Exam 2: An Introduction to Cost Terms and Purposes

Exam 1: The Accountants Vital Role in Decision Making33 Questions

Exam 2: An Introduction to Cost Terms and Purposes60 Questions

Exam 3: Cost-Volume-Profit Analysis41 Questions

Exam 4: Job Costing49 Questions

Exam 5: Activity-Based Costing and Management40 Questions

Exam 6: Master Budget and Responsibility Accounting50 Questions

Exam 7: Flexible Budgets, Variances, and Management Control: I47 Questions

Exam 8: Flexible Budgets, Variances, and Management Control: II35 Questions

Exam 9: Income Effects of Denominator Level on Inventory Valuation52 Questions

Exam 10: Analysis of Cost Behaviour80 Questions

Exam 11: Decision Making and Relevant Information54 Questions

Exam 12: Pricing Decisions, Product Profitability Decisions, and Cost Management36 Questions

Exam 13: Strategy, Balanced Scorecard, and Profitability Analysis43 Questions

Exam 14: Period Cost Allocation38 Questions

Exam 15: Cost Allocation: Joint Products and Byproducts57 Questions

Exam 16: Revenue and Customer Profitability Analysis29 Questions

Exam 17: Process Costing50 Questions

Exam 18: Spoilage, Rework, and Scrap62 Questions

Exam 19: Inventory Cost Management Strategies46 Questions

Exam 20: Capital Budgeting: Methods of Investment Analysis42 Questions

Exam 21: Transfer Pricing and Multinational Management Control Systems45 Questions

Exam 22: Multinational Performance Measurement and Compensation62 Questions

Select questions type

Which of the following formulas determine cost of goods sold in a manufacturing entity?

(Multiple Choice)

4.8/5  (42)

(42)

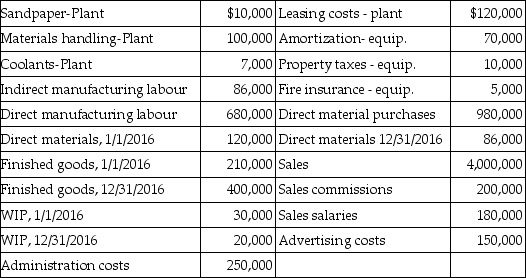

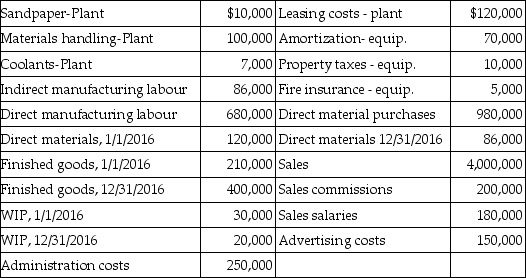

Use the information below to answer the following question(s).

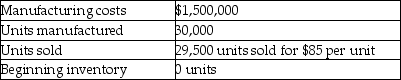

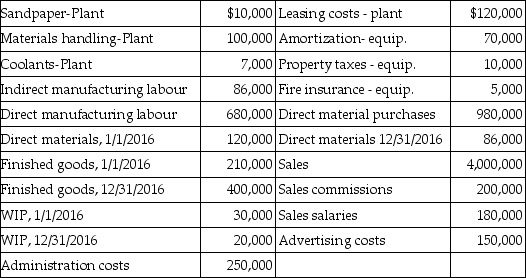

Consider the following data of the Vancouver Company for the year 2016:

-What is the unit cost for the plant leasing cost for 2016 assuming plant leasing costs are for the production of 2,000,000 units?

-What is the unit cost for the plant leasing cost for 2016 assuming plant leasing costs are for the production of 2,000,000 units?

(Multiple Choice)

4.9/5  (42)

(42)

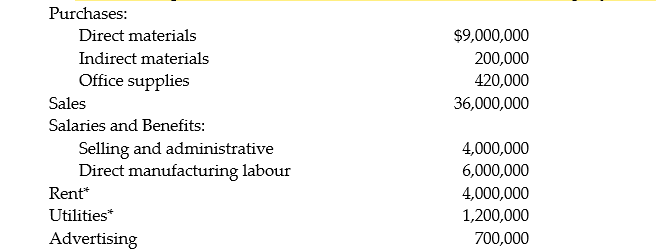

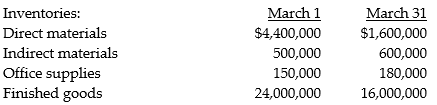

The following information is taken from the records of Britton Company for March:

* Of these costs, 60 percent are assigned to manufacturing and 40 percent to selling and administration.

Required:

a. Prepare a schedule of cost of goods manufactured.

b. Prepare an income statement for the month.

c. Compute the prime costs using a two-part production costing system, conversion costs, and indirect manufacturing costs.

* Of these costs, 60 percent are assigned to manufacturing and 40 percent to selling and administration.

Required:

a. Prepare a schedule of cost of goods manufactured.

b. Prepare an income statement for the month.

c. Compute the prime costs using a two-part production costing system, conversion costs, and indirect manufacturing costs.

(Essay)

4.7/5  (35)

(35)

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-factory supervisor's salaries

(Multiple Choice)

4.8/5  (34)

(34)

A manufacturing company contracts with the labour union to guarantee full employment for all employees with at least 10 years seniority. The Company expects to be working at capacity for the next 2 years (the life of the contract), so this was seen as a bargaining concession without any cost to the company. On average, an employee earns $30 per hour, including benefits. The work force consists of 800 employees, with seniority ranging from 1 year to 18 years.

Required:

Analyze the direct labour cost in term of variable costs, fixed costs, and the relevant range.

(Essay)

4.8/5  (37)

(37)

Use the information below to answer the following question(s).

Ontario Industries Inc. had the following activities during the year:

-What is the amount of the manufacturing overhead incurred at Ontario Industries Inc.?

-What is the amount of the manufacturing overhead incurred at Ontario Industries Inc.?

(Multiple Choice)

4.8/5  (31)

(31)

Use the information below to answer the following question(s).

Consider the following data of the Vancouver Company for the year 2016:

-What is the unit cost for the direct materials for 2016 assuming direct materials costs are for the production of 1,014,000 units?

-What is the unit cost for the direct materials for 2016 assuming direct materials costs are for the production of 1,014,000 units?

(Multiple Choice)

4.9/5  (40)

(40)

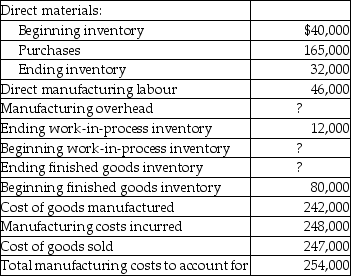

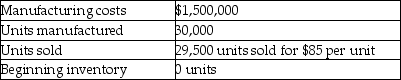

Answer the following question(s) using the information below.

The following information pertains to Alleigh's Mannequins:

-What is the amount of ending finished goods inventory?

-What is the amount of ending finished goods inventory?

(Multiple Choice)

4.8/5  (39)

(39)

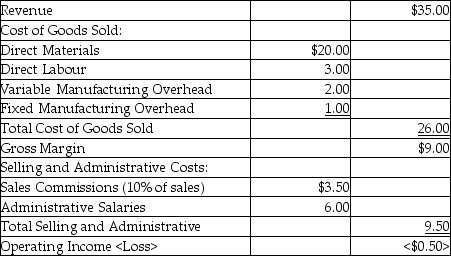

Use the information below to answer the following question(s).

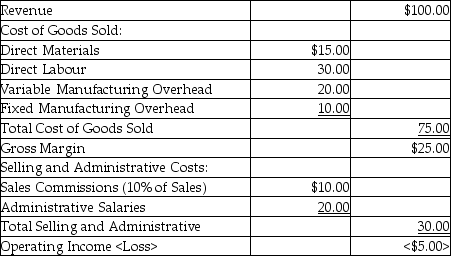

Big Island Coffee Co. produced and sold 120,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate last year's operating income when the company produced and sold 120,000 units.

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate last year's operating income when the company produced and sold 120,000 units.

(Multiple Choice)

4.8/5  (38)

(38)

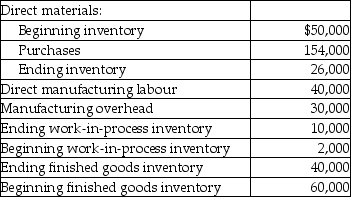

Use the information below to answer the following question(s).

Montreal Industries Inc. had the following activities during the year:

-What is Montreal's cost of goods manufactured during the year?

-What is Montreal's cost of goods manufactured during the year?

(Multiple Choice)

4.7/5  (35)

(35)

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-safety hats and shoes

(Multiple Choice)

4.7/5  (35)

(35)

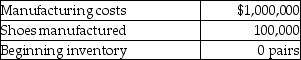

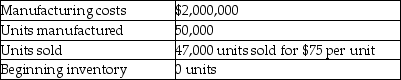

Answer the following question(s) using the information below.

The following information pertains to Alleigh's Mannequins:

-What is the average manufacturing cost per unit?

-What is the average manufacturing cost per unit?

(Multiple Choice)

5.0/5  (31)

(31)

Use the information below to answer the following question(s).

The following information pertains to Payton's Shoe Manufacturing:

99,500 pairs of shoes are sold during the year for $18.

-What is Payton's manufacturing cost per pair of shoes?

99,500 pairs of shoes are sold during the year for $18.

-What is Payton's manufacturing cost per pair of shoes?

(Multiple Choice)

4.8/5  (30)

(30)

Use the information below to answer the following question(s).

Macadamia Co. produced and sold 40,000 units last year. Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate this year's operating income if the company plans to produce and sell 60,000 units.

Fixed manufacturing overhead and administrative salaries are fixed costs. The per unit amounts are based on last year's production.

-Calculate this year's operating income if the company plans to produce and sell 60,000 units.

(Multiple Choice)

4.7/5  (38)

(38)

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which ar e listed below. Match the type of cost with the most appropriate cost pool or as a period cost.

-fringe benefits for factory workers

(Multiple Choice)

4.7/5  (40)

(40)

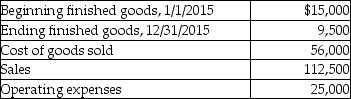

The following information pertains to Tom's Country Wood Shop:

What is the cost of goods manufactured for 2015?

What is the cost of goods manufactured for 2015?

(Multiple Choice)

4.8/5  (41)

(41)

Use the information below to answer the following question(s).

Consider the following data of the Vancouver Company for the year 2016:

-What is the unit cost for the direct materials for 2016 assuming direct materials are for the production of 507,000 units?

-What is the unit cost for the direct materials for 2016 assuming direct materials are for the production of 507,000 units?

(Multiple Choice)

4.8/5  (39)

(39)

Gimble Manufacturing Inc. makes vibration control springs for heating, ventilating, and air conditioning (HVAC) equipment. Materials cost $52 per spring set, and the machinists are paid $44 per hour. A machinist can produce four sets of springs per hour. Fixed manufacturing costs for springs are $5,000 per period. Non-manufacturing spring set costs are fixed at $11,000 per period. Each spring set sells for $75 and Gimble sells on average 4,000 spring sets per period.

Required:

a. Competition has entered the market and is selling spring sets for an introductory price of $66. Can Gimble Manufacturing Inc.meet this price and still make a profit?

b. How would your answer to requirement a. change if Gimble sells on average 8,000 spring sets per period.

c. What should Gimble Manufacturing Inc.'s management do in the short-run and for the long-term if it appears that $66 is going to be the new market price for the future.

(Essay)

4.7/5  (39)

(39)

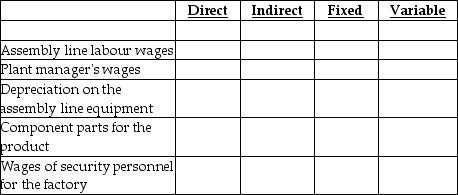

Whippany manufacturing wants to estimate costs for each product they produce at its Troy plant. The Troy plant produces three products at this plant, and runs two flexible assembly lines. Each assembly line can produce all three products.

Required:

a. Classify each of the following costs as either direct or indirect for each product.

b. Classify each of the following costs as either fixed or variable with respect to the number of units produced of each product.

(Essay)

4.8/5  (43)

(43)

Answer the following question using the information below.

Pederson Company reported the following:

-What is the amount of finished goods inventory?

-What is the amount of finished goods inventory?

(Multiple Choice)

4.8/5  (43)

(43)

Showing 41 - 60 of 60

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)