Exam 3: Transactions, Adjustments, and Financial Statements

Exam 1: Financial Accounting for MBAS71 Questions

Exam 2: Introducing Financial Statements90 Questions

Exam 3: Transactions, Adjustments, and Financial Statements61 Questions

Exam 4: Analyzing and Interpreting Financial Statements66 Questions

Exam 5: Revenues, Receivables, and Operating Expenses60 Questions

Exam 6: Inventory, Accounts Payable, and Long-Term Assets58 Questions

Exam 7: Current Liabilities and Long-Term Liabilities65 Questions

Exam 8: Stock Transactions, Dividends, and EPS75 Questions

Exam 9: Intercorporate Investments75 Questions

Exam 10: Leases, Pensions, and Income Taxes68 Questions

Exam 11: Cash Flows64 Questions

Exam 12: Forecasting Financial Statements70 Questions

Exam 13: Using Financial Statements for Valuation83 Questions

Select questions type

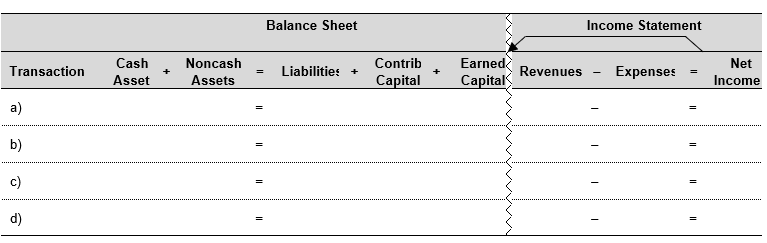

Record the following transactions in the financial statements effects template below.

a) Founder contributes $44,000 in cash in exchange for common stock.

b) Obtain $26,000 short-term bank loan.

c) Purchase equipment costing $24,000 for cash.

d) Purchase inventory costing $14,000 on account.

(Short Answer)

4.8/5  (42)

(42)

Companies make adjustments to more accurately reflect items on the income statement and the balance sheet.

(True/False)

4.9/5  (33)

(33)

Weimar World, a tax-preparation service, had a cash balance of $122,500 as of March 1, 2017. During the month of March, Weimar World had the following transactions.

Billed $496,000 in revenues on credit

Received $164,000 from customers' accounts receivable

Incurred expenses of $194,000 but only paid $87,700 cash for these expenses

Prepaid $32,200 for computer services to be used next month

What was the company's cash balance on March 31, 2017?

(Multiple Choice)

4.8/5  (31)

(31)

A company closes all of its accounts in order to zero out the balances so that next period starts with a fresh slate.

(True/False)

4.8/5  (26)

(26)

There is a certain order in which a company prepares its financial statements. First, a company prepares its balance sheet.

(True/False)

4.8/5  (36)

(36)

To close revenue accounts, a company must debit Retained Earnings because Revenue has a credit balance and debits must equal credits.

(True/False)

5.0/5  (37)

(37)

Two steps must be completed in order to prepare financial statements: recording transactions during the period and adjusting records to ensure all events are properly recorded.

(True/False)

4.9/5  (38)

(38)

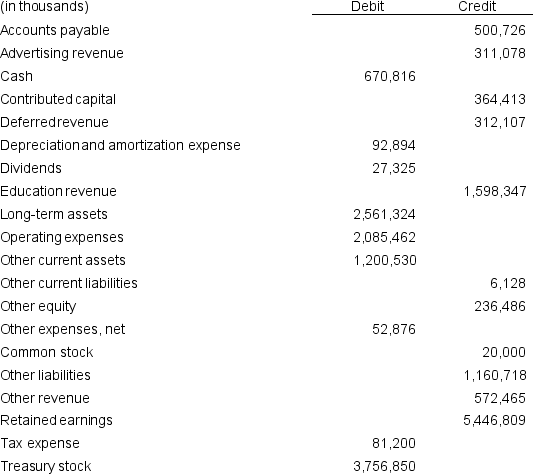

Graham Holdings Company (formerly The Washington Post Company) has the following account balances as of December 31, 2016, the end of its fiscal year.

Prepare the closing entries for the fiscal year.

Prepare the closing entries for the fiscal year.

(Short Answer)

4.9/5  (38)

(38)

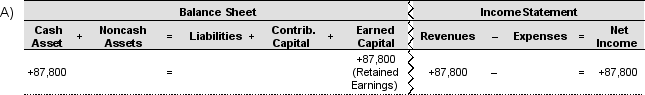

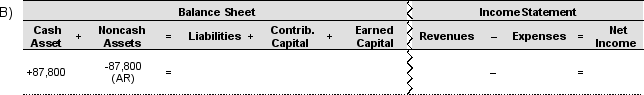

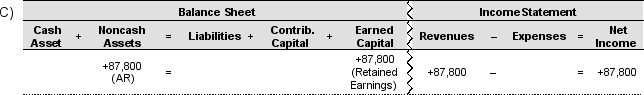

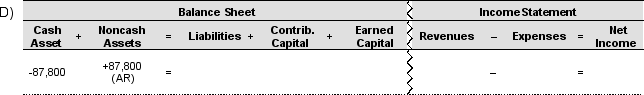

During fiscal 2016, Plastics and Synthetic Resins Company recorded cash of $87,800 from customers for accounts receivable collections.

Which of the following financial statement effects template entries captures this transaction?

(Short Answer)

4.8/5  (39)

(39)

During fiscal 2016, Stanley Black & Decker Corporation reported Net income of $965.3 million and paid dividends of $330.9 million.

Which of the following describes how these transactions would affect Stanley Black and Decker's equity accounts? (in millions)

(Multiple Choice)

4.8/5  (40)

(40)

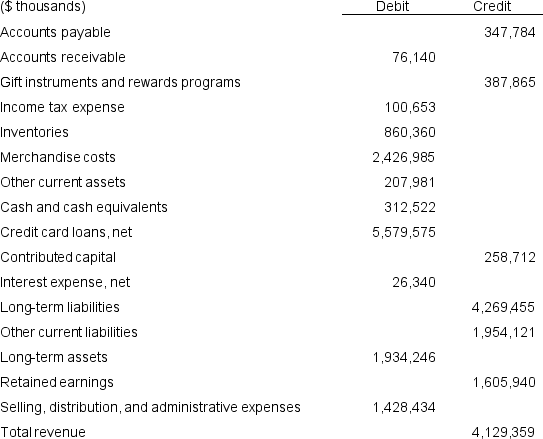

Cabela's Incorporated has the following account balances as of December 31, 2016, the end of its fiscal year.

Prepare the company's income statement and balance sheet for December 31, 2016. The company paid no dividends during the year.

Prepare the company's income statement and balance sheet for December 31, 2016. The company paid no dividends during the year.

(Short Answer)

4.9/5  (42)

(42)

Increases are recorded on the left side of asset T-accounts and on the right side of liability T-accounts.

(True/False)

4.9/5  (46)

(46)

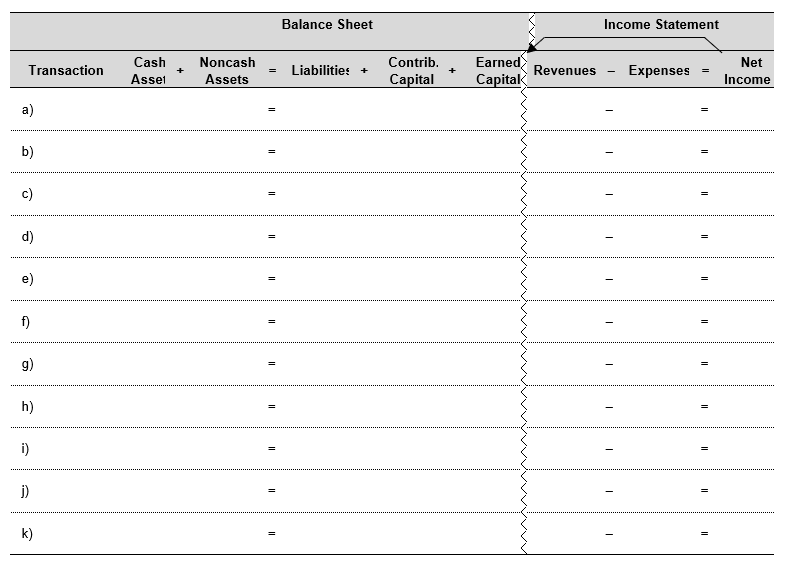

Maibrit's Bike's began operations in April 2017 and had the following transactions.

a) Owner invested $120,000 cash and a truck worth $36,000 in exchange for stock.

b) Paid $84,000 cash for 6 months' rent.

c) Purchased $300,000 of bicycle inventory on credit.

d) Sold bicycles for cash of $507,000. The cost of the bikes sold was $180,000.

e) Sold and invoiced bicycles to a client for $95,400. The cost of the bikes sold was $48,000.

f) Paid $90,000 cash for an advertising campaign in connection with Tour de France. The campaign will run over the next two of months.

g) Paid $24,000 in cash for supplies to have on hand for bike repairs.

h) Collected $60,000 from accounts receivable.

i) Paid for bikes purchased on credit in Transaction c above.

j) Paid cash dividends of $3,000.

k) Received $6,000 cash from a customer as a deposit for a custom bicycle to be built.

At the end of April, the following information is available:

i. At the end of April, $19,200 supplies remained on hand.

ii. Rent paid in Transaction b is for a lease that began on April 1.

iii. At the end of April, one-third of the advertising campaign in Transaction f was completed.

iv. The truck is expected to be used for five years (60 months).

v. The custom bicycle in Transaction k was built and delivered to the customer on April 30.

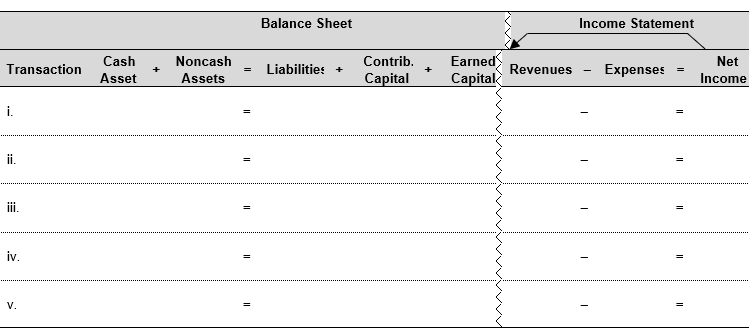

Required: Record any accounting adjustments required for items i. through v., in the financial statement effects template, that follows.

At the end of April, the following information is available:

i. At the end of April, $19,200 supplies remained on hand.

ii. Rent paid in Transaction b is for a lease that began on April 1.

iii. At the end of April, one-third of the advertising campaign in Transaction f was completed.

iv. The truck is expected to be used for five years (60 months).

v. The custom bicycle in Transaction k was built and delivered to the customer on April 30.

Required: Record any accounting adjustments required for items i. through v., in the financial statement effects template, that follows.

(Short Answer)

4.9/5  (38)

(38)

The balance sheet of Taos Promotion includes the amounts shown below. Analysis of the company's records reveals the following transactions during 2017, the company's first year of operations:

Cash received from customers, recorded as service revenue $311,475

Purchase of supplies for cash, expensed $ 43,500

Cash paid for salaries, expensed $ 28,100

Analysis of the company's balance sheet accounts reveals that at year-end, supplies on hand total $7,950, employees have earned $12,000 but have not yet been paid, and on the last day of the fiscal year, customers paid deposits of $22,050 for future promotions (this is included in total cash received from customers, above).

Required: Prepare journal entries to adjust the account balances for revenue, supplies expense and salary expense for the year-end. Prepare closing entries.

(Short Answer)

4.8/5  (33)

(33)

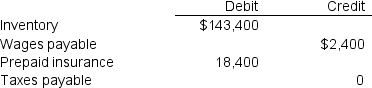

Select accounts of Pete's Pizza are shown below as of the end fiscal 2017, before any accounts have been adjusted for the current fiscal year.

Your analysis reveals additional information as follows:

The cost of inventory items on hand is $69,600.

Employee wages earned prior to year-end were $23,400. These will not be paid until the 2018 fiscal year.

The unexpired portion of the company's insurance policy at year end was $13,800.

The company's tax accountant reports that the company will owe $162,000 for income taxes for fiscal 2017.

Prepare journal entries for any required accounting adjustments.

Your analysis reveals additional information as follows:

The cost of inventory items on hand is $69,600.

Employee wages earned prior to year-end were $23,400. These will not be paid until the 2018 fiscal year.

The unexpired portion of the company's insurance policy at year end was $13,800.

The company's tax accountant reports that the company will owe $162,000 for income taxes for fiscal 2017.

Prepare journal entries for any required accounting adjustments.

(Short Answer)

4.9/5  (42)

(42)

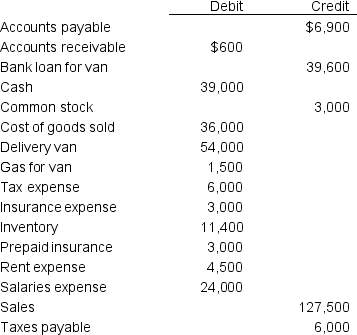

Organic Floral is an organic flower shop. After its first quarter of operations, the company's accountant prepared the following list of account balances, in alphabetical order. The accountant also tells you that net income for the quarter was $52,500.

Use the information below along with the net income information to prepare a balance sheet for Organic Floral.

(Short Answer)

4.8/5  (33)

(33)

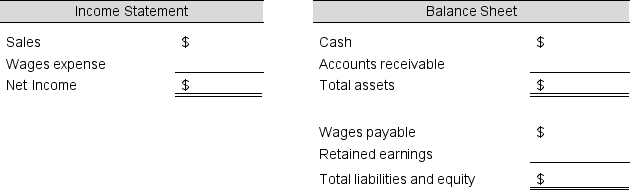

Green Garden Company made $192,000 in net income during September 2017, its first month of business. It sold its services on credit and billed its customers $360,000 for September sales. The company collected $24,000 of these receivables in September. Company employees earned September wages (the company's only expense), but those are not paid until the first of October.

Complete the following financial statements for the end of September 2017.

(Short Answer)

4.8/5  (41)

(41)

How would a purchase $400 of inventory on credit affect the income statement?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following accounts would not appear in a closing entry?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 21 - 40 of 61

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)