Exam 8: Completing the Operating Cycle

Exam 1: Accounting Information: Users and Uses47 Questions

Exam 2: Financial Statements: An Overview118 Questions

Exam 3: The Accounting Cycle: The Mechanics of Accounting109 Questions

Exam 4: Completing the Accounting Cycle112 Questions

Exam 5: Internal Controls: Ensuring the Integrity of Financial Information108 Questions

Exam 6: Receivables: Selling a Product or a Service115 Questions

Exam 7: Inventory and the Cost of Sales148 Questions

Exam 8: Completing the Operating Cycle93 Questions

Exam 9: Investments: Property, Plant, and Equipment and Intangible Assets130 Questions

Exam 10: Financing: Long-Term Liabilities113 Questions

Exam 11: Financing: Equity86 Questions

Exam 12: Investments: Debt and Equity Securities89 Questions

Exam 13: Statement of Cash Flows97 Questions

Exam 14: Analyzing Financial Statements91 Questions

Exam 15: Management Accounting and Cost Concepts104 Questions

Exam 16: Cost Flows and Business Organizations136 Questions

Exam 17: Activity-Based Costing64 Questions

Exam 18: Budgeting and Control128 Questions

Exam 19: Controlling Cost and Profit137 Questions

Exam 20: Inventory Management and Variable and Absorption Costing89 Questions

Exam 21: Cost Behavior and Decisions Using C-V-P Analysis152 Questions

Exam 22: Relevant Information and Decisions97 Questions

Exam 23: Capital Investment Decisions103 Questions

Exam 24: New Measures of Performance83 Questions

Select questions type

Property taxes are usually assessed by county or city governments based on a company's

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following types of advertising is typically capitalized?

(Multiple Choice)

4.8/5  (27)

(27)

Which of the following taxes must be paid by both the employee and the employer?

(Multiple Choice)

4.8/5  (39)

(39)

On December 31, 2012, Johnson Corporation reported total revenue of $750,000 and total expenses of $425,000. Johnson had 4,000 shares of stocks outstanding. Also, as of January 1, 2012, Johnson had issued stock options that allowed employees to receive 1,000 shares of stock for free at a time of their choosing in the future. As of December 31, none of these stock options had been exercised. What is basic earnings per share for Johnson Corporation?

(Multiple Choice)

4.8/5  (33)

(33)

The yearly increase in the pension obligation associated with work done during the year is the

(Multiple Choice)

4.9/5  (28)

(28)

During the first week of January, Nathan Mills earned $800. Assume that FICA taxes are 7.65 percent of wages up to $50,000; state unemployment tax is 5.0 percent of wages up to $13,000; and federal unemployment tax is 0.8 percent of wages up to $13,000. Assume that Nathan has voluntary withholdings of $40 (in addition to taxes) and that federal and state income tax withholdings are $72 and $24, respectively. What is the employer's payroll tax expense for the week, assuming that Nathan Mills is the only employee?

(Multiple Choice)

4.8/5  (39)

(39)

Diluted earnings per share includes stock transactions that might occur in the future such as

(Multiple Choice)

4.8/5  (46)

(46)

Earnings per share is NOT calculated on which of the following amounts?

(Multiple Choice)

4.8/5  (39)

(39)

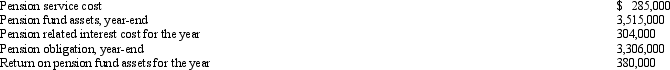

Bristol Company's accounting records contained the following information for a current year:

(Essay)

4.8/5  (37)

(37)

Eldora, Inc. paid property taxes of $16,500 on June 30, 2012, for the period July 1, 2012, to June 30, 2013, and debited prepaid property tax expense. Eldora, Inc. uses a fiscal year end of September 30 for financial purposes. What journal entry should be made to recognize property tax expense for the period October 1, 2012, to June 30, 2013?

(Multiple Choice)

4.9/5  (40)

(40)

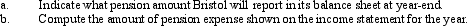

Romulus Corporation incurred the following losses during 2012:  Assuming that Romulus has a 40% income tax rate, what amount of net loss should Romulus report as extraordinary on its annual income statement?

Assuming that Romulus has a 40% income tax rate, what amount of net loss should Romulus report as extraordinary on its annual income statement?

(Multiple Choice)

4.7/5  (35)

(35)

Marino, Inc. makes a sale and collects a total of $378, which includes an 8 percent sales tax. The amount credited to Sales Tax Payable is

(Multiple Choice)

4.9/5  (38)

(38)

Accounting rules give specific instructions on whether to expense or capitalize research and development costs and advertising costs. List the rules associated with these two costs.

(Essay)

4.9/5  (38)

(38)

A cash compensation received by an employee after that employee has retired is a(n)

(Multiple Choice)

5.0/5  (33)

(33)

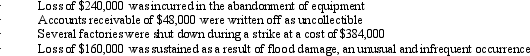

The following information relates to the defined benefit pension plan of Wendy Corporation for the year ending December 31, 2012:  What is the net pension asset or liability for Wendy corporation in 2012?

What is the net pension asset or liability for Wendy corporation in 2012?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following items would NOT be classified in the "Other Revenues and Expenses" section of the income statement?

(Multiple Choice)

4.7/5  (35)

(35)

No disclosure is required for contingent liabilities that are

(Multiple Choice)

4.8/5  (33)

(33)

Showing 61 - 80 of 93

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)