Exam 9: Compound Interest: Further Topics and Applications

Exam 1: Review and Applications of Basic Mathematics205 Questions

Exam 2: Review and Applications of Algebra379 Questions

Exam 3: Ratios and Proportions148 Questions

Exam 4: Mathematics of Merchandising130 Questions

Exam 5: Applications of Linear Equations91 Questions

Exam 6: Simple Interest159 Questions

Exam 7: Applications of Simple Interest90 Questions

Exam 8: Compound Interest: Future Value and Present Value155 Questions

Exam 9: Compound Interest: Further Topics and Applications168 Questions

Exam 10: Ordinary Annuities: Future Value and Present Value137 Questions

Exam 11: Ordinary Annuities: Periodic Payment, Number of Payments, and Interest Rate107 Questions

Exam 12: Annuities Due277 Questions

Exam 13: Annuities: Special Situations20 Questions

Exam 14: Loan Amortization: Mortgages88 Questions

Exam 15: Bonds and Sinking Funds177 Questions

Exam 16: Business Investment Decisions129 Questions

Select questions type

What is the effective interest rate corresponding to a nominal annual rate of:

a) 9% compounded semiannually?

b) 9% compounded quarterly?

c) 9% compounded monthly?

(Short Answer)

4.8/5  (35)

(35)

Calculate the effective annual rate for 19.2% compounded semi-annually.

(Multiple Choice)

4.8/5  (40)

(40)

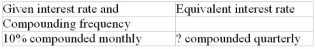

Calculate the equivalent interest rate (to the nearest 0.01%)

(Short Answer)

4.9/5  (43)

(43)

A six-year, $20,000 GIC has a maturity value of $29,625. Calculate the semi-annually compounded nominal interest rate.

(Multiple Choice)

4.7/5  (41)

(41)

The maturity value of a $5000 four-year compound- interest GIC was $6147.82. What quarterly compounded rate of interest did it earn?

(Short Answer)

4.9/5  (32)

(32)

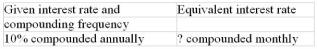

Calculate the equivalent interest rate (to the nearest 0.01%)

(Short Answer)

4.7/5  (46)

(46)

Consider the Province of Ontario strip bond in Table 9.1.

a) Calculate the bond's market price on June 1, 2009 based on the quoted yield of 5.081% compounded semiannually.

b) What would the price be on June 1, 2015 if the bond's yield remains the same?

(Short Answer)

4.9/5  (33)

(33)

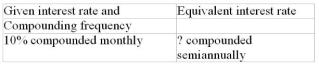

Calculate the equivalent interest rate (to the nearest 0.01%)

(Short Answer)

4.9/5  (30)

(30)

Searching a Mutual Fund Data Base Follow the instructions in the NET @ssets box earlier in this section to locate the "Mutual Funds" link in the student textbook's OLC. When the globefund. Com page loads, move your cursor over "GLOBE FUND" in the menu bar and select "Fund Selector" from the drop-down list. In the "Option C" area, you can enter the name of a particular fund. Enter "RBC Canadian Dividend" and click on "Go."

The table that loads has several tabs along its top. Select "Long-term." This brings up another table with columns giving the fund's compound annual return for 3-year, 5-year, and 10-year periods ending on the last business day of the previous month. How much would $10,000 invested in this fund 10 years earlier be worth at the end of the previous month? Repeat for the "IA Group Dividends" and the "Trans IMS Canadian Growth" funds.

(Essay)

4.9/5  (39)

(39)

To the nearest month, how long will it take an investment to increase in value by 200% if it earns 7.5% compounded semiannually?

(Short Answer)

4.9/5  (45)

(45)

At the end of 2009, the Trans IMS Canadian Growth Fund had one of the worst 10-year compound annual returns of any Canadian diversified equity mutual fund. The fund's annual returns in successive years from 2000 to 2009 inclusive were -12.8%, -38.3%, -24.1%, 25.4%, 9.2%, 18.6%, 12.0%, -0.2%, - 38.5%, and 15.6%, respectively. For 3-year, 5-year, and 10-year periods ended December 31, 2009, what were the fund's equivalent annually compounded returns?

(Short Answer)

4.9/5  (35)

(35)

Camille can obtain a residential mortgage loan from a bank at 6.5% compounded semiannually, or from an independent mortgage broker at 6.4% compounded monthly. Which source should she pick if other terms and conditions of the loan are the same? Present calculations that support your answer.

(Short Answer)

4.9/5  (43)

(43)

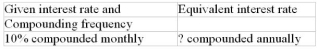

Calculate the equivalent interest rate (to the nearest 0.01%)

(Short Answer)

4.8/5  (40)

(40)

Lisa is offered a loan from a bank at 7.2% compounded monthly. A credit union offers similar terms but a rate of 7.4% compounded semiannually. Which loan should she accept? Present calculations that support your answer.

(Short Answer)

4.9/5  (25)

(25)

Which scenario had the higher periodic rate of return: "$1 grew to $2" or "$3 grew to $5"? Both investments were for the same length of time at the same compounding frequency. Justify your choice.

(Essay)

4.8/5  (41)

(41)

Showing 121 - 140 of 168

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)