Exam 9: Reporting and Analyzing Liabilities

Exam 1: Introducing Financial Accounting69 Questions

Exam 2: Constructing Financial Statements53 Questions

Exam 3: Adjusting Accounts for Financial Statements53 Questions

Exam 4: Reporting and Analyzing Cash Flows59 Questions

Exam 5: Analyzing and Interpreting Financial Statements51 Questions

Exam 6: Reporting and Analyzing Revenues and Receivables52 Questions

Exam 7: Reporting and Analyzing Inventory57 Questions

Exam 8: Reporting and Analyzing Long-Term Operating Assets58 Questions

Exam 9: Reporting and Analyzing Liabilities58 Questions

Exam 10: Reporting and Analyzing Leases, Pensions, and Income Taxes54 Questions

Exam 11: Reporting and Analyzing Stockholders Equity55 Questions

Exam 12: Reporting and Analyzing Financial Investments56 Questions

Exam 13: Appendix : Compound Interest and the Time-Value of Money24 Questions

Select questions type

Which of the following is true concerning contingency reporting?

(Multiple Choice)

4.8/5  (32)

(32)

Market prices of bonds fluctuate because the company's obligation (in the form of principal and interest payments) remains fixed.

(True/False)

4.9/5  (39)

(39)

Cat Chow Corp. recently issued bonds with a face value of $4,000,000 and a coupon rate of 6% for 10 years. The market rate of interest is 4% and the bonds pay interest semi-annually.

A. Compute the market value of the bond using a financial calculator or Excel.

B. How much is the premium at the bond issuance date?

C. Assume the market rate remains the same after one year and Cat Chow Corp decides to retire this bond issuance at a cost of $ 4,480,000. Will there be a gain or loss on the retirement and what amount? How is this transaction recorded?

(Essay)

4.9/5  (33)

(33)

Flower Mart borrows $240,000 on July 1 with a short-term loan that has an annual interest rate of 5% which is payable on the first day of each subsequent quarter.

What will Flower Mart need to accrue on August 31, assuming that no accrual had been made since the last interest payment?

(Multiple Choice)

4.9/5  (40)

(40)

Middle Earth Company gave a creditor a 90-day, 6% note payable for $56,000 on December 1, 2016. What amount of interest will be accrued as of December 31, 2016? Where will this amount be reported in the company's financial statements?

(Essay)

4.8/5  (40)

(40)

Select the following items with each of the following:

-Short-term loans from a financial institution

(Multiple Choice)

4.8/5  (36)

(36)

On January 1, 2016, Lumos Maxima, Inc. issued $800,000, 10-year, 10% bonds for $750,000. The bonds pay interest on June 30 and December 31. The market rate is 12%.

How much is the interest expense on the bonds for the first interest payment on June 30, 2016?

(Multiple Choice)

4.9/5  (32)

(32)

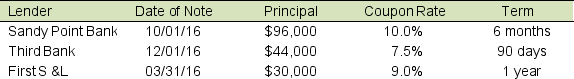

Calculate the interest accrued for each of the following notes payable owed by Four Square Company as of December 31, 2016:

(Essay)

4.7/5  (33)

(33)

Companies typically delay paying accounts payable as it represents an inexpensive form of financing.

(True/False)

4.8/5  (39)

(39)

What are the requirements for determining the financial reporting of a contingent liability? Why would a company want to keep its contingent liability as low as possible? How could a company manipulate contingent liability to its advantage?

(Essay)

4.9/5  (40)

(40)

Wheat Inc. issued a 120-day note in the amount of $300,000 on October 31, 2016 with an annual rate of 6%. What amount of interest has accrued as of December 31, 2016?

(Multiple Choice)

4.7/5  (36)

(36)

On June 30, one year before maturity, Tennis Shoes, Inc. retired $720,000 of its 10% bonds payable at 96. The bond's book value on June 30 is $660,000. Bond interest is presently paid up to the date of retirement.

How much is the gain or loss on the retirement of these bonds?

(Essay)

4.8/5  (38)

(38)

Indicate the proper financial classification (balance sheet or income statement) for each of the following accounts:

A. Loss on bond retirement

B. Bonds payable

C. Mortgage interest expense

D. Gift certificates sold to customers

E. Bonds due to be paid within 12 months

(Essay)

4.7/5  (37)

(37)

Imagination Industries plans to issue 8-year, 8%, $400,000 bonds paying interest on an annual basis, at a $5,760 premium. Which one of the following statements is true?

(Multiple Choice)

4.7/5  (34)

(34)

Which of the following transactions that impact current liabilities has a corresponding entry on the income statement?

(Multiple Choice)

4.7/5  (29)

(29)

Showing 41 - 58 of 58

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)