Exam 13: Appendix A: The Language of Accountants: Debits and Credits

Exam 1: Financial Accounting and Business Decisions129 Questions

Exam 2: Processing Accounting Information91 Questions

Exam 3: Accrual Basis of Accounting133 Questions

Exam 4: Understanding Accounting Information72 Questions

Exam 5: Internal Control and Cash43 Questions

Exam 6: Receivables80 Questions

Exam 7: Inventory124 Questions

Exam 8: Property, Plant and Equipment and Intangible Assets134 Questions

Exam 9: Liabilities92 Questions

Exam 10: Stockholders Equity110 Questions

Exam 11: Statement of Cash Flows57 Questions

Exam 12: Analysis and Interpretation of Financial Statements55 Questions

Exam 13: Appendix A: The Language of Accountants: Debits and Credits128 Questions

Exam 14: Appendix B: Accounting for Investments and Consolidated Financial Statements29 Questions

Exam 15: Appendix C: Accounting and the Time Value of Money9 Questions

Select questions type

Video, Inc., had the following separate situations occur during the year. The company's accountant is preparing the annual financial statements at December 31 and has asked you to prepare the adjusting entries for each situation using the journal entry form.

a. On June 1, Video, Inc. paid the annual lease amount on its warehouse space. The annual lease is $6,600 and was recorded by debiting Prepaid Rent and crediting Cash. No adjusting entries have been prepared since June 1.

b. The Unearned Revenue account has an unadjusted balance of $4,000 consisting of gift cards sold to customers. Redeemed gift cards that have not yet been recorded total $1,200.

c. The company has not yet received a bill for utilities nor paid for the month of December. The expense is estimated to be $840.

d. On December 1, Video, Inc., received $1,500 cash from a customer related to a special order. The special order was delivered to the customer on December 29 but no entry has been made to record the delivery.

e. At December 31, employee wages of $2,300 have been incurred but not paid or recorded.

f. At December 31, $440 of interest has been incurred, but not yet paid or recorded.

g. Unrecorded depreciation on equipment is $2,800.

(Essay)

4.7/5  (34)

(34)

Which of the following accounts normally has a debit balance?

(Multiple Choice)

5.0/5  (36)

(36)

At the end of the accounting period, the Service Fees Earned account has a normal balance of $76,000. The accountant makes two adjustments--one to accrue unbilled service fees of $6,000, and the other to reduce the Unearned Service Fees liability account by $900.

After the adjustments are posted, the Service Fees Earned account has a balance of:

(Multiple Choice)

4.7/5  (37)

(37)

Make T accounts for the following general ledger accounts of Mast Printers, Inc., which began business on January 1: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; Notes Payable; Common Stock; Dividends; Printing Fees Earned; Salaries Expense; Rent Expense; and Utilities Expense. Record the following January transactions in the accounts and key each entry with the transaction number.

(1) Shareholders purchased $90,000 in stock.

(2) Paid rent for the month, $1,100.

(3) Purchased equipment for $30,000, giving a note payable for $30,000.

(4) Purchased supplies on account, $5,000.

(5) Billed clients for services rendered, $19,000.

(6) Paid salaries for the month, $7,800.

(7) Paid $4,000 on account for supplies purchased in transaction (4).

(8) Collected $8,700 from clients previously billed.

(9) Paid utilities for the month, $490.

(10) Paid $5,800 cash dividends.

(Essay)

4.8/5  (42)

(42)

Which one of the following will never appear on a post-closing trial balance?

(Multiple Choice)

4.8/5  (29)

(29)

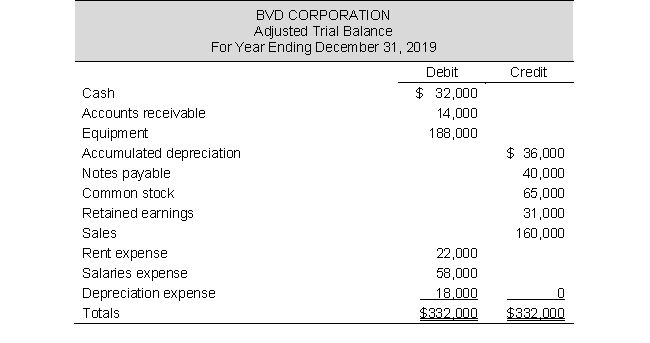

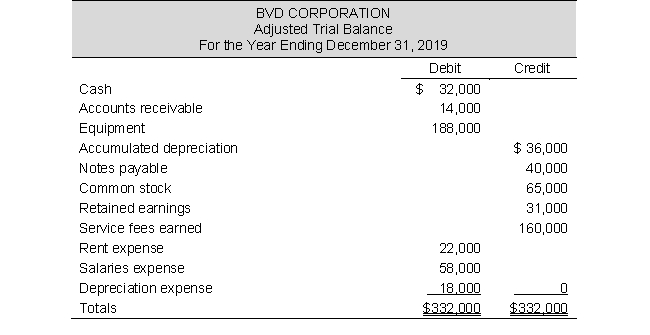

Use BVD's adjusted trial balance to prepare the company's income statement.

(Essay)

4.8/5  (42)

(42)

Paying a previously recorded invoice from a supplier (of supplies) involves:

(Multiple Choice)

4.8/5  (34)

(34)

Horizon Company, an internet service provider, has 1,000,000 customers. The customers make electronic payments of $70 each for that month's service on the last day of each month. Horizon Company does not send any bills to their customers.

The company's journal entry on the day they receive the payment will include:

(Multiple Choice)

4.9/5  (34)

(34)

Recording the borrowing of money for which a note is signed involves:

(Multiple Choice)

4.8/5  (41)

(41)

Use BVD's adjusted trial balance to prepare entries to close BVD's temporary accounts in journal entry form.

(Essay)

4.9/5  (35)

(35)

Which of the following transactions should be recorded using a compound journal entry?

(Multiple Choice)

4.8/5  (32)

(32)

Each adjusting entry affects a balance sheet account and an income statement account.

(True/False)

4.9/5  (45)

(45)

Each transaction entered in a general journal must have equal dollar amounts of debits and credits.

(True/False)

4.8/5  (32)

(32)

The analysis of each transaction must result in equal amounts being recorded as debits and as credits.

(True/False)

4.8/5  (38)

(38)

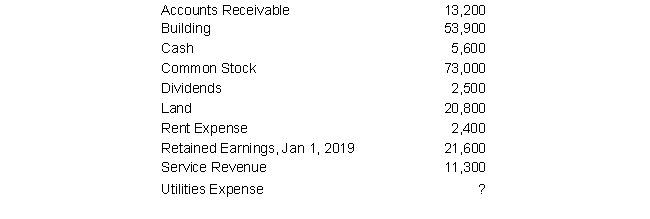

The unadjusted Trial Balance for Tyler Company shows the following accounts (in alphabetical order) on December 31, 2019. Each account shown has a normal balance.

Assuming the Trial Balance in balance, determine Tyler Company's Utilities Expense for 2019:

Assuming the Trial Balance in balance, determine Tyler Company's Utilities Expense for 2019:

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following accounts is not affected by closing entries?

(Multiple Choice)

4.7/5  (31)

(31)

Showing 81 - 100 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)