Exam 2: Refresher on Cost Terms Road Map

Exam 1: Cost Accounting Has Purpose108 Questions

Exam 2: Refresher on Cost Terms Road Map186 Questions

Exam 3: Cost Behavior and Estimation105 Questions

Exam 4: Cost-Volume-Profit Analysis195 Questions

Exam 5: Cost Accounting Has Purpose134 Questions

Exam 6: Mastering the Master Budget141 Questions

Exam 7: Capital Budgeting Choices and Decisions112 Questions

Exam 8: Job Costing142 Questions

Exam 9: Activity- Based Costing141 Questions

Exam 10: Variance Analysis and Standard Costing149 Questions

Exam 11: Process Costing139 Questions

Exam 12: Absorption Versus Variable Costing122 Questions

Exam 13: Data Analytics141 Questions

Exam 14: Support Department Costing135 Questions

Exam 15: Joint Costs and Decision-Making128 Questions

Exam 16: The Art and Science of Pricing to Optimize Revenue138 Questions

Exam 17: Management Control Systems and Transfer Pricing141 Questions

Exam 18: Business Strategy, Performance Measurement, and the Balanced Scorecard141 Questions

Select questions type

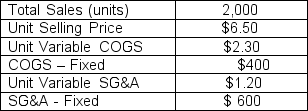

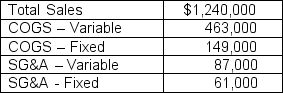

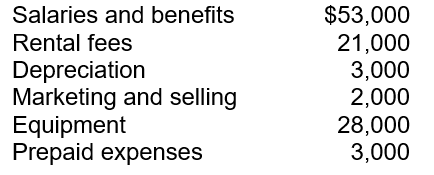

Shawna's Smoothies has the following cost information for the current month:  Shawna would like to know how profitable the business was for the current month. She is not sure which income statement format is best for her to given her insight into what is contributing to the profitability of the business. She has asked for a traditional income statement and a contribution margin income statement to be prepared (headings not required).

a) Is the operating income different based on the type of income statement prepared?

b) Which type of income statement is normally used for internal reporting purposes? Which type of income statement is normally used for external reporting purposes?

Shawna would like to know how profitable the business was for the current month. She is not sure which income statement format is best for her to given her insight into what is contributing to the profitability of the business. She has asked for a traditional income statement and a contribution margin income statement to be prepared (headings not required).

a) Is the operating income different based on the type of income statement prepared?

b) Which type of income statement is normally used for internal reporting purposes? Which type of income statement is normally used for external reporting purposes?

(Essay)

4.9/5  (36)

(36)

Manseco Manufacturing had sales revenue last year of $500,000, variable manufacturing costs of $320,000, and fixed manufacturing costs of $80,000.

a) If Manseco expects sales revenue to increase by 20% for the upcoming year, with variable manufacturing costs maintaining the same percentage relationship to sales revenue as in the previous year, with the same fixed manufacturing costs, what will the expected operating income (profit) be for Manseco?

b) If Manseco instead expects sales revenue to decline by 10% for the upcoming year, with variable manufacturing costs maintaining the same percentage relationship to sales revenue as in the previous year, with the same fixed manufacturing costs, what will the expected operating income (profit) be for Manseco?

(Essay)

4.7/5  (39)

(39)

Given the following items listed below, identify on which type(s) of business financial statements these items would normally appear , More than one selection may be included in an answer.

-Cost of Goods Sold

(Multiple Choice)

4.8/5  (41)

(41)

Match the following terms the appropriate defintion.

-Opportunity Cost

(Multiple Choice)

4.9/5  (37)

(37)

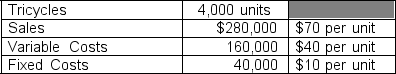

Tiny Tots Trikes (TTT), Inc. makes tricycles for toddlers. Sales and cost data is available for the current year below:  Answer the following questions regarding Tiny Tots Trikes assuming that each scenario is independent.

a) If Tiny Tots Trikes were able to increase production and sales by 2,000 units without adding extra fixed costs, what would the unit variable cost and unit fixed cost be?

b) If Tiny Tots Trikes were able to increase production and sales by 3,000 units without adding extra fixed costs, what would the operating income be and by how much would it differ from the current year's amount? What would the new unit variable cost and unit fixed cost be under this scenario?

c) If Tiny Tots Trikes is able to increase production and sales by 3,000 units but have to add additional capacity to meet demand by incurring extra fixed costs of $30,000, what would the operating income be based on these changes? What would the new unit variable cost and unit fixed cost be under this scenario?

Answer the following questions regarding Tiny Tots Trikes assuming that each scenario is independent.

a) If Tiny Tots Trikes were able to increase production and sales by 2,000 units without adding extra fixed costs, what would the unit variable cost and unit fixed cost be?

b) If Tiny Tots Trikes were able to increase production and sales by 3,000 units without adding extra fixed costs, what would the operating income be and by how much would it differ from the current year's amount? What would the new unit variable cost and unit fixed cost be under this scenario?

c) If Tiny Tots Trikes is able to increase production and sales by 3,000 units but have to add additional capacity to meet demand by incurring extra fixed costs of $30,000, what would the operating income be based on these changes? What would the new unit variable cost and unit fixed cost be under this scenario?

(Essay)

5.0/5  (31)

(31)

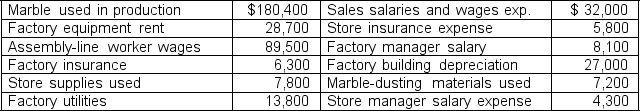

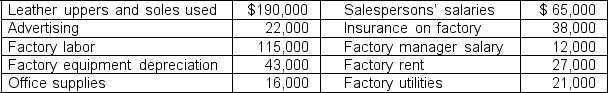

Miracle Marble, Inc. incurred the following costs for the current month to produce high-end marble countertops:  Respectively, the total manufacturing and non-manufacturing costs for Miracle Marble are

Respectively, the total manufacturing and non-manufacturing costs for Miracle Marble are

(Multiple Choice)

4.7/5  (32)

(32)

When assigning manufacturing costs to production, which account will be debited?

(Multiple Choice)

4.7/5  (36)

(36)

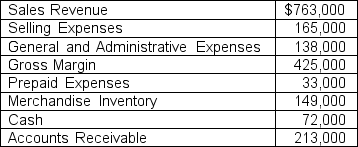

Fabulous Furs, Inc. reports the following information at the end of the current year:  What is Fabulous Furs' cost of goods sold, net income, and total current assets at year-end?

What is Fabulous Furs' cost of goods sold, net income, and total current assets at year-end?

(Essay)

4.8/5  (35)

(35)

Given the following items listed below, identify on which type(s) of business financial statements these items would normally appear , More than one selection may be included in an answer.

-Merchandise Inventory

(Multiple Choice)

4.8/5  (42)

(42)

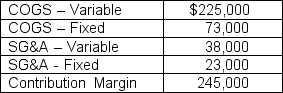

Jambany Juice, Inc. has the following information for the current fiscal year:  What are the gross margin and contribution margin for Jambany Juice, Inc.

What are the gross margin and contribution margin for Jambany Juice, Inc.

(Essay)

4.9/5  (34)

(34)

When determining the ending balances in the inventory accounts, the ending balance the Work-In-Process Inventory account represents the manufacturing costs of

(Multiple Choice)

4.9/5  (31)

(31)

Anwar, Inc. incurred the costs listed below for the month of May in manufacturing shoes.  From this list, the total product costs are

From this list, the total product costs are

(Multiple Choice)

4.8/5  (48)

(48)

Harper's Hunting and Fishing has the following information for the current fiscal year:  The Sales for Harper's Hunting and Fishing are

The Sales for Harper's Hunting and Fishing are

(Multiple Choice)

4.9/5  (34)

(34)

Vinyl Sign Suppliers makes signs for businesses. For the previous month, the company had the following information and business transactions:

Beginning Balances: Raw Materials Inventory, $28,300; Work-In-Process Inventory, $14,900; and Finished Goods Inventory, $21,400

Production data for the month: Direct materials, direct labor and manufacturing overhead costs totaling $115,000 were incurred in producing 300 vinyl signs.

Ending Balances: Raw Materials Inventory, $15,200; Work-In-Process Inventory $34,500; and Finished Goods Inventory, $13,700. What was the cost of the goods manufactured and transferred to the Finished Goods Inventory at the end of last month?

(Essay)

4.8/5  (39)

(39)

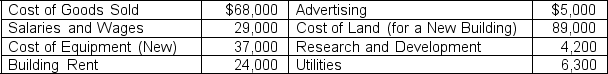

White Water Springs Rafting Company has the following cost data for its first year of operations:  Given these costs, first classify the costs as expenses or assets, and then, total the amounts.

Given these costs, first classify the costs as expenses or assets, and then, total the amounts.

(Essay)

4.9/5  (41)

(41)

At December 31, Puppy Scrub had Service Revenue of $106,000. Other pertinent data is shown below.  Compute the net income for Puppy Scrub by preparing an income statement.

Compute the net income for Puppy Scrub by preparing an income statement.

(Essay)

4.9/5  (31)

(31)

Showing 121 - 140 of 186

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)