Exam 2: Processing Accounting Information

Exam 1: Financial Accounting and Business Decisions129 Questions

Exam 2: Processing Accounting Information91 Questions

Exam 3: Accrual Basis of Accounting133 Questions

Exam 4: Understanding Accounting Information72 Questions

Exam 5: Internal Control and Cash43 Questions

Exam 6: Receivables80 Questions

Exam 7: Inventory124 Questions

Exam 8: Property, Plant and Equipment and Intangible Assets134 Questions

Exam 9: Liabilities92 Questions

Exam 10: Stockholders Equity110 Questions

Exam 11: Statement of Cash Flows57 Questions

Exam 12: Analysis and Interpretation of Financial Statements55 Questions

Exam 13: Appendix A: The Language of Accountants: Debits and Credits128 Questions

Exam 14: Appendix B: Accounting for Investments and Consolidated Financial Statements29 Questions

Exam 15: Appendix C: Accounting and the Time Value of Money9 Questions

Select questions type

Which of the following has no effect on stockholders' equity?

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

E

The analysis of each transaction must result in the accounting equation remaining in balance.

Free

(True/False)

4.8/5  (33)

(33)

Correct Answer:

True

St. Clair Motor Supplies had the following transactions during December:

Paid a note of $17,000 owed since March plus $425 for interest.

Sold $36,525 of merchandise to customers on account. Cost of goods sold was $21,250.

Paid accounts payable of $2,050.

As a result of these transactions, at year-end, liabilities and stockholders' equity would show a total:

Free

(Multiple Choice)

4.9/5  (34)

(34)

Correct Answer:

B

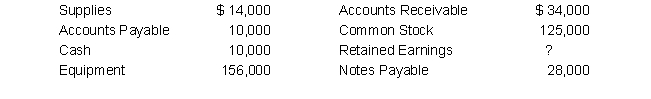

The following balance sheet information is given for Solar, Inc., at June 30, 2019:

Assume that, during the next three days, the following transactions occurred:

July 1 Paid $5,000 on accounts payable.

2 Purchased equipment for $25,000 and gave a note payable for the amount due.

3 Declared and paid a cash dividend, $4,000.

a. What was the amount of retained earnings on June 30, 2019?

b. Assume a balance sheet is prepared on July 3, 2019, after the three transactions have occurred:

(1) What amount of total assets would appear?

(2) What amount of total liabilities would appear?

(3) What amount of stockholders' equity would appear?

Assume that, during the next three days, the following transactions occurred:

July 1 Paid $5,000 on accounts payable.

2 Purchased equipment for $25,000 and gave a note payable for the amount due.

3 Declared and paid a cash dividend, $4,000.

a. What was the amount of retained earnings on June 30, 2019?

b. Assume a balance sheet is prepared on July 3, 2019, after the three transactions have occurred:

(1) What amount of total assets would appear?

(2) What amount of total liabilities would appear?

(3) What amount of stockholders' equity would appear?

(Essay)

5.0/5  (46)

(46)

An individual record of increases and decreases in specific assets, liabilities, and stockholders' equity is called:

(Multiple Choice)

4.8/5  (36)

(36)

On December 31, 2018, the balance sheet of Roberts Realty reported total assets of $200,000. The following transactions occurred during the month of January 2019:

(1) The business purchased land for $250,000, paying $100,000 cash and issuing a note payable for the balance.

(2) The business collected accounts receivable totaling $45,000.

(3) The business sold land (which had cost $50,000) for $60,000 cash.

(4) The business paid off $50,000 of Notes Payable.

What is the amount of the company's total assets on January 31, 2019?

(Multiple Choice)

4.9/5  (35)

(35)

If the beginning Cash account balance was $10,000, the ending balance was $16,800, and the total cash paid out during the period was $32,000, what amount of cash was received during the period?

(Multiple Choice)

4.8/5  (32)

(32)

When invoices are sent to customers billing them for services that have been performed, the correct transaction analysis is:

(Multiple Choice)

4.9/5  (35)

(35)

The chart of accounts is a tabular record in which business activities are analyzed in terms of debits and credits and recorded in chronological order.

(True/False)

4.9/5  (39)

(39)

Match each of the numbered transactions of a corporation with the appropriate letters, indicating the effect of the transactions (increases and decreases

-Paid cash dividends.

(Multiple Choice)

4.8/5  (40)

(40)

Horizon Company, an internet service provider, has 1,000,000 customers. The customers make electronic payments of $70 each for that month's service on the last day of each month. Horizon Company does not send any bills to their customers.

The company's transaction on the day they receive the payment will include:

(Multiple Choice)

4.8/5  (39)

(39)

The accountant at Error Prone Company recorded the purchase of $300 of supplies for cash as an increase to Supplies for $300 and an increase to Accounts Payable for $300.

Determine the effect of this error on the accounting equation of Error Prone Company.

(Multiple Choice)

4.7/5  (27)

(27)

Match each of the numbered transactions of a corporation with the appropriate letters, indicating the effect of the transactions (increases and decreases

-Billed customers for services rendered.

(Multiple Choice)

4.9/5  (35)

(35)

Match each of the numbered transactions of a corporation with the appropriate letters, indicating the effect of the transactions (increases and decreases

-Paid employees' salaries.

(Multiple Choice)

4.7/5  (35)

(35)

Match each of the numbered transactions of a corporation with the appropriate letters, indicating the effect of the transactions (increases and decreases

-Collected amounts due from customers billed in transaction 5

(Multiple Choice)

4.8/5  (41)

(41)

Prepare a horizontal worksheet with the following column headings for Mast Printers, Inc., which began business on January 1: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; Notes Payable; Common Stock; Dividends; Printing Fees Earned; Salaries Expense; Rent Expense; and Utilities Expense. Record the following January transactions. Total all columns to show that assets equal liabilities plus stockholders' equity as of January 31.

(1) Shareholders purchased $90,000 in stock.

(2) Paid rent for the month, $1,100.

(3) Purchased equipment for $30,000, giving a note payable for $30,000.

(4) Purchased supplies on account, $5,000.

(5) Billed clients for services rendered, $19,000.

(6) Paid salaries for the month, $7,800.

(7) Paid $4,000 on account for supplies purchased in transaction (4).

(8) Collected $8,700 from clients previously billed.

(9) Paid utilities for the month, $490.

(10) Paid $5,800 cash dividends.

(Essay)

4.7/5  (33)

(33)

On December 31, 2018, Frazier Company had a $61,275 balance in Accounts Receivable. During the year 2019, the company collected $100,000 from its credit customers. The December 31, 2019 balance of the Accounts Receivable was $85,325.

Determine the amount of sales on accounts for 2019.

(Multiple Choice)

4.8/5  (32)

(32)

Match each of the numbered transactions of a corporation with the appropriate letters, indicating the effect of the transactions (increases and decreases

-Made partial payment for equipment purchased in transaction 4

(Multiple Choice)

4.9/5  (40)

(40)

Match each of the numbered transactions of a corporation with the appropriate letters, indicating the effect of the transactions (increases and decreases

-A shareholder purchased stock.

(Multiple Choice)

4.8/5  (34)

(34)

Showing 1 - 20 of 91

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)