Exam 11: Setting Performance Expectations in Large, Complex Organizations

Exam 1: Business Planning and Analysis: An Integrative Framework for Management Accounting41 Questions

Exam 2: Measuring and Evaluating Performance43 Questions

Exam 3: Defining and Using Cost Estimates71 Questions

Exam 4: Cost Pools, Capacity, and Activity- Based Costing48 Questions

Exam 5: Understanding the Management Process58 Questions

Exam 6: Planning in the Product Domain54 Questions

Exam 7: Assessing and Improving Product Profitability44 Questions

Exam 8: Setting Process Expectations48 Questions

Exam 9: Evaluating and Improving Process Performance49 Questions

Exam 10: Setting Performance Expectations at the Entity Level54 Questions

Exam 11: Setting Performance Expectations in Large, Complex Organizations65 Questions

Exam 12: Evaluating and Improving Entity Performance44 Questions

Exam 13: Setting and Achieving Targets in the Customer Domain43 Questions

Exam 14: Strategic Cost Management and the Value Chain Domain43 Questions

Select questions type

Kern Manufacturing has several divisions and evaluates performance using segment income. Since sales include transfers to other divisions, Kern has established a price for internal sales as cost plus 10%. Red Division has requested 10,000 units of Green Division's product. Green Division is selling its product externally at a 60% markup over cost. The corporate policy will encourage the Green Division to:

(Multiple Choice)

4.8/5  (37)

(37)

A cash flow occurring five years from today has a larger present value than the same cash flow occurring three years from today.

(True/False)

4.9/5  (35)

(35)

The claimed benefits flowing from a decentralized organizational structure include which of the following?

(Multiple Choice)

5.0/5  (39)

(39)

The allocation of service department costs to operating departments is more complicated when the service departments consume support from one another.

(True/False)

4.8/5  (46)

(46)

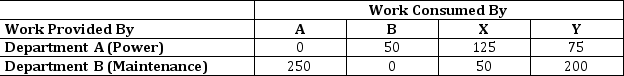

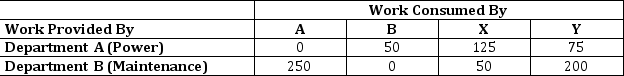

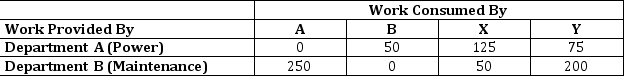

P & M Corporation manufactures products exclusively for military clients. Due to security concerns, each product is manufactured entirely within its own department. Department X specializes in communications equipment and Department Y in armor plating. Both production departments are supported by the corporation's power-generating department (Department A) and its equipment maintenance department (Department B). The work supplied by support Department A is measured in kilowatt-hours of electricity, and that in Department B is measured in labor hours. Departments A and B also consume service from one another. The work done by Departments A and B is summarized in the table below.

-The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000, respectively. Of the $80,000 of maintenance cost, what amount would be assigned to Department Y under the direct method?

-The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000, respectively. Of the $80,000 of maintenance cost, what amount would be assigned to Department Y under the direct method?

(Multiple Choice)

4.7/5  (36)

(36)

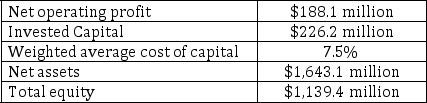

Pinehurst Company has two divisions, Household Appliances and Precision Equipment. Some recent financial metrics for the Household Appliances division are given in the table below.

What is the division's residual income?

What is the division's residual income?

(Multiple Choice)

4.7/5  (39)

(39)

One definition of the value of an economic asset is given by:

(Multiple Choice)

4.8/5  (37)

(37)

A transfer price should exclude any variable selling costs on outside sales incurred by the selling division.

(True/False)

4.7/5  (41)

(41)

P & M Corporation manufactures products exclusively for military clients. Due to security concerns, each product is manufactured entirely within its own department. Department X specializes in communications equipment and Department Y in armor plating. Both production departments are supported by the corporation's power-generating department (Department A) and its equipment maintenance department (Department B). The work supplied by support Department A is measured in kilowatt-hours of electricity, and that in Department B is measured in labor hours. Departments A and B also consume service from one another.

- Of the following approaches to allocating the costs of the power and equipment departments, which fully accounts for the costs of the work that the support departments consume from one another?

(Multiple Choice)

4.7/5  (44)

(44)

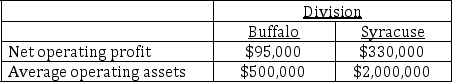

AP Industries has two divisions, located in Buffalo and Syracuse. Financial metrics for each division for the most recently concluded year are given in the table below:

For purposes of computing residual income, the corporation employs a 14% weighted average cost of capital.

Required:

a) Compute ROI for both the Buffalo and Syracuse divisions.

b) Compute residual income for both the Buffalo and Syracuse divisions.

c) How does the performance of the divisions compare? Discuss the shortcoming of residual income as a comparative measure of divisional performance.

For purposes of computing residual income, the corporation employs a 14% weighted average cost of capital.

Required:

a) Compute ROI for both the Buffalo and Syracuse divisions.

b) Compute residual income for both the Buffalo and Syracuse divisions.

c) How does the performance of the divisions compare? Discuss the shortcoming of residual income as a comparative measure of divisional performance.

(Essay)

4.8/5  (35)

(35)

The preparation of an operating budget is typically preceded by the development of a strategic plan and the identification of specific action plans to allocate scarce resources.

(True/False)

4.8/5  (39)

(39)

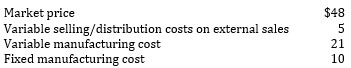

Manhattan Corporation has several divisions that operate as decentralized profit centers. At the present time, the Fabrication Division has excess capacity of 5,000 units with respect to the UT-371 circuit board, a popular item in many digital applications. Information about the circuit board follows.

Manhattan's Electronic Assembly Division wants to purchase 4,500 circuit boards either internally, or else use a similar board in the marketplace that sells for $46. The Electronic Assembly Division's management feels that if the first alternative is pursued, a price concession is justified, given that both divisions are part of the same firm. To optimize the overall goals of Manhattan, the minimum price to be charged for the board from the Fabrication Division to the Electronic Assembly Division should be:

Manhattan's Electronic Assembly Division wants to purchase 4,500 circuit boards either internally, or else use a similar board in the marketplace that sells for $46. The Electronic Assembly Division's management feels that if the first alternative is pursued, a price concession is justified, given that both divisions are part of the same firm. To optimize the overall goals of Manhattan, the minimum price to be charged for the board from the Fabrication Division to the Electronic Assembly Division should be:

(Multiple Choice)

4.8/5  (36)

(36)

Many companies assess performance using what are called non-GAAP measures of income. These measures violate generally accepted accounting principles by excluding some items when computing company income while including others. For example, some measures exclude charges for depreciation and amortization. Using such measures is an attempt to overcome:

(Multiple Choice)

4.8/5  (33)

(33)

In the United States, generally accepted accounting principles require that research and development expenditures be charged against income in the periods in which they are incurred. Application of this principle:

(Multiple Choice)

4.9/5  (37)

(37)

A minimum transfer price should cover the marginal cost of producing the transferred product plus any opportunity costs incurred by the selling division.

(True/False)

4.8/5  (34)

(34)

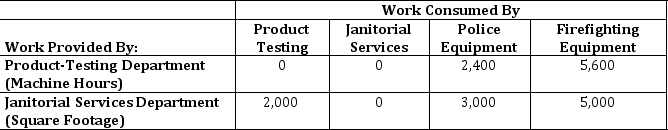

Star Products, Inc., produces safety equipment for first responders in both police and fire departments. The company has two operating departments: one specializing in equipment for police and the other in equipment for firefighters. The company also has two service departments. The product-testing department subjects the products of both operating divisions to exhaustive testing since external product failures are totally unacceptable. The janitorial department performs general cleaning for the other departments. The work in product testing is highly automated and, as a result, its cost is allocated based on machine hours. The costs of janitorial support are allocated based on the square footage occupied by the consuming departments. Budgeted costs for the coming year are $840,000 for the product-testing department and $420,000 for the janitorial services department. The table below contains data regarding budgeted measures of support to be provided by the service departments in the coming year.

Required:

a) Determine the amount of product testing and janitorial services costs that would be charged to the two operating departments using direct allocation.

b) Determine the amount of product testing and janitorial services costs that would be charged to the two operating departments using sequential allocation.

c) Which method of allocating the service department costs should be used? Why?

Required:

a) Determine the amount of product testing and janitorial services costs that would be charged to the two operating departments using direct allocation.

b) Determine the amount of product testing and janitorial services costs that would be charged to the two operating departments using sequential allocation.

c) Which method of allocating the service department costs should be used? Why?

(Essay)

4.8/5  (38)

(38)

P & M Corporation manufactures products exclusively for military clients. Due to security concerns, each product is manufactured entirely within its own department. Department X specializes in communications equipment and Department Y in armor plating. Both production departments are supported by the corporation's power-generating department (Department A) and its equipment maintenance department (Department B). The work supplied by support Department A is measured in kilowatt-hours of electricity, and that in Department B is measured in labor hours. Departments A and B also consume service from one another.

-The work done by Departments A and B is summarized in the table below.

The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000 respectively. What fraction of the kilowatt-hours provided by the power department is consumed by the maintenance department?

The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000 respectively. What fraction of the kilowatt-hours provided by the power department is consumed by the maintenance department?

(Multiple Choice)

4.8/5  (41)

(41)

P & M Corporation manufactures products exclusively for military clients. Due to security concerns, each product is manufactured entirely within its own department. Department X specializes in communications equipment and Department Y in armor plating. Both production departments are supported by the corporation's power-generating department (Department A) and its equipment maintenance department (Department B). The work supplied by support Department A is measured in kilowatt-hours of electricity, and that in Department B is measured in labor hours. Departments A and B also consume service from one another. The work done by Departments A and B is summarized in the table below.

- The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000, respectively. If P & M Corporation elects to use the step-down method and begins the allocation with the $80,000 of maintenance cost, what amount of the $80,000 of maintenance cost should be assigned to the power department in the first step?

- The costs of power and maintenance for the coming year are budgeted to be $200,000 and $80,000, respectively. If P & M Corporation elects to use the step-down method and begins the allocation with the $80,000 of maintenance cost, what amount of the $80,000 of maintenance cost should be assigned to the power department in the first step?

(Multiple Choice)

4.8/5  (40)

(40)

Allowing buying divisions to make purchases from external suppliers will eliminate transfer pricing problems.

(True/False)

4.9/5  (32)

(32)

Showing 21 - 40 of 65

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)