Exam 2: Processing Accounting Information

Exam 1: Financial Accounting and Business Decisions113 Questions

Exam 2: Processing Accounting Information108 Questions

Exam 3: Accrual Basis of Accounting167 Questions

Exam 4: Understanding Financial Statements64 Questions

Exam 5: Accounting for Merchandising Operations90 Questions

Exam 6: Accounting for Inventory156 Questions

Exam 7: Internal Control and Cash43 Questions

Exam 8: Accounting for Receivables118 Questions

Exam 9: Accounting for Long-Lived and Intangible Assets129 Questions

Exam 10: Accounting for Liabilities119 Questions

Exam 11: Stockholders Equity108 Questions

Exam 12: Statement of Cash Flows43 Questions

Exam 13: Analysis and Interpretation of Financial Statements14 Questions

Exam 14: Overview of Managerial Accounting, Managerial Accounting Concepts and Cost Flows8 Questions

Exam 15: Cost Accounting Systemsjob Order Costing20 Questions

Exam 16: Cost Accounting Systemsprocess Costing31 Questions

Exam 17: Activity-Based Costing8 Questions

Exam 18: Cost-Volume-Profit Relationships13 Questions

Exam 19: Variable Costinga Tool for Decision Making5 Questions

Exam 20: Relevant Costs and Short-Term Decision Making19 Questions

Exam 21: Planning and Budgeting12 Questions

Exam 22: Standard Costing and Variance Analysis19 Questions

Exam 23: Flexible Budgets, Segment Analysis, and Performance Reporting15 Questions

Exam 24: Capital Budgeting27 Questions

Select questions type

Ken Baar started a company (Baar Company) by contributing $300,000 cash, and a building valued at $2,400,000. The company then purchased a machine by making a $300,000 down payment (which accounted for half its purchase price), and signed a note payable to the bank.

After recording the above transactions, Larson Company's balance sheet will show:

Assets Liabilities Stockholders' Equity

Free

(Multiple Choice)

4.8/5  (43)

(43)

Correct Answer:

D

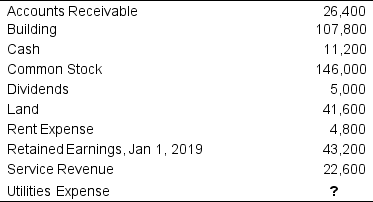

The unadjusted Trial Balance for Ann Z. Company shows the following accounts (in alphabetical order) on December 31, 2019. Each account shown has a normal balance.

Assuming the Trial Balance is in balance, determine Ann Z, Company's Utilities Expense for 2019:

Assuming the Trial Balance is in balance, determine Ann Z, Company's Utilities Expense for 2019:

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

B

During the current week, Julissa, (1) received a cash payment for services previously billed to one of her clients. Also, she (2) paid her telephone bill, and (3) bought equipment on credit.

For the three separate transactions, at least one of the journal entries will include a:

Free

(Multiple Choice)

4.8/5  (45)

(45)

Correct Answer:

D

Bousfield Company had $28,460 of Accounts Payable on September 1 and $25,520 on September 30. During September, the company paid total cash of $26,550 on accounts payable.

Determine the total purchases on account during September.

(Multiple Choice)

4.7/5  (29)

(29)

Posting is the process of transferring the debits and credits of each journal entry to the appropriate general ledger accounts.

(True/False)

4.8/5  (46)

(46)

The purchase of a delivery truck for $57,000 (on credit) was posted as debit to Delivery Trucks for $57,000, and a debit to Notes Payable for $57,000.

What effect would this error have on the trial balance?

(Multiple Choice)

4.8/5  (35)

(35)

Rabbit Company's Accounts Payable account had a balance of $22,200 on September 1, 2019, and a balance of $27,000 on September 30, 2019. During September 2019, the company made total payments of $196,800 on accounts payables.

What must have been their total purchases on account during September 2019.

(Multiple Choice)

4.8/5  (34)

(34)

A transaction caused a $200,000 increase in both assets and total liabilities. This transaction could have been:

(Multiple Choice)

4.9/5  (33)

(33)

Suzanne Mi, starting her own business, made an investment of a building to the company. The building is valued at $400,000 with a $360,000 outstanding mortgage payable.

The effect of this transaction on the accounting equation of the business would be to:

(Multiple Choice)

4.8/5  (34)

(34)

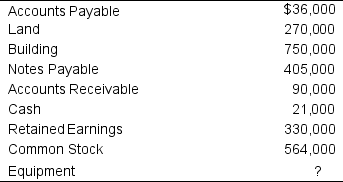

As of December 31, 2019, the Balance Sheet of Pokagon Products, Inc. contains the following items (in random order):

Determine the amount of Equipment.

Determine the amount of Equipment.

(Multiple Choice)

4.8/5  (47)

(47)

Hannibal Company's Accounts Payable account had a balance of $7,400 on September 1, 2019, and a balance of $9,000 on September 30, 2019. During September 2019, the company made total payments of $65,600 on accounts payables.

What must have been their total purchases on account during September 2019.

(Multiple Choice)

4.8/5  (40)

(40)

If the beginning Cash account balance of Firefly, Inc. was $60,000, the ending balance was $100,800, and the total cash paid out during the period was $192,000, what amount of cash was received during the period?

(Multiple Choice)

4.8/5  (32)

(32)

The Cash T-account of Rainbow, Inc. has a beginning balance of $52,000. During the year, $244,000 was debited and $241,000 was credited to the account. What is the ending balance of cash?

(Multiple Choice)

4.9/5  (38)

(38)

Posting is the process of formally recording a business transaction in the appropriate journal.

(True/False)

4.9/5  (30)

(30)

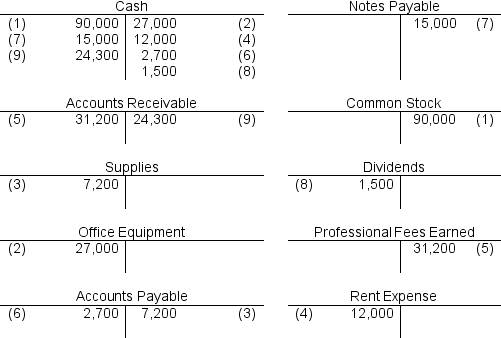

The following T-accounts contain numbered entries for the July transactions of NCN, Inc., which opened on July 1 of this year.

Give a reasonable description of each of the nine numbered transactions entered in the above accounts. Example: (1) Shareholders invested $90,000 cash in the business.

Give a reasonable description of each of the nine numbered transactions entered in the above accounts. Example: (1) Shareholders invested $90,000 cash in the business.

(Essay)

4.8/5  (36)

(36)

Patrick's Show Choir Company's Accounts Receivable account had a balance of $45,000 on September 1, 2016, and a balance of $64,200 on September 30, 2019. During September 2019, the company received cash of $118,200 from credit customers.

Determine the amount of sales on account that occurred in September 2019.

(Multiple Choice)

4.8/5  (51)

(51)

To meet its cash flow needs, a company obtained a 6 month bank loan in the amount of $10,000. Annual interest on the loan (note payable) is 10%, payable when the note is due.

What would the effect of this transaction on the company's current month accounting equation?

(Multiple Choice)

4.7/5  (37)

(37)

During its first month of operations, Lavender Company (1) borrowed $600,000 from a bank, and then (2) purchased an equipment costing $240,000 by paying cash of $120,000 and signing a long term note for the remaining amount. During the month, the company also (3) purchased inventory for $180,000 on credit, (4) performed services for clients for $360,000 on account, (5) paid $90,000 cash for accounts payable, and (6) paid $180,000 cash for utilities.

What is the amount of Stockholders' equity at the end of the month?

(Multiple Choice)

4.9/5  (41)

(41)

Didwania Company had a transaction that caused a $40,000 decrease in both assets and liabilities. This transaction could have been a(n):

(Multiple Choice)

4.9/5  (33)

(33)

Showing 1 - 20 of 108

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)