Exam 9: Forecasting Exchange Rates

Exam 1: Multinational Financial Management: An Overview79 Questions

Exam 2: International Flow of Funds74 Questions

Exam 3: International Financial Markets101 Questions

Exam 4: Exchange Rate Determination69 Questions

Exam 5: Currency Derivatives161 Questions

Exam 6: Government Influence on Exchange Rates116 Questions

Exam 7: International Arbitrage and Interest Rate Parity92 Questions

Exam 8: Relationships among Inflation, Interest Rates, and Exchange Rates59 Questions

Exam 9: Forecasting Exchange Rates84 Questions

Exam 10: Measuring Exposure to Exchange Rate Fluctuations82 Questions

Exam 11: Managing Transaction Exposure81 Questions

Exam 12: Managing Economic Exposure and Translation Exposure58 Questions

Exam 13: Direct Foreign Investment53 Questions

Exam 14: Multinational Capital Budgeting60 Questions

Exam 15: International Corporate Governance and Control72 Questions

Exam 16: Country Risk Analysis57 Questions

Exam 17: Multinational Cost of Capital and Capital Structure68 Questions

Exam 18: Long-Term Debt Financing53 Questions

Exam 19: Financing International Trade66 Questions

Exam 20: Short-Term Financing49 Questions

Exam 21: International Cash Management50 Questions

Select questions type

Which of the following is not a forecasting technique mentioned in your text?

Free

(Multiple Choice)

4.8/5  (44)

(44)

Correct Answer:

A

If foreign exchange markets are strong-form efficient, then all relevant public and private information is already reflected in today's exchange rates.

Free

(True/False)

4.8/5  (37)

(37)

Correct Answer:

True

Forecast errors tend to be large for short forecast horizons.

Free

(True/False)

4.8/5  (41)

(41)

Correct Answer:

False

If the one-year forward rate for the euro is $1.07, while the current spot rate is $1.05, the expected percentage change in the euro is ____ percent.

(Multiple Choice)

5.0/5  (32)

(32)

Different departments in an MNC should establish their own exchange rate forecasts because each department can best determine the type of forecasts that it needs.

(True/False)

4.8/5  (32)

(32)

Which of the following is not a limitation of technical forecasting?

(Multiple Choice)

4.9/5  (34)

(34)

The U.S. inflation rate is expected to be 4 percent over the next year, while the European inflation rate is expected to be 3 percent. The current spot rate of the euro is $1.03. Using purchasing power parity, the expected spot rate at the end of one year is $____.

(Multiple Choice)

4.8/5  (37)

(37)

If it was determined that the movement of exchange rates was not related to previous exchange rate values, this implies that a ____ is not valuable for speculating on expected exchange rate movements.

(Multiple Choice)

4.7/5  (33)

(33)

If points are scattered evenly on both sides of the perfect forecast line, then the forecast appears to be very accurate.

(True/False)

4.9/5  (36)

(36)

The absolute forecast error of a currency is ____, on average, in periods when the currency is more ____.

(Multiple Choice)

4.7/5  (44)

(44)

Leila Corp. used the following regression model to determine if the forecasts over the last ten years were biased:

,

where St is the spot rate of the yen in year t and Ft - 1 is the forward rate of the yen in year t - 1. Regression results reveal coefficients of a₀ = 0 and a₁ = .30. Thus, Leila Corp. has reason to believe that its past forecasts have ____ the realized spot rate.

(Multiple Choice)

4.8/5  (32)

(32)

Fundamental models examine moving averages over time and thus allow the development of a forecasting rule.

(True/False)

4.9/5  (27)

(27)

A regression model was applied to explain movements in the Canadian dollar's value over time. The coefficient for the inflation differential between the United States and Canada was -0.2. The coefficient of the interest rate differential between the United States and Canada produced a coefficient of 0.8. Thus, the Canadian dollar depreciates when the inflation differential ____ and the interest rate differential ____.

(Multiple Choice)

4.9/5  (37)

(37)

If today's exchange rate reflects any historical trends in Canadian dollar exchange rate movements, but not all relevant public information, then the Canadian dollar market is:

(Multiple Choice)

4.8/5  (39)

(39)

A forecasting technique based on fundamental relationships between economic variables and exchange rates, such as inflation, is referred to as technical forecasting.

(True/False)

4.8/5  (31)

(31)

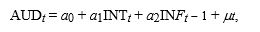

The following regression model was estimated to forecast the percentage change in the Australian dollar (AUD):

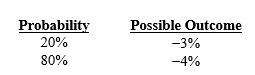

Where AUD is the quarterly change in the Australian dollar, INT is the real interest rate differential in period t between the United States and Australia, and INF is the inflation rate differential between the United States and Australia in the previous period. Regression results indicate coefficients of a₀=.001; a₁=-.8; and a₂=.5. Assume that INFt - 1 = 4%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

Where AUD is the quarterly change in the Australian dollar, INT is the real interest rate differential in period t between the United States and Australia, and INF is the inflation rate differential between the United States and Australia in the previous period. Regression results indicate coefficients of a₀=.001; a₁=-.8; and a₂=.5. Assume that INFt - 1 = 4%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

There is a 20 percent probability that the Australian dollar will change by ____, and an 80 percent probability it will change by ____.

There is a 20 percent probability that the Australian dollar will change by ____, and an 80 percent probability it will change by ____.

(Multiple Choice)

4.9/5  (34)

(34)

Monson Co., based in the United States, exports products to Japan denominated in yen. If the forecasted value of the yen is substantially ____ than the forward rate, Monson Co. will likely decide ____ the payments.

(Multiple Choice)

4.7/5  (47)

(47)

If speculators expect the spot rate of the yen in 60 days to be ____ than the 60-day forward rate on the yen, they will ____ the yen forward and put ____ pressure on the yen's forward rate.

(Multiple Choice)

4.9/5  (36)

(36)

A forecast of a currency one year in advance is typically more accurate than a forecast one week in advance since the currency reverts to equilibrium over a longer term period.

(True/False)

4.7/5  (35)

(35)

A fundamental forecast that uses multiple values of the influential factors is an example of:

(Multiple Choice)

4.9/5  (38)

(38)

Showing 1 - 20 of 84

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)