Exam 5: Product Costing: Job and Process Operations

Exam 1: Managerial Accounting: Tools for Decision Making81 Questions

Exam 2: Cost Behavior, Activity Analysis, and Cost Estimation111 Questions

Exam 3: Cost-Volume-Profit Analysis and Planning111 Questions

Exam 4: Relevant Costs and Benefits for Decision Making60 Questions

Exam 5: Product Costing: Job and Process Operations106 Questions

Exam 6: Activity-Based Costing, Customer Profitability, and Activity-Based Management50 Questions

Exam 7: Additional Topics in Product Costing57 Questions

Exam 8: Pricing and Other Product Management Decisions71 Questions

Exam 9: Operational Budgeting and Profit Planning81 Questions

Exam 10: Standard Costs and Performance Reports85 Questions

Exam 11: Segment Reporting, Transfer Pricing, and Balanced Scorecard76 Questions

Exam 12: Capital Budgeting Decisions108 Questions

Exam 13: Appendix: Managerial Analysis of Financial Statements91 Questions

Select questions type

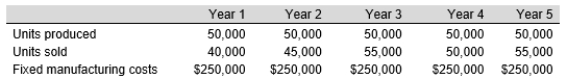

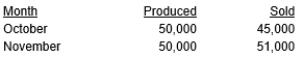

The Grand Rapid Corporation has two identical divisions: Western and Northern. Their sales, production volume, and fixed manufacturing costs have been the same for both divisions for the last five years and are as follows:

Western uses absorption costing and Northern uses variable costing. Both use FIFO inventory methods. Variable manufacturing costs are $5 per unit. Both have identical selling prices and selling and administrative expenses. There were no Year 1 beginning inventories.

Determine the difference in profits for each division for Years 1 through 5. Explain why profits differ between the two divisions.

Western uses absorption costing and Northern uses variable costing. Both use FIFO inventory methods. Variable manufacturing costs are $5 per unit. Both have identical selling prices and selling and administrative expenses. There were no Year 1 beginning inventories.

Determine the difference in profits for each division for Years 1 through 5. Explain why profits differ between the two divisions.

(Essay)

4.9/5  (38)

(38)

The beginning inventory consisted of 10,000 units, 30 percent complete and the ending inventory consisted of 8,000 units, 40 percent complete. There were 22,000 units started during the period.

Determine the equivalent units of conversion in process

(Multiple Choice)

4.9/5  (40)

(40)

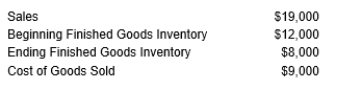

Marni Corp. obtained the following information from its accounting records:

The Cost of Goods Manufactured this period equals:

The Cost of Goods Manufactured this period equals:

(Multiple Choice)

4.7/5  (38)

(38)

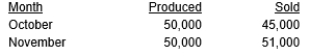

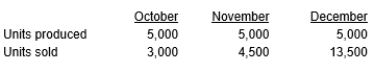

Stanley Steel Company reported the following units of production and sales for October and November of this year:

Net income under absorption costing for October was $22,000.

Net income under variable costing for November was $32,000.

Fixed manufacturing costs were $300,000 for each month.

Calculate net income for October using variable costing.

Net income under absorption costing for October was $22,000.

Net income under variable costing for November was $32,000.

Fixed manufacturing costs were $300,000 for each month.

Calculate net income for October using variable costing.

(Essay)

4.8/5  (35)

(35)

When is the cost of manufacturing equipment recognized as an expense?

(Multiple Choice)

4.9/5  (28)

(28)

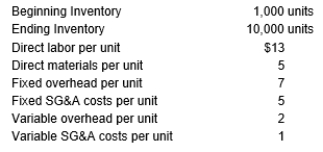

The following information pertains to Jack Corporation:

What is the value of the ending inventory using the variable costing method?

What is the value of the ending inventory using the variable costing method?

(Multiple Choice)

4.8/5  (38)

(38)

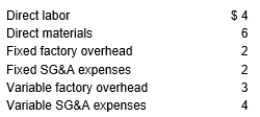

Robert Corporation has the following information for October, November, and December of the current year:

Production costs per unit (based on 10,000 units) are as follows:

Production costs per unit (based on 10,000 units) are as follows:

There were no beginning inventories for October, and all units were sold for $25. Costs are stable over the three months.

Calculate Robert's December ending inventory using the absorption costing method.

There were no beginning inventories for October, and all units were sold for $25. Costs are stable over the three months.

Calculate Robert's December ending inventory using the absorption costing method.

(Essay)

4.9/5  (34)

(34)

Under variable costing, fixed manufacturing costs are classified a period expense.

(True/False)

4.7/5  (29)

(29)

Stanley Steel Company reported the following units of production and sales for October and November of this year:

Net income under absorption costing for October was $22,000.

Net income under variable costing for November was $32,000.

Fixed manufacturing costs were $300,000 for each month.

Calculate net income for November using absorption costing.

Net income under absorption costing for October was $22,000.

Net income under variable costing for November was $32,000.

Fixed manufacturing costs were $300,000 for each month.

Calculate net income for November using absorption costing.

(Essay)

4.8/5  (32)

(32)

Partially completed goods that are in the process of being converted into a finish product are defined as:

(Multiple Choice)

4.8/5  (32)

(32)

Kevin Jewelry Company sells its product for $70 per unit. Variable manufacturing costs per unit are $20, and fixed manufacturing costs at the normal operating level of 5,000 units are $35,000. Variable expenses are $8 per unit sold. Fixed administration expenses total $40,000. Kevin Jewelry Company had no beginning inventory in 2018. During 2018, the company produced 5,000 units and sold 2,000.

What would the net income be for Kevin Jewelry Company in 2018 using both variable costing and absorption costing?

(Multiple Choice)

4.8/5  (42)

(42)

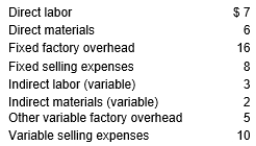

Winston Company incurred the following costs in manufacturing desk calculators:

During the period, the company produced and sold 1,000 units.

What is the cost per unit using absorption costing?

During the period, the company produced and sold 1,000 units.

What is the cost per unit using absorption costing?

(Essay)

4.8/5  (39)

(39)

The process of assigning cost to inventories as they are converted from raw material to finished goods is called product costing.

(True/False)

4.8/5  (43)

(43)

Which of the following results in an increase in work-in-process inventory?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following statements is not true regarding costing for services?

(Multiple Choice)

4.8/5  (40)

(40)

Briefly discuss and give examples of the three classifications of organizations discussed in this chapter.

(Essay)

4.7/5  (33)

(33)

Variable assumes fixed overhead costs only expire when product is sold.

(True/False)

4.9/5  (39)

(39)

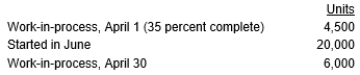

The following information pertains to the Denise Company:

Materials are added at the beginning of the process. If equivalent units in process for conversion using the weighted average method were 20,000, ending work-in-process at Apri 30:

Materials are added at the beginning of the process. If equivalent units in process for conversion using the weighted average method were 20,000, ending work-in-process at Apri 30:

(Multiple Choice)

4.8/5  (28)

(28)

Describe the difference between job-order and process costing in terms of the primary cost objective and time period for which costs are accumulated.

(Essay)

4.9/5  (37)

(37)

A single product produced by a continuous manufacturing process is an example of:

(Multiple Choice)

4.9/5  (27)

(27)

Showing 61 - 80 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)