Exam 22: Single Entry and Incomplete Records

Exam 1: Entities and Financial Reporting Standards16 Questions

Exam 2: International Accounting: Institutional Framework and Standards16 Questions

Exam 3: The Nature and Objectives of Financial Accounting16 Questions

Exam 4: Accounting Principles, Concepts and Policies16 Questions

Exam 5: The Conceptual Framework of Accounting16 Questions

Exam 6: Auditing, Corporate Governance and Ethics16 Questions

Exam 7: The Accounting Equation and Its Components16 Questions

Exam 8: Basic Documentation and Books of Accounts16 Questions

Exam 9: The General Ledger16 Questions

Exam 10: The Balancing of Accounts and the Trial Balance16 Questions

Exam 11: Day Books and the Journal16 Questions

Exam 12: The Cash Book16 Questions

Exam 13: The Petty Cash Book6 Questions

Exam 14: The Final Financial Statements of Sole Traders20 Questions

Exam 15: Depreciation and Non-Current Assets20 Questions

Exam 16: Bad Debts and Provisions for Bad Debts16 Questions

Exam 17: Accruals and Prepayments20 Questions

Exam 18: The Preparation of Final Financial Statements From the Trial Balance6 Questions

Exam 19: The Bank Reconciliation Statement17 Questions

Exam 20: Control Accounts16 Questions

Exam 21: Errors and Suspense Accounts16 Questions

Exam 22: Single Entry and Incomplete Records16 Questions

Exam 23: Inventory Valuation16 Questions

Exam 24: Financial Statements for Manufacturing Entities16 Questions

Exam 25: The Final Financial Statements of Clubs16 Questions

Exam 26: The Final Financial Statements of Partnerships16 Questions

Exam 27: Changes in Partnerships16 Questions

Exam 28: Partnership Dissolution and Conversion to Company Status14 Questions

Exam 29: The Nature of Limited Companies and Their Capital16 Questions

Exam 30: The Final Financial Statements of Limited Companies14 Questions

Exam 31: Statement of Cash Flows16 Questions

Exam 32: The Appraisal of Company Financial Statements Using Ratio Analysis20 Questions

Select questions type

A business commenced with a bank balance of £6,500; it subsequently purchased goods by cheque for £20,000; gross profit mark-up was 120%; half the goods were sold for cash, less cash discount of 5%; all takings were banked.

The resulting net profit is:

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

C

You are told that the mark up on an item is 20%. If the item costs £50, then the sales price should be:

Free

(Multiple Choice)

4.9/5  (25)

(25)

Correct Answer:

A

If gross profit is £50,000 and the net profit is 25% of gross profit, the expenses must be:

Free

(Multiple Choice)

4.9/5  (31)

(31)

Correct Answer:

B

Opening inventory is £29,000, closing inventory is £31,000, purchases are £128,000, and purchase returns are £8,500.

Assume that the suppliers are always paid for in cash and returns are always received in cash, what is the charge to the income statement in the period.

(Multiple Choice)

4.9/5  (33)

(33)

Anna had an opening cash balance of £500, she received £28,000 cash in the period, paid £15,000 into the bank, paid staff wages of £3,200, paid sundry expenses of £800, paid the window cleaner £200, paid a repair man £2,000 and had £800 left on hand at the end of the year.

Anna helped herself to cash when she was short. Which of the following is correct?

(Multiple Choice)

4.9/5  (37)

(37)

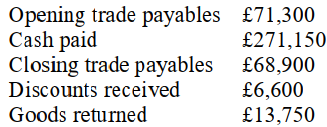

Calculate the value of purchases from the following information:

(Multiple Choice)

4.8/5  (36)

(36)

An entity sells goods earning a constant mark up of 25%. Sales revenue in the period is £250,000. Opening inventory is valued at £5,000; closing inventory is valued at £10,000. Purchases were £225,000. The owner suspects theft; calculate the expected loss from theft given all the previous figures are correct.

(Multiple Choice)

4.8/5  (42)

(42)

The net assets of Stuart Ltd. at 1 January 20X1 amounted to £128,000. During the year ended 31 December 20X1 he introduced a further £50,000 of capital and made drawings of £48,000. At 31 December 20X1 Stuart Ltd's net assets totalled £94,000

What was Stuart Ltd.s profit/ (loss) for the year ended 31 December 20X1?

(Multiple Choice)

4.9/5  (43)

(43)

B. Little owed his suppliers £95,000 at the start of the year. By the end of the year he had debts

Outstanding to suppliers of £60,000. He paid suppliers £150,000 by cheque and £25,000 in cash. The

Suppliers gave B. Little a total of £4,000 in cash discounts.

What are the purchases for the year?

(Multiple Choice)

4.8/5  (32)

(32)

The net book value of a company's non-current assets was £400,000 at 1 January 20X0. During the year to 31 December 20X0 the company sold non-current assets for £50,000, incurring a loss of £10,000. The depreciation charge for the year was £40,000. What was the net book value of the non-current assets at 31 December 20X0?

(Multiple Choice)

4.9/5  (37)

(37)

A business has the following cash and bank transactions during the year ended 31/12/X1. Opening balance: Cash £1,000, Bank £2,000 overdrawn

Cash receipts: £25,200

Cash paid: £6,400

Cash paid to bank: £11,000

Cheque payments: £16,400

Closing balance: Cash £1,200, Bank £12,400 overdrawn. What are the total cash and bank drawings?

(Multiple Choice)

4.9/5  (47)

(47)

Anna is not wealthy. Her retail business had an opening cash balance of £500, she paid £15,000 cash into the bank, paid staff wages of £3,200 cash, paid sundry expenses of £800 cash, paid the window cleaner £200 cash, paid a repair man £2,000 cash and had £800 left on hand at the end of the year. Anna did not take any cash drawings.

Which of the following is most likely to be correct?

(Multiple Choice)

4.8/5  (38)

(38)

A business has the following items extracted from its accounting records. Sales £75,000, opening inventory £5,000, closing inventory £7,500. The business applies a constant mark up of 25%. The total purchases for the year are?

(Multiple Choice)

4.8/5  (35)

(35)

The telephone account for the year ended 30 June 20X2 was as follows: Opening balance for telephone accrued at 1 July 20X2 £6,000 Payments made during the year:

1 August 20X1 for the period to 31 July 20X1 £12,000

1 November 20X1 for the period to 31 October 20X1 £14,400 1 February 20X2 for the period to 31 January 20X2 £18,000 30 June for the period to 30 April 20X2 £16,800

Which of the following is the appropriate entry for telephone in the financial statements at 30 June 20X2?

(Multiple Choice)

4.9/5  (35)

(35)

A business achieves a margin of 25% on sales revenue. Opening inventory was £36,000, closing inventory was £56,000 and purchases totalled £600,000. The sales in the period are therefore:

(Multiple Choice)

4.9/5  (39)

(39)

Opening inventory is £29,000, closing inventory is £31,000, purchases are £128,000, and purchase returns are £8,500.

There was an opening balance on the supplier's account of £10,000 and a closing balance of £12,500. How much was paid to the suppliers in the period.

(Multiple Choice)

4.8/5  (30)

(30)

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)