Exam 2: Introducing Financial Statements

Exam 1: Financial Accounting for MBAS71 Questions

Exam 2: Introducing Financial Statements90 Questions

Exam 3: Transactions, Adjustments, and Financial Statements61 Questions

Exam 4: Analyzing and Interpreting Financial Statements66 Questions

Exam 5: Revenues, Receivables, and Operating Expenses60 Questions

Exam 6: Inventory, Accounts Payable, and Long-Term Assets58 Questions

Exam 7: Current Liabilities and Long-Term Liabilities65 Questions

Exam 8: Stock Transactions, Dividends, and EPS75 Questions

Exam 9: Intercorporate Investments75 Questions

Exam 10: Leases, Pensions, and Income Taxes68 Questions

Exam 11: Cash Flows64 Questions

Exam 12: Forecasting Financial Statements70 Questions

Exam 13: Using Financial Statements for Valuation83 Questions

Select questions type

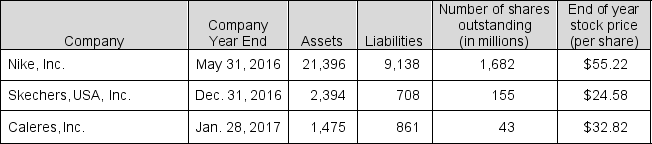

Below are selected balance sheet and market data for three shoe companies. ($ millions)

a. Calculate the market capitalization of each company.

b. Calculate the market to book ratio for each company.

c. Comment on differences you observe.

a. Calculate the market capitalization of each company.

b. Calculate the market to book ratio for each company.

c. Comment on differences you observe.

(Short Answer)

4.8/5  (30)

(30)

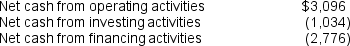

In its fiscal 2016 annual report, Nike, Inc. reported cash of $3,138 million at year end. The statement of cash flows reports the following (in millions):

What was the balance in Nike's cash account at the start of fiscal 2016?

What was the balance in Nike's cash account at the start of fiscal 2016?

(Multiple Choice)

4.7/5  (35)

(35)

Under accrual accounting principles, the cost of inventory should be reported as an expense in the income statement when it is sold, regardless of when it was purchased.

(True/False)

4.9/5  (37)

(37)

The income statements of the prior and current year are linked via the balance sheet.

(True/False)

4.7/5  (40)

(40)

In order for an asset to be reported on the balance sheet, it must be owned or controlled by the company and be expected to provide future benefits.

(True/False)

4.8/5  (36)

(36)

Identify the financial statements in which you would find each of the items listed below. Some items may appear on more than one statement. Indicate all financial statements that apply to each item. The possible choices are:

-Cash

(Multiple Choice)

5.0/5  (33)

(33)

On its fiscal year ended February 3, 2017 statement of cash flows, Dell Technologies Inc. reports the following (in millions):

What did Dell report for "Net cash from financing activities" during fiscal year ended 2017?

What did Dell report for "Net cash from financing activities" during fiscal year ended 2017?

(Multiple Choice)

4.9/5  (33)

(33)

During fiscal 2016, Kohl's had sales of $18,686 million, Cost of merchandise sold of $11,944 million, and gross profit of $6,741 million.

What was net income for 2016?

(Multiple Choice)

4.8/5  (38)

(38)

Miguel decided to open a lemonade stand on Saturdays. Match Miguel's business activities to the following balance sheet items. (Note: each balance sheet item can only be used once).

-At the end of the day, Miguel has cash in his pocket from sales.

(Multiple Choice)

4.9/5  (30)

(30)

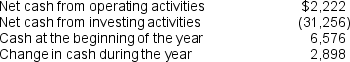

Consider the effects of the independent transactions, a through d, on a company's balance sheet, income statement, statement of cash flows, and statement of stockholders' equity.

a. Services were performed for cash.

b. Inventory was purchased for cash.

c. Wages were accrued at the end of the period.

d. Rent was paid in cash.

Complete the table below to explain the effects and financial statement linkages. Use "+" to indicate the account increases and "-" to indicate the account decreases.

(Short Answer)

4.9/5  (35)

(35)

Caterpillar Inc. reports a net loss for 2016 of $(67) million, retained earnings at the end of the year of $27,377 million, and dividends during the year of $1,802 million.

What was the company's retained earnings balance at the start of 2016?

(Multiple Choice)

4.9/5  (37)

(37)

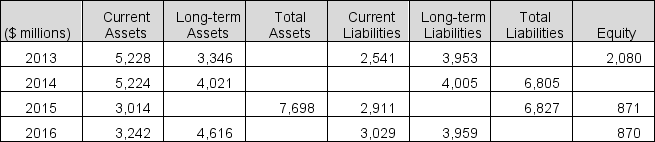

Selected balance sheet amounts for Nordstrom Inc. for four recent years follow.

Compute the missing balance sheet amounts for each of the four years.

Compute the missing balance sheet amounts for each of the four years.

(Short Answer)

4.7/5  (29)

(29)

A publicly traded company must file a Form 8-K with the SEC within four business days following a change in its certified public accounting firm.

(True/False)

4.9/5  (33)

(33)

Articulation refers to the concept that financial statements are linked to each other and linked across time.

(True/False)

4.8/5  (47)

(47)

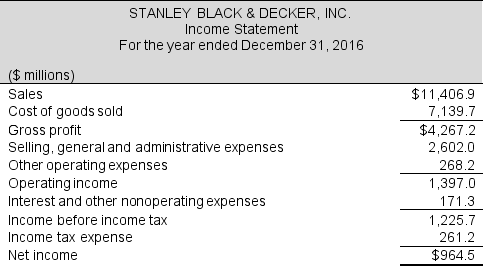

Following is Stanley Black & Decker's income statement for 2016 (in millions):

Compute Stanley Black & Decker's gross profit margin.

Compute Stanley Black & Decker's gross profit margin.

(Multiple Choice)

4.7/5  (34)

(34)

Explain the concept of articulation among the four financial statements.

(Short Answer)

4.8/5  (44)

(44)

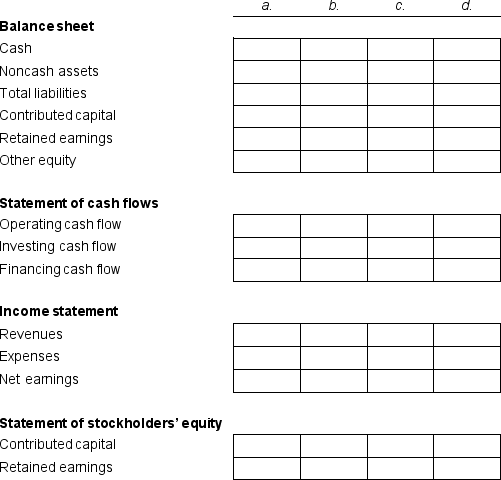

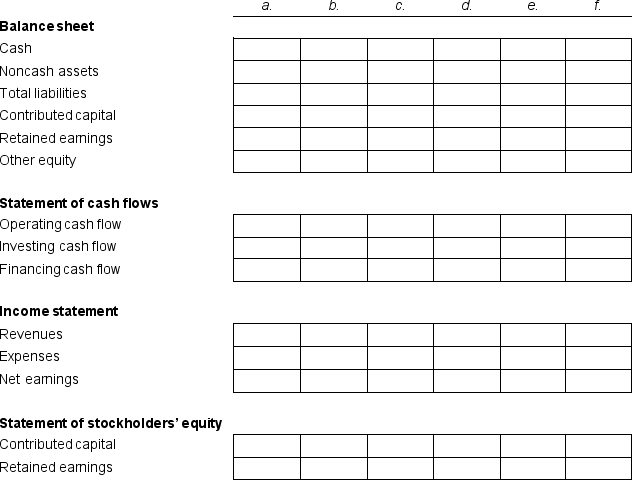

Consider the effects of the independent transactions, a through f, on a company's balance sheet, income statement, statement of cash flows, and statement of stockholders' equity.

a. Owner invests cash into the business in exchange for stock.

b. Recognizes account receivable for services provided.

c. Pays account payable with cash.

d. Buys land with cash.

e. Buys plant equipment on credit.

f. Borrows money by taking out loan at bank.

Complete the table below to explain the effects and financial statement linkages. Use "+" to indicate the account increases and "-" to indicate the account decreases.

(Short Answer)

4.9/5  (38)

(38)

Identify the financial statements in which you would find each of the items listed below. Some items may appear on more than one statement. Indicate all financial statements that apply to each item. The possible choices are:

-Trademarks

(Multiple Choice)

4.7/5  (45)

(45)

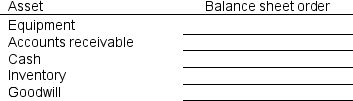

Indicate the order of appearance on the balance sheet of the assets listed on the left.

(Short Answer)

4.8/5  (42)

(42)

Showing 21 - 40 of 90

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)