Exam 11: Flexible Budgets, Segment Analysis, and Performance Reporting

Exam 1: Overview of Managerial Accounting58 Questions

Exam 2: Managerial Accounting Concepts and Cost Flows74 Questions

Exam 3: Cost Accounting Systems: Job Order Costing106 Questions

Exam 4: Cost Accounting Systems: Process Costing146 Questions

Exam 5: Activity-Based Costing130 Questions

Exam 6: Cost-Volume-Profit Relationships142 Questions

Exam 7: Variable Costing: A Tool for Decision Making86 Questions

Exam 8: Relevant Costs and Short-Term Decision Making133 Questions

Exam 9: Planning and Budgeting111 Questions

Exam 10: Standard Costing and Variance Analysis147 Questions

Exam 11: Flexible Budgets, Segment Analysis, and Performance Reporting128 Questions

Exam 12: Capital Budgeting166 Questions

Exam 13: Statement of Cash Flows115 Questions

Exam 14: Analysis and Interpretation of Financial Statements76 Questions

Exam 15: Appendix: Accounting and the Time Value of Money16 Questions

Select questions type

In segmenting the reporting of a company, it would be appropriate to create divisions organized by:

(Multiple Choice)

5.0/5  (39)

(39)

What is the primary purpose of segmented contribution margin statement analysis?

(Essay)

4.9/5  (38)

(38)

The balanced scorecard tracks both financial and non-financial metrics in a company.

(True/False)

4.8/5  (45)

(45)

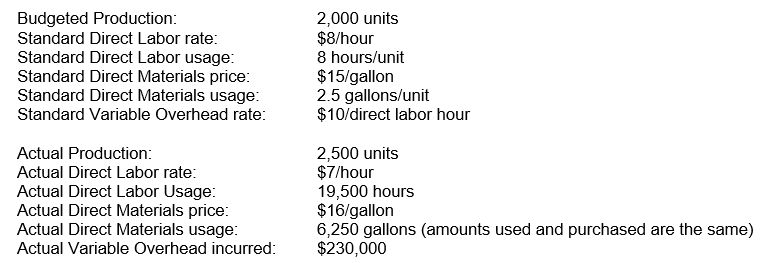

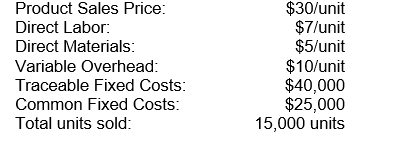

The following information is available for Simon & Simon Corporation for this last year:

What is the Direct Materials Flexible Budget Variance?

What is the Direct Materials Flexible Budget Variance?

(Essay)

4.9/5  (28)

(28)

Why is the cost function for the flexible budget only applicable within the relevant range?

(Multiple Choice)

4.9/5  (27)

(27)

SJL Co. is a manufacturing company that has two major investment centers. Both divisions have required a significant investment, and management wants to compare the performance of the two divisions. Below is information related to the two divisions.

Division 1:

Sales: $100,000,000

Expenses: $80,000,000

Asset investment: $150,000,000

Division 2:

Sales: $200,000,000

Expenses: $160,000,000

Asset investment: $500,000,000

Management currently requires investments to meet a rate of return on asset investment of 5%. Which Division has the greatest level of "residual income"?

(Essay)

4.9/5  (46)

(46)

Large businesses tend to segment themselves according to divisions or departments for accountability purposes.

(True/False)

4.8/5  (38)

(38)

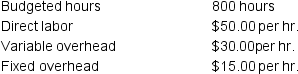

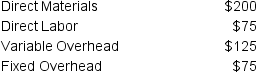

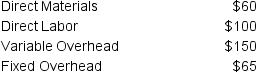

HSS Company provides security services to senior executives of prominent corporations when they travel outside the United States. HSS applies both fixed and variable overhead using direct labor hours. The annual budget for one if its customers is as follows:

During the year, HSS had the following activity related to this customer:

Actual hours were 850 at a total cost of $44,200.

Actual fixed overhead was $12,750.

Actual variable overhead was $22,950.

What is the Variable Overhead Static Budget Variance?

During the year, HSS had the following activity related to this customer:

Actual hours were 850 at a total cost of $44,200.

Actual fixed overhead was $12,750.

Actual variable overhead was $22,950.

What is the Variable Overhead Static Budget Variance?

(Multiple Choice)

4.9/5  (28)

(28)

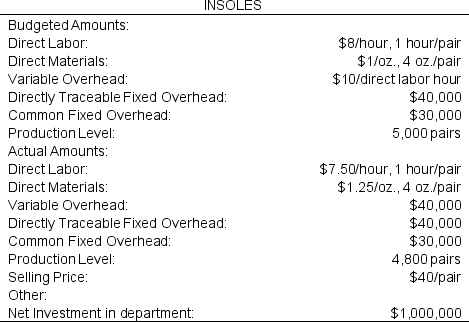

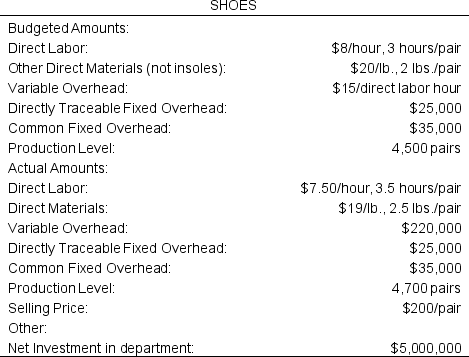

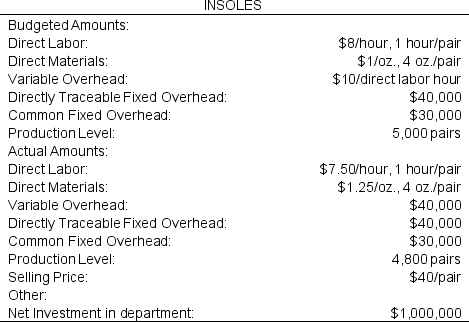

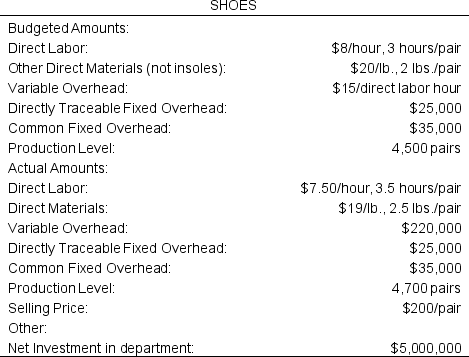

Use the following information to answer Problems below

Walkeasy Co. produces shoes and memory foam insoles. The memory foam insoles were originally designed to be a component of the shoes (1 insole per shoe). However, the market for memory foam insoles was profitable enough that management has opted to sell some of the insoles on their own. Any insoles produced beyond what is necessary to meet the needs of shoes production are sold at market prices. Normally, the transfer cost of the insoles is equal to the market sale price. Because of a differentiation strategy, management at Walkeasy has decided that the Shoes department and the Insoles department should be measured and tracked separately. When insoles are transferred to the Shoes department, they are inventoried at market prices.

The following information relates to the costs of production for the year for the two departments. Per the company policy, all inventories are kept at stable levels: in other words, sales and production are equal, and purchases of raw materials equal those requisitioned for production.

-Right at the end of the year, Walkeasy received a special order for 300 pairs of shoes. The Shoes department has the capacity to meet the order, but the Insoles department is already at full capacity. Walkeasy has found a supplier of insoles to purchase from when the supply of insoles runs short. However, due to the rush nature of the special order, Walkeasy's supplier would charge them $10,000.

a. What would be the minimum transfer price where the Insoles department would agree to cancel current sales in order to fill this order?

b. Should the Shoes department purchase the insoles from the supplier or from the Insoles department?

-Right at the end of the year, Walkeasy received a special order for 300 pairs of shoes. The Shoes department has the capacity to meet the order, but the Insoles department is already at full capacity. Walkeasy has found a supplier of insoles to purchase from when the supply of insoles runs short. However, due to the rush nature of the special order, Walkeasy's supplier would charge them $10,000.

a. What would be the minimum transfer price where the Insoles department would agree to cancel current sales in order to fill this order?

b. Should the Shoes department purchase the insoles from the supplier or from the Insoles department?

(Essay)

4.8/5  (42)

(42)

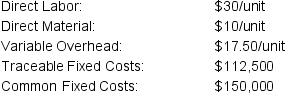

Cole Co. is a large company that segments its business into cost and profit centers. The Cost center for the manufacture of Product AC2 incurred the following costs in the previous period:

Sales were 5,000 units last period. Each unit sells for $100. The AC2 Department is being evaluated on overall profitability. Last period the department margin was $50,000.

By how much did the department margin increase or decrease this period?

Sales were 5,000 units last period. Each unit sells for $100. The AC2 Department is being evaluated on overall profitability. Last period the department margin was $50,000.

By how much did the department margin increase or decrease this period?

(Essay)

4.8/5  (41)

(41)

Use the following information to answer Problems below

Walkeasy Co. produces shoes and memory foam insoles. The memory foam insoles were originally designed to be a component of the shoes (1 insole per shoe). However, the market for memory foam insoles was profitable enough that management has opted to sell some of the insoles on their own. Any insoles produced beyond what is necessary to meet the needs of shoes production are sold at market prices. Normally, the transfer cost of the insoles is equal to the market sale price. Because of a differentiation strategy, management at Walkeasy has decided that the Shoes department and the Insoles department should be measured and tracked separately. When insoles are transferred to the Shoes department, they are inventoried at market prices.

The following information relates to the costs of production for the year for the two departments. Per the company policy, all inventories are kept at stable levels: in other words, sales and production are equal, and purchases of raw materials equal those requisitioned for production.

-Which department has the higher ROI? Is it due to greater profitability per sales dollar, or to efficient use of assets in generating sales?

-Which department has the higher ROI? Is it due to greater profitability per sales dollar, or to efficient use of assets in generating sales?

(Essay)

4.9/5  (52)

(52)

Which of the following are not reasons to involve lower management in making business decisions?

(Multiple Choice)

4.9/5  (41)

(41)

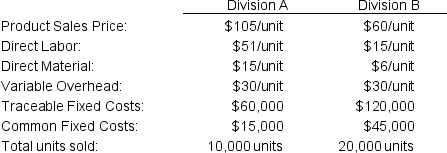

MC Ryan Inc. is a manufacturing company that has two production divisions. Both divisions report their costs to the Sales division, which is considered the profit center of the company. Information for the following divisions is as follows:

Which division had the highest division costs for the period?

Which division had the highest division costs for the period?

(Essay)

4.9/5  (33)

(33)

Which of the following is needed in order to prepare the flexible budget performance report?

(Multiple Choice)

5.0/5  (46)

(46)

An investment center manager is mostly concerned about the financial performance of the company's debt and equity securities.

(True/False)

4.9/5  (42)

(42)

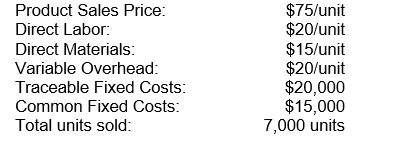

Pierre & Sons is a baked-goods manufacturing firm. Pierre has two main divisions: Packaged Mixes and Finished Desserts. The Finished Desserts division is considering purchasing the mix for its cakes from an outside supplier.

The Packaged Mixes department incurs the following costs for each batch of cake mix:

In addition to the cost of the cake mix, the Finished Desserts Department would incur the following costs for each batch of cakes:

In addition to the cost of the cake mix, the Finished Desserts Department would incur the following costs for each batch of cakes:

Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide cake mix to the Finished Desserts department. Management estimates that $125 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Desserts department is $500: this is the price at which Peterson can purchase the mix from an outside supplier. The finished cakes from each batch will sell for $1,000.

Based on the decision that will maximize the overall benefit to Pierre & Sons, what is the contribution margin per batch that can be realized by the Finished Desserts department?

Currently, the Packaged Mixes department is producing at full capacity and would need to decrease production in another area in order to provide cake mix to the Finished Desserts department. Management estimates that $125 of contribution margin would be lost by the decrease in other areas. The current market price for the quantity of mix needed by the Finished Desserts department is $500: this is the price at which Peterson can purchase the mix from an outside supplier. The finished cakes from each batch will sell for $1,000.

Based on the decision that will maximize the overall benefit to Pierre & Sons, what is the contribution margin per batch that can be realized by the Finished Desserts department?

(Essay)

4.8/5  (31)

(31)

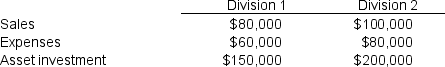

Christensen & Co. is a manufacturing company that has two major divisions. Both divisions have required a significant investment, and management wants to compare the performance of the two divisions. Below is information related to the two divisions.

Based on ROI, which division is more profitable? Is it due to efficient asset use or relative profitability of sales or both?

Based on ROI, which division is more profitable? Is it due to efficient asset use or relative profitability of sales or both?

(Essay)

4.9/5  (32)

(32)

The budgeted level of activity often differs from the actual level of activity.

(True/False)

4.9/5  (32)

(32)

Tapping Danes Inc. is a manufacturing company that has two production divisions. Both divisions report their costs to the Sales division, which is considered the profit center of the company. Information for the production divisions is as follows:

DIVISION 1:

DIVISION 2:

DIVISION 2:

Which division had the highest division costs for the period?

Which division had the highest division costs for the period?

(Essay)

5.0/5  (37)

(37)

Showing 61 - 80 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)