Exam 19: Variable Costinga Tool for Decision Making

What are some of the drawbacks of variable costing?

It cannot be used for GAAP reporting or tax preparation, and it may cause management to overlook some of the costs of production.

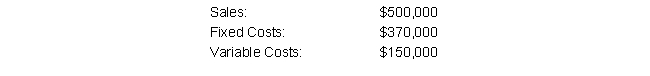

Lotso Inc. is a toy design company that serves both commercial and independent brands. Lotso recorded the following information for last month's transactions:

All projects in process at the beginning of the month are considered completed by the end of the month, and costs are tracked for each project individually. This month, fixed overhead was allocated at a rate of $5,000/project (applied evenly over the production process).

Management is concerned about their costs, and wants to get a short-term bank loan-just enough to cover their variable operating loss from this past month while projects are completed. The bank requires Lotso to submit GAAP-compliant financial statements, and will only grant a loan if they can show absorption operating income at least $10,000 greater than the loan requested.

Will Lotso be able to receive the loan needed?

All projects in process at the beginning of the month are considered completed by the end of the month, and costs are tracked for each project individually. This month, fixed overhead was allocated at a rate of $5,000/project (applied evenly over the production process).

Management is concerned about their costs, and wants to get a short-term bank loan-just enough to cover their variable operating loss from this past month while projects are completed. The bank requires Lotso to submit GAAP-compliant financial statements, and will only grant a loan if they can show absorption operating income at least $10,000 greater than the loan requested.

Will Lotso be able to receive the loan needed?

Absorption Operating Income =

Variable Operating Income + Change in Fixed Overhead applied to inventory

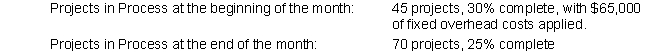

Variable Operating Income:

Change in Fixed Overhead applied to Inventory:

Change in Fixed Overhead applied to Inventory:

Fixed Overhead in ending inventory: 70 Projects × 25% complete × $5,000/project = $87,500

$87,500 - $65,000 = $22,500 Increase

Absorption Operating Income: ($20,000) + $22,500 = $2,500

Bank Loan needed: $20,000 (to cover operating loss)

Absorption operating Income required by bank: $20,000 + $10,000 = $30,000

No, Lotso will not be able to receive the loan.

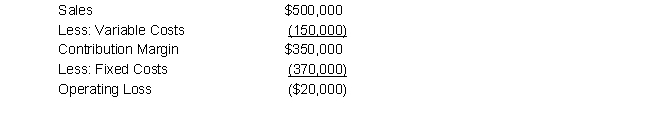

Tropical Shelters, a pavilion installation company, is trying to prepare their financial statements for the year. The company uses variable costing to track all expenses, in an effort to maintain competitive prices. However, the bank requires Tropical Shelters to submit audited financial statements in accordance with GAAP in order to continue receiving funding. Tropical Shelters has the following information regarding their work for the period:

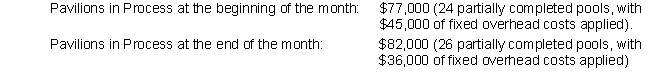

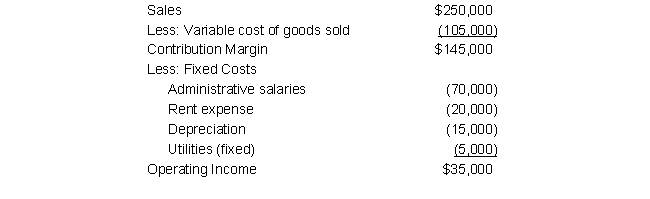

Tropical Shelters prepared the following variable costing income statement for the month:

Tropical Shelters prepared the following variable costing income statement for the month:

What is the amount of net operating income or loss that Tropical Shelters will have to report to the bank on their audited financial statements?

What is the amount of net operating income or loss that Tropical Shelters will have to report to the bank on their audited financial statements?

Absorption costing is required by GAAP. Absorption Costing Operating Income = Variable Income + Change in Fixed Overhead in Inventory

Change in Fixed Overhead: $36,000 - $45,000 = ($9,000)

Absorption Operating Income/Loss = $35,000 ($9,000) = $44,000 Net Operating Income

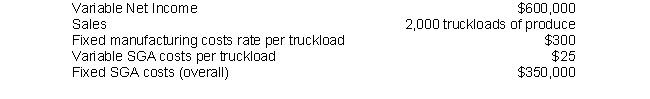

AgRanch Co. is a farming corporation that grows and sells crops in the Midwest. The company is publicly traded on the stock market: however, management prefers to use variable costing for decision purposes. The company's books are adjusted to arrive at Absorption Income for financial reporting purposes.

The company reported the following financial information for the past month:

The company tracks harvested crops that have not yet been shipped out as "in-process." This inventory of food increased from the equivalent of 50 full truckloads at the beginning of the month to 75 full truckloads at the end of the month.

What was Absorption Net Income?

The company tracks harvested crops that have not yet been shipped out as "in-process." This inventory of food increased from the equivalent of 50 full truckloads at the beginning of the month to 75 full truckloads at the end of the month.

What was Absorption Net Income?

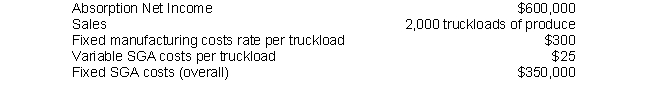

AgRanch Co. is a farming corporation that grows and sells crops in the Midwest. The company is publically traded on the stock market: however, management prefers to use variable costing for decision purposes. The company's books are adjusted to arrive at Absorption Income for financial reporting purposes.

The company reported the following financial information for the past month:

The company tracks harvested crops that have not yet been shipped out as "in-process." This inventory of food decreased from 50 truckloads at the beginning of the month to 45 truckloads at the end of the month.

What was Variable Net Income?

The company tracks harvested crops that have not yet been shipped out as "in-process." This inventory of food decreased from 50 truckloads at the beginning of the month to 45 truckloads at the end of the month.

What was Variable Net Income?

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)