost and Profit137 Questions

Exam 20: Inventory Management and Variable and Absorption Costing89 Questions

Exam 21: Cost Behavior and Decisions Using C-V-P Analysis152 Questions

Exam 22: Relevant Information and Decisions97 Questions

Exam 23: Capital Investment Decisions103 Questions

Exam 24: New Measures of Performance83 Questions

Select questions type

To properly recognize the expense associated with compensated absences, a company should

(Multiple Choice)

4.9/5  (39)

(39)

When recording the costs associated with a postemployment benefit of a employer that was just laid off in the current period, a debit will be made to

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following items should be reported as an extraordinary item?

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following are reported on the income statement along with their tax effects?

(Multiple Choice)

4.9/5  (33)

(33)

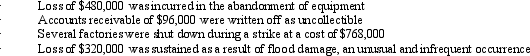

Dike Corporation incurred the following losses during 2012:  Ignoring income taxes, what amount of loss should Dike report as extraordinary on its annual income statement?

Ignoring income taxes, what amount of loss should Dike report as extraordinary on its annual income statement?

(Multiple Choice)

4.7/5  (37)

(37)

During the month of July, Joel Mayer earned $2,000. Joel has been on the payroll all year at a salary of $2,000 per month. Salaries are paid at the end of each month. Assume that FICA taxes are 7.65 percent of wages up to $50,000; state unemployment tax is 5.0 percent of wages up to $13,000; and federal unemployment tax is 0.8 percent of wages up to $13,000. Assume that Joel has voluntary withholdings of $75 (in addition to taxes) and that federal and state income tax withholdings are $300 and $100, respectively. What is the employer's payroll tax expense for the month of July, assuming that Joel Mayer is the only employee?

(Multiple Choice)

4.9/5  (28)

(28)

Amy Tan earns $7,200 per month as the only employee of a small shop. FICA taxes on her salary are 7.65 percent of the first $50,000. Federal income taxes are withheld at the rate of 30 percent and state income taxes at the rate of 7 percent. Her employer is subject to 0.8 percent FUTA tax and 3.0 percent SUTA tax.

Prepare the journal entries to be made by her employer for the month of January. (Round to the nearest dollar.)

(Essay)

4.9/5  (38)

(38)

Which of the following is the required treatment of research and development costs under FASB?

(Multiple Choice)

4.9/5  (37)

(37)

Which type of pension plan requires a company to place a certain amount of money into a pension fund each year on behalf of the employees?

(Multiple Choice)

4.8/5  (41)

(41)

During the month of July, Joel Mayer earned $2,000. Joel has been on the payroll all year at a salary of $2,000 per month. Salaries are paid at the end of each month. Assume that FICA taxes are 7.65 percent of wages up to $50,000; state unemployment tax is 5.0 percent of wages up to $13,000; and federal unemployment tax is 0.8 percent of wages up to $13,000. Assume that Joel has voluntary withholdings of $75 (in addition to taxes) and that federal and state income tax withholdings are $300 and $100, respectively. What amount is the check, net of all deductions, that Joel received for his July pay?

(Multiple Choice)

4.9/5  (39)

(39)

The required recording of research and development expenditures has which of the following effects on the financial statements?

(Multiple Choice)

4.7/5  (35)

(35)

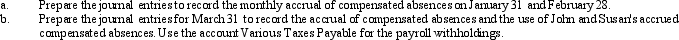

John Ackley and Susan Baldwin are employees of Clarion Company. Both John and Susan work 8 hours a day and are paid monthly on the last day of the month. John is paid at a rate of $15 per hour and Susan is paid $12 per hour. John and Susan accrue compensated absences throughout the year at a rate of 1.5 days per month. In March, John missed three days of work due to illness and Susan missed one day of work. Both John and Susan have payroll withholdings of 25%.

(Essay)

4.8/5  (42)

(42)

Unger Sporting Goods Company sold a pair of skis for cash. It recorded the sale as:  Given this entry, what would be the nature of Account C?

Given this entry, what would be the nature of Account C?

(Multiple Choice)

4.7/5  (38)

(38)

Which of the following is NOT true regarding taxes deducted from an employee's earnings?

(Multiple Choice)

4.8/5  (37)

(37)

During the year, Perez Company earned revenues of $113,625 and incurred $98,000 for various operating expenses. There are 1,250 shares of stock outstanding. Earnings per share is

(Multiple Choice)

4.9/5  (40)

(40)

What makes environmental liabilities unique among contingent liabilities?

(Multiple Choice)

4.8/5  (37)

(37)

A contingent liability is recorded by making the appropriate journal entry if the likelihood of a loss from a contingency is

(Multiple Choice)

4.9/5  (40)

(40)

Showing 21 - 40 of 93

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)