Exam 9: Operating Activities

Exam 1: Overview of Financial Reporting, financial Statement Analysis, and Valuation101 Questions

Exam 2: Asset and Liability Valuation and Income Measurement81 Questions

Exam 3: Income Flows Versus Cash Flows: Understanding the Statement of Cash Flows88 Questions

Exam 4: Profitability Analysis97 Questions

Exam 5: Risk Analysis86 Questions

Exam 6: Accounting Quality64 Questions

Exam 7: Financing Activities66 Questions

Exam 8: Investing Activities100 Questions

Exam 9: Operating Activities94 Questions

Exam 10: Forecasting Financial Statements63 Questions

Exam 11: Risk-Adjusted Expected Rates of Return and the Dividends Valuation Approach52 Questions

Exam 12: Valuation: Cash-Flow-Based Approaches65 Questions

Exam 13: Valuation: Earnings-Based Approaches67 Questions

Exam 14: Valuation: Market-Based Approaches64 Questions

Select questions type

When cash collectibility is uncertain,a firm using the ____________________ method recognizes revenue as it collects portions of the selling price in cash.

(Short Answer)

4.8/5  (47)

(47)

Which of the following is not part of the balance sheet approach when computing income tax expense?

(Multiple Choice)

4.9/5  (46)

(46)

A LIFO liquidation during periods when prices are increasing results in a company

(Multiple Choice)

4.8/5  (36)

(36)

At the end of 2012 Funtime provided the following information about the project: Costs incurred Estimuted rast 2012 \ 1,200,000 \ 600,000

What percentage is playground complete?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following accounts would not be considered a reserve account?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following will most likely help identify an increasing proportion of uncollectible sales?

(Multiple Choice)

4.9/5  (41)

(41)

Which of the following calculations is used to determine the amount of the liability reported on the balance sheet for underfunding?

(Multiple Choice)

4.8/5  (41)

(41)

Playtime Corporation

Assume that Playtime Corp. has agreed to construct a new playground for SurreyCounty for $2,450,000. Construction of the new playground will begin on March 17, 2012 and is expected to be completed in August 2013. At the signing of the contract Playtime Corp. estimates that the it will cost $1,750,000 to build the playground

-At the end of 2012 Funtime provided the following information about the project: Costs incurred Estimuted rast 2012 \ 1,200,000 \ 600000

If Playtime uses the percentage of completion to recognize revenue on the long-term contract how much gross margin should Playtime recognize in 2012?

(Multiple Choice)

4.9/5  (26)

(26)

A company that uses FIFO will find that its ___________________________________ account tends to be somewhat out of date.

(Short Answer)

5.0/5  (39)

(39)

Income tax expense consists of two components,the ____________________ portion and the ____________________ portion.

(Short Answer)

4.9/5  (37)

(37)

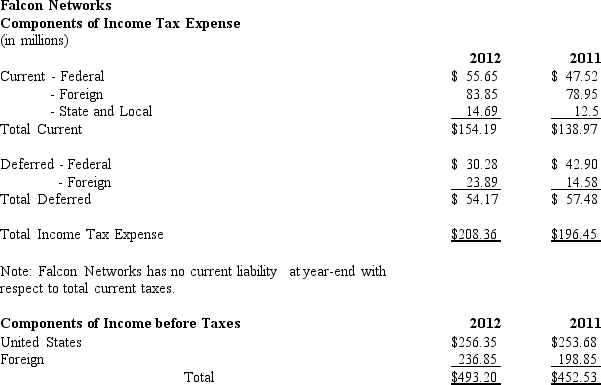

Falcon Networks

Falcon Networks is a leading semiconductor company with operations in 17 different countries. Information about the company's taxes appears below:

-Based on the information provided by Falcon Networks how much cash did income taxes use during 2012?

-Based on the information provided by Falcon Networks how much cash did income taxes use during 2012?

(Multiple Choice)

4.8/5  (37)

(37)

The installment method of revenue recognition can be used when cash collectibility is uncertain.The installment method

(Multiple Choice)

4.8/5  (47)

(47)

The statement of cash flows allows the accountant to agree the net cash provided to the _________________________ the general ledger

(Short Answer)

4.7/5  (45)

(45)

Regarding actuarial assumptions,firms must disclose in notes to the financial statements all of the following except:

(Multiple Choice)

4.8/5  (48)

(48)

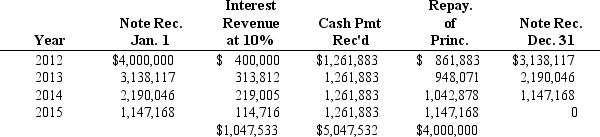

Parnell Industries

Parnell Industries sold a copy machine to Ranger Inc. on January 1, 2012. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Parnell to manufacture. Ranger will make four payments at the end of each year, beginning with 2012, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below:

-If Parnell Industries is uncertain that it will collect all four payments from Ranger Inc.and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Parnell recognize in 2012 from the sale?

-If Parnell Industries is uncertain that it will collect all four payments from Ranger Inc.and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Parnell recognize in 2012 from the sale?

(Multiple Choice)

4.7/5  (31)

(31)

Many firms use derivative instruments to hedge exposure to changes in the fair value an asset or liability or to hedge exposure to variability in expected future cash flows.As an analyst examining the financial reports of a company that uses derivative instruments to hedge,what questions should be asked when thinking about derivatives and accounting quality?

(Essay)

4.8/5  (32)

(32)

Which of the following is not a disclosure for derivatives required under SFAS No.133?

(Multiple Choice)

4.8/5  (30)

(30)

All of the following are events that can change the projected benefit obligation (PBO)during a period except:

(Multiple Choice)

4.9/5  (36)

(36)

Showing 41 - 60 of 94

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)