Exam 8: Analysis of Risk and Return

Exam 1: The Role and Objective of Financial Management84 Questions

Exam 2: The Domestic and International Financial Marketplace88 Questions

Exam 3: Evaluation of Financial Performance109 Questions

Exam 4: Financial Planning and Forecasting71 Questions

Exam 5: The Time Value of Money113 Questions

Exam 5: A: The Time Value of Money28 Questions

Exam 6: Fixed-Income Securities: Characteristics and Valuation131 Questions

Exam 7: Common Stock: Characteristics, Valuation, and Issuance115 Questions

Exam 8: Analysis of Risk and Return118 Questions

Exam 9: Capital Budgeting and Cash Flow Analysis96 Questions

Exam 10: Capital Budgeting: Decision Criteria and Real Option Considerations107 Questions

Exam 10: A: Capital Budgeting: Decision Criteria and Real Option Considerations21 Questions

Exam 11: Capital Budgeting and Risk78 Questions

Exam 12: The Cost of Capital, Capital Structure, and Dividend Policy104 Questions

Exam 13: Capital Structure Concepts75 Questions

Exam 14: Capital Structure Management in Practice85 Questions

Exam 14: A: Capital Structure Management in Practice23 Questions

Exam 15: Dividend Policy96 Questions

Exam 16: Working Capital Management81 Questions

Exam 17: The Management of Cash and Marketable Securities80 Questions

Exam 18: The Management of Accounts Receivable and Inventories80 Questions

Exam 19: Lease and Intermediate-Term Financing52 Questions

Exam 20: Financing with Derivatives80 Questions

Exam 20: A: Financing with Derivatives19 Questions

Exam 21: Risk Management49 Questions

Exam 22: International Financial Management51 Questions

Exam 23: Corporate Restructuring75 Questions

Select questions type

An investor plans to invest 75 percent of her funds in the common stock of Gamma Industries and 25 percent in Epsilon Company.The expected return on Gamma is 12 percent and the expected return on Epsilon is 16 percent.The standard deviation of returns for Gamma is 8 percent and for Epsilon is 12 percent.The correlation between the returns for Gamma and Epsilon is +0.8.Determine the expected return on the investor's portfolio.

(Multiple Choice)

4.7/5  (40)

(40)

The risk premium for an individual security is equal to the

(Multiple Choice)

4.9/5  (36)

(36)

The maturity premium reflects a preference by many lenders for

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following is not an approach for managing risk:

(Multiple Choice)

4.8/5  (37)

(37)

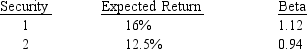

Assume you want to construct a portfolio with a 14 percent return from the following two securities:

What percentage of your portfolio should be invested in Security 1?

What percentage of your portfolio should be invested in Security 1?

(Multiple Choice)

4.7/5  (47)

(47)

Which of the following would be considered a risk-free investment?

(Multiple Choice)

4.7/5  (37)

(37)

An investor, who believes the economy is slowing down, wishes to reduce the risk of her portfolio.She currently owns 12 securities, each with a market value of $3,000.The current beta of the portfolio is 1.21 and the beta of the riskiest security is 1.62.What will the portfolio beta be if the riskiest security is replaced with a security of equal market value but a beta of 0.80?

(Multiple Choice)

4.8/5  (36)

(36)

Recalling the meaning and calculation of beta, a security that is completely uncorrelated (ρj,m = 0) with the market portfolio would have a beta of

(Multiple Choice)

4.7/5  (36)

(36)

The expected rate of return for the coming year on FTC common stock is normally distributed with a mean of 14% and a standard deviation of 7%.Determine the probability of earning more than 21% on FTC common stock.(Note: Table V is required to work this problem.)

(Multiple Choice)

4.9/5  (34)

(34)

The is a statistical measure of the mean or average value of the possible outcomes.

(Multiple Choice)

4.9/5  (44)

(44)

The slope of the characteristic line for a specific security is an estimate of for that security.

(Multiple Choice)

4.8/5  (32)

(32)

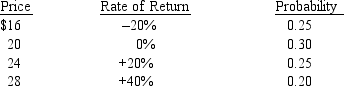

Phoenix Company common stock is currently selling for $20 per share.Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the coefficient of variation for the rate of return on Phoenix stock.

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the coefficient of variation for the rate of return on Phoenix stock.

(Multiple Choice)

4.9/5  (34)

(34)

The security market line can be thought of as expressing relationships between required rates of return and

(Multiple Choice)

4.8/5  (34)

(34)

An increase in uncertainty regarding the future economic outlook has the effect of .

(Multiple Choice)

4.9/5  (35)

(35)

Don has $3,000 invested in AT&T with an expected return of 11.6 percent;$10,000 in IBM with an expected return of 12.8 percent;and $6,000 in GM with an expected return of 12.2 percent.What is Don's expected return on his portfolio?

(Multiple Choice)

4.8/5  (33)

(33)

A diversified portfolio has many stocks as opposed to a single stock.Diversification can occur with a little as stocks.

(Multiple Choice)

4.8/5  (41)

(41)

HDTV has planned on diversifying into the dual-VCR field.As a result, HDTV's beta would rise to 1.6 from 1.2 and the expected future long-term growth rate in the firm's earnings would increase from 12% to 16%.The expected market return, km, is 14%;the risk free rate, rf, is 7%;and the current dividend, Do, is $0.50.Should HDTV go into the dual-VCR field?

(Multiple Choice)

4.7/5  (36)

(36)

Which of the following (if any) is a relative (rather than absolute) measure of risk?

(Multiple Choice)

4.7/5  (43)

(43)

Showing 21 - 40 of 118

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)