Exam 11: Managing Transaction Exposure

Exam 1: Multinational Financial Management: An Overview79 Questions

Exam 2: International Flow of Funds74 Questions

Exam 3: International Financial Markets101 Questions

Exam 4: Exchange Rate Determination69 Questions

Exam 5: Currency Derivatives161 Questions

Exam 6: Government Influence on Exchange Rates116 Questions

Exam 7: International Arbitrage and Interest Rate Parity92 Questions

Exam 8: Relationships among Inflation, Interest Rates, and Exchange Rates59 Questions

Exam 9: Forecasting Exchange Rates84 Questions

Exam 10: Measuring Exposure to Exchange Rate Fluctuations82 Questions

Exam 11: Managing Transaction Exposure81 Questions

Exam 12: Managing Economic Exposure and Translation Exposure58 Questions

Exam 13: Direct Foreign Investment53 Questions

Exam 14: Multinational Capital Budgeting60 Questions

Exam 15: International Corporate Governance and Control72 Questions

Exam 16: Country Risk Analysis57 Questions

Exam 17: Multinational Cost of Capital and Capital Structure68 Questions

Exam 18: Long-Term Debt Financing53 Questions

Exam 19: Financing International Trade66 Questions

Exam 20: Short-Term Financing49 Questions

Exam 21: International Cash Management50 Questions

Select questions type

When comparing the forward hedge to the money market hedge, the MNC can easily determine which hedge is more desirable, because the cost of each hedge can be determined with certainty.

Free

(True/False)

4.8/5  (51)

(51)

Correct Answer:

True

If interest rate parity exists, the forward hedge will always outperform the money market hedge.

Free

(True/False)

4.8/5  (38)

(38)

Correct Answer:

False

A ____ does not represent an obligation.

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

D

Blake Inc. needs €1,000,000 in 30 days. It can earn 5 percent annualized on a German security. The current spot rate for the euro is $1.00. Blake can borrow funds in the United States at an annualized interest rate of 6 percent. If Blake uses a money market hedge to hedge the payable, what is the cost of implementing the hedge?

(Multiple Choice)

4.8/5  (40)

(40)

The ____ hedge is not a technique to eliminate transaction exposure discussed in your text.

(Multiple Choice)

4.9/5  (39)

(39)

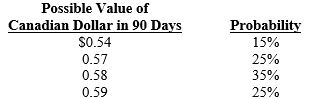

Lorre Co. needs 200,000 Canadian dollars (C$) in 90 days and is trying to determine whether or not to hedge this position. Lorre has developed the following probability distribution for the Canadian dollar:

The 90-day forward rate of the Canadian dollar is $.575, and the expected spot rate of the Canadian dollar in 90 days is $.55. If Lorre implements a forward hedge, what is the probability that hedging will be more costly to the firm than not hedging?

The 90-day forward rate of the Canadian dollar is $.575, and the expected spot rate of the Canadian dollar in 90 days is $.55. If Lorre implements a forward hedge, what is the probability that hedging will be more costly to the firm than not hedging?

(Multiple Choice)

4.9/5  (37)

(37)

A futures hedge involves taking a money market position to cover a future payables or receivables position.

(True/False)

4.8/5  (35)

(35)

Samson Inc. needs €1,000,000 in 30 days. Samson can earn 5 percent annualized on a German security. The current spot rate for the euro is $1.00. Samson can borrow funds in the United States at an annualized interest rate of 6 percent. If Samson uses a money market hedge, how much should it borrow in the United States?

(Multiple Choice)

4.9/5  (34)

(34)

Assume that Smith Corp. will need to purchase 200,000 British pounds in 90 days. A call option exists on British pounds with an exercise price of $1.68, a 90-day expiration date, and a premium of $.04. A put option exists on British pounds with an exercise price of $1.69, a 90-day expiration date, and a premium of $.03. Smith Corporation plans to purchase options to cover its future payables. It will exercise the option in 90 days (if at all). It expects the spot rate of the pound to be $1.76 in 90 days. Determine the amount of dollars it will pay for the payables, including the amount paid for the option premium.

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following might be used to hedge exposure in the long run?

(Multiple Choice)

4.7/5  (39)

(39)

A money market hedge on payables would involve, among others, borrowing ____ and investing in the ____.

(Multiple Choice)

4.7/5  (33)

(33)

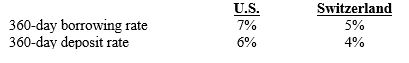

Assume that Parker Co. will receive SF200,000 in 360 days. Assume the following interest rates:

Assume the forward rate of the Swiss franc is $.50 and the spot rate of the Swiss franc is $.48. If Parker Co. uses a money market hedge, it will receive ____ in 360 days.

Assume the forward rate of the Swiss franc is $.50 and the spot rate of the Swiss franc is $.48. If Parker Co. uses a money market hedge, it will receive ____ in 360 days.

(Multiple Choice)

4.9/5  (28)

(28)

Assume zero transaction costs. If the 90-day forward rate of the euro underestimates the spot rate 90 days from now, then the real cost of hedging payables will be:

(Multiple Choice)

4.9/5  (36)

(36)

A money market hedge involves taking a money market position to cover a future payables or receivables position.

(True/False)

4.7/5  (35)

(35)

A money market hedge involves taking a money market position to cover a future payables or receivables position.

(True/False)

4.7/5  (44)

(44)

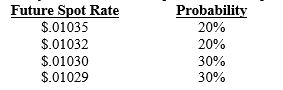

You are the treasurer of Montana Corp. and must decide how to hedge (if at all) future payables of 1,000,000 Japanese yen 90 days from now. Call options are available with a premium of $.01 per unit and an exercise price of $.01031 per Japanese yen. The forecasted spot rate of the Japanese yen in 90 days is:

The 90-day forward rate of the Japanese yen is $.01033.

What is the probability that the call option will be exercised (assuming Montana purchased it)?

The 90-day forward rate of the Japanese yen is $.01033.

What is the probability that the call option will be exercised (assuming Montana purchased it)?

(Multiple Choice)

4.8/5  (26)

(26)

An advantage of using options to hedge is that the MNC can let the option expire. However, a disadvantage of using options is that a premium must be paid for it.

(True/False)

4.9/5  (23)

(23)

To hedge payables with futures, an MNC would sell futures; to hedge receivables with futures, an MNC would buy futures.

(True/False)

4.9/5  (34)

(34)

Exhibit 11-1

-Refer to Exhibit 11-1. Perkins Corp. will receive 250,000 Jordanian dinar (JOD) in 360 days. The current spot rate of the dinar is $1.48, while the 360-day forward rate is $1.50. How much will Perkins receive in 360 days from implementing a money market hedge (assume any receipts before the date of the receivable are invested)?

-Refer to Exhibit 11-1. Perkins Corp. will receive 250,000 Jordanian dinar (JOD) in 360 days. The current spot rate of the dinar is $1.48, while the 360-day forward rate is $1.50. How much will Perkins receive in 360 days from implementing a money market hedge (assume any receipts before the date of the receivable are invested)?

(Multiple Choice)

4.9/5  (41)

(41)

Your company will receive C$600,000 in 90 days. The 90-day forward rate in the Canadian dollar is $.80. If you use a forward hedge, you will:

(Multiple Choice)

4.8/5  (36)

(36)

Showing 1 - 20 of 81

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)