Exam 7: Variable Costing: A Tool for Decision Making

Exam 1: Overview of Managerial Accounting58 Questions

Exam 2: Managerial Accounting Concepts and Cost Flows74 Questions

Exam 3: Cost Accounting Systems: Job Order Costing106 Questions

Exam 4: Cost Accounting Systems: Process Costing146 Questions

Exam 5: Activity-Based Costing130 Questions

Exam 6: Cost-Volume-Profit Relationships142 Questions

Exam 7: Variable Costing: A Tool for Decision Making86 Questions

Exam 8: Relevant Costs and Short-Term Decision Making133 Questions

Exam 9: Planning and Budgeting111 Questions

Exam 10: Standard Costing and Variance Analysis147 Questions

Exam 11: Flexible Budgets, Segment Analysis, and Performance Reporting128 Questions

Exam 12: Capital Budgeting166 Questions

Exam 13: Statement of Cash Flows115 Questions

Exam 14: Analysis and Interpretation of Financial Statements76 Questions

Exam 15: Appendix: Accounting and the Time Value of Money16 Questions

Select questions type

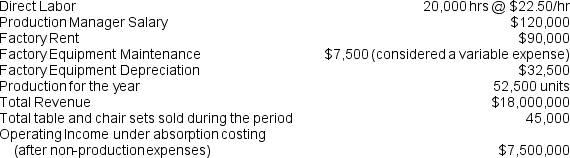

FourSquare Mfg manufactures tables and chairs, which are sold in sets of 4 chairs to a table to businesses, schools, and public facilities. They reported the following financial information for last year:

What would Operating Income be under variable costing if there were no table and chair sets in beginning inventory? (Round per-unit costs to the nearest cent.)

What would Operating Income be under variable costing if there were no table and chair sets in beginning inventory? (Round per-unit costs to the nearest cent.)

(Essay)

4.9/5  (38)

(38)

Which of the following will not affect Net Income under variable costing?

(Multiple Choice)

4.7/5  (42)

(42)

If inventory increases in the period, then variable net income will typically be higher than absorption net income.

(True/False)

4.9/5  (46)

(46)

Under absorption costing, which of the following costs are applied to manufactured inventory?

(Multiple Choice)

4.9/5  (35)

(35)

How does absorption costing create the opportunity for "earnings management"?

(Essay)

4.9/5  (30)

(30)

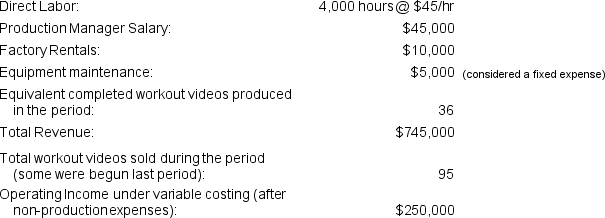

TBody Inc. produces exercise workout videos for private distribution. They hire fitness professionals, and record all films in rented facilities, which are rented on a temporary basis for each filming engagement. TBody reported the following financial information for last period:

Assume that the fixed costs were the same on a per-unit basis during the prior period.

What would Operating Income be under absorption costing? (round per-unit costs to the nearest cent)

Assume that the fixed costs were the same on a per-unit basis during the prior period.

What would Operating Income be under absorption costing? (round per-unit costs to the nearest cent)

(Essay)

4.8/5  (34)

(34)

Sunflower, Inc. is considering obtaining a bank loan to finance a new unit. The company is required by the bank to submit GAAP-compliant accounting records (which they currently do not keep). Sunflower has contracted with your consulting firm to estimate the costs and benefits of this new unit. Management provides you with the following information regarding their financial position:

Expected performance next month (before considering the potential investment):

The loan contract has the following information:

Bank loan: $65,000

Interest rate: 1% per month, payable at the end of the month. Interest rate increases to 1.25% per month if the company suffers a net Operating Loss before Interest and Taxes that month (by GAAP standards).

After evaluating the company, you report the following estimates:

Monthly cost of keeping a second set of accounting records: $650

Potential return on investment: 2% per month (through increased sales, after considering the costs involved).

Would you recommend that Sunflower take out the loan (i.e. would it be profitable for them)?

The loan contract has the following information:

Bank loan: $65,000

Interest rate: 1% per month, payable at the end of the month. Interest rate increases to 1.25% per month if the company suffers a net Operating Loss before Interest and Taxes that month (by GAAP standards).

After evaluating the company, you report the following estimates:

Monthly cost of keeping a second set of accounting records: $650

Potential return on investment: 2% per month (through increased sales, after considering the costs involved).

Would you recommend that Sunflower take out the loan (i.e. would it be profitable for them)?

(Essay)

4.8/5  (34)

(34)

How are variable selling and administrative costs treated under variable costing?

(Essay)

4.7/5  (39)

(39)

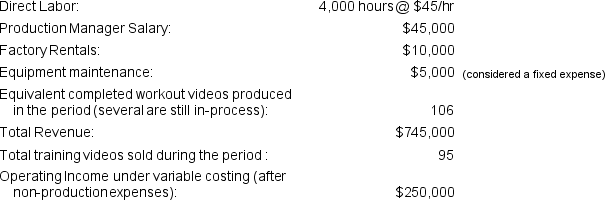

Workout, Inc. produces exercise workout videos for private distribution. They hire fitness professionals, and record all films in rented facilities. Workout reported the following financial information for last year:

Assume that the fixed costs were the same on a per-unit basis during the prior period.

What would Operating Income be under absorption costing? (round per-unit costs to the nearest cent)

Assume that the fixed costs were the same on a per-unit basis during the prior period.

What would Operating Income be under absorption costing? (round per-unit costs to the nearest cent)

(Essay)

4.9/5  (45)

(45)

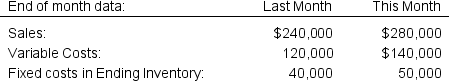

Shoots & Leaves, (SL), is a local health food store that uses an absorption costing approach when pricing their goods, in order to make sure that their fixed costs are covered. All costs except purchasing-related variable costs (such as the supplier price of the goods and the shipping costs) are considered fixed costs and are allocated to inventory. The allocation is made when each item is purchased, and is based on the sales mark-up of each item, at a rate of $0.70/dollar. Any under- or over-applied overhead is closed to Cost of Goods Sold. Financial information for this month and last month are as follows.

Over-applied overhead for this month was $5,000. The owners of SL want to increase income, and want to know if the best way to do that is to increase sales volume or to barter with suppliers for lower prices. To assist in making the decision, they want to know what Operating Income would be under Variable costing rather than Absorption costing, in order to remove the effect of inventoried fixed costs.

What would Variable Operating Income be this month?

Over-applied overhead for this month was $5,000. The owners of SL want to increase income, and want to know if the best way to do that is to increase sales volume or to barter with suppliers for lower prices. To assist in making the decision, they want to know what Operating Income would be under Variable costing rather than Absorption costing, in order to remove the effect of inventoried fixed costs.

What would Variable Operating Income be this month?

(Essay)

4.8/5  (38)

(38)

Which of the following is not a disadvantage of using variable costing as opposed to absorption costing?

(Multiple Choice)

5.0/5  (37)

(37)

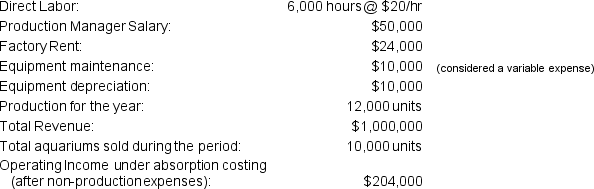

Wet Pets Inc. makes 100-gallon plexiglass aquariums. They reported the following financial information for last year:

Assume that the fixed costs were the same on a per-unit basis during the prior period.

What would Operating Income be under variable costing? (Round per-unit costs to the nearest cent.)

Assume that the fixed costs were the same on a per-unit basis during the prior period.

What would Operating Income be under variable costing? (Round per-unit costs to the nearest cent.)

(Multiple Choice)

4.8/5  (34)

(34)

Variable costing is required by GAAP for publicly reported financial results.

(True/False)

4.8/5  (38)

(38)

The difference between variable net income and absorption net income may be computed by multiplying the change in inventory by the total overhead application rate.

(True/False)

4.9/5  (45)

(45)

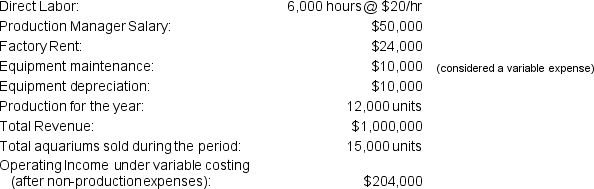

Andy's Water Pets Inc. makes 100-gallon plexiglass aquariums. They reported the following financial information for last year:

Assume that the fixed costs were the same on a per-unit basis during the prior period.

What would Operating Income be under absorption costing? (Round per-unit costs to the nearest cent.)

Assume that the fixed costs were the same on a per-unit basis during the prior period.

What would Operating Income be under absorption costing? (Round per-unit costs to the nearest cent.)

(Multiple Choice)

4.9/5  (46)

(46)

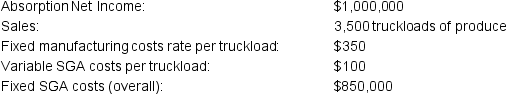

Sunshine Yellow Co. is a banana plantation that grows and sells bananas in Florida. The company is publicly traded on the stock market: however, management prefers to use variable costing for decision purposes. The company's books are adjusted to arrive at Absorption Income for financial reporting purposes. The company reported the following financial information for the past month:

The company tracks harvested crops that have not yet been shipped out as "in-process." This inventory of food decreased from 40 truckloads at the beginning of the month to 33 truckloads at the end of the month.

What was Variable Net Income?

The company tracks harvested crops that have not yet been shipped out as "in-process." This inventory of food decreased from 40 truckloads at the beginning of the month to 33 truckloads at the end of the month.

What was Variable Net Income?

(Essay)

4.7/5  (40)

(40)

Wonton Makers Co., (WMC), uses variable costing for managerial purposes and absorption costing for external reporting. These past two months, WMC has had an even number of sales at $70,000, at a price of $35/unit. However, in an effort to reduce inventory levels, management decreased production from the regular 2,000 units to 1,700 units for last month only. WMC has fixed costs of $15,000 per month.

If absorption net income was $25,000 last month, what will it be this month (assuming that sales continue to hold constant and production returns to normal levels)? (Round per-unit costs to the nearest cent.)

(Essay)

4.9/5  (23)

(23)

If production is greater than sales, Cost of Goods Sold will be higher under absorption costing than under variable costing.

(True/False)

4.8/5  (38)

(38)

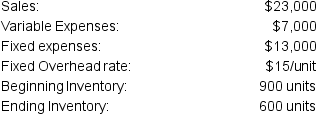

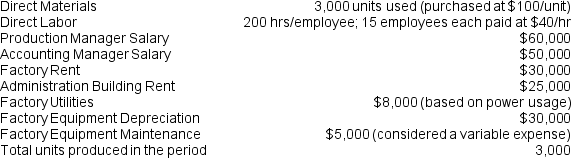

Smart Shades Inc. produces venetian blinds for homes and business. They reported the following financial information for the previous period:

What is the per-unit cost of inventory produced under absorption costing?

What is the per-unit cost of inventory produced under absorption costing?

(Essay)

4.8/5  (34)

(34)

Showing 41 - 60 of 86

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)