Exam 4: Economic Efficiency, Government Price Setting, and Taxes

Exam 1: Economics: Foundations and Models145 Questions

Exam 2: Trade-Offs, Comparative Advantage, and the Market System151 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply159 Questions

Exam 4: Economic Efficiency, Government Price Setting, and Taxes127 Questions

Exam 5: Externalities, Environmental Policy, and Public Goods141 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply149 Questions

Exam 7: Comparative Advantage and the Gains From International Trade125 Questions

Exam 8: Consumer Choice and Behavioral Economics154 Questions

Exam 9: Technology, Production, and Costs169 Questions

Exam 10: Firms in Perfectly Competitive Markets153 Questions

Exam 11: Monopolistic Competition140 Questions

Exam 12: Oligopoly: Firms in Less Competitive Markets130 Questions

Exam 13: Monopoly and Antitrust Policy146 Questions

Exam 14: The Markets for Labour and Other Factors of Production149 Questions

Exam 15: Public Choice, Taxes, and the Distribution of Income134 Questions

Exam 16: Pricing Strategy132 Questions

Exam 17: Firms, the Stock Market, and Corporate Governance137 Questions

Select questions type

The difference between the ________ and the ________ from the sale of a product is called producer surplus.

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

A

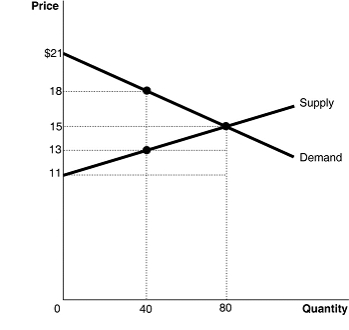

Figure 4.3

Figure 4.3 shows the market for tiger shrimp. The market is initially in equilibrium at a price of $15 and a quantity of 80. Now suppose producers decide to cut output to 40 in order to raise the price to $18.

-Refer to Figure 4.3.What is the value of producer surplus at a price of $18?

Figure 4.3 shows the market for tiger shrimp. The market is initially in equilibrium at a price of $15 and a quantity of 80. Now suppose producers decide to cut output to 40 in order to raise the price to $18.

-Refer to Figure 4.3.What is the value of producer surplus at a price of $18?

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

A

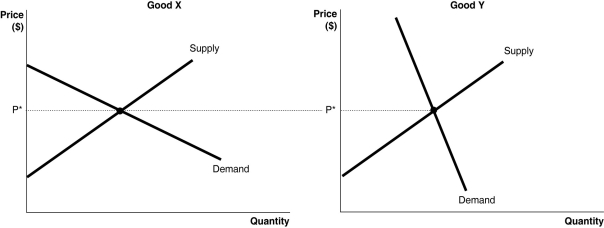

Figure 4.11

-Refer to Figure 4.11.The figure above illustrates the markets for two goods, Good X and Good Y.Suppose an identical dollar tax is imposed in each market.

a.Compare the consumer burden and producer burden in each market.Illustrate your answer graphically.

b.If the goal of the government is to raise revenue with minimum impact to quantity consumed, in which market should the tax be imposed?

c.If the goal of the government is to discourage consumption, in which market should the tax be imposed?

-Refer to Figure 4.11.The figure above illustrates the markets for two goods, Good X and Good Y.Suppose an identical dollar tax is imposed in each market.

a.Compare the consumer burden and producer burden in each market.Illustrate your answer graphically.

b.If the goal of the government is to raise revenue with minimum impact to quantity consumed, in which market should the tax be imposed?

c.If the goal of the government is to discourage consumption, in which market should the tax be imposed?

(Essay)

4.8/5  (26)

(26)

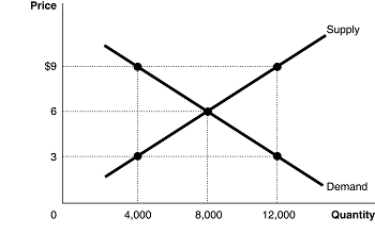

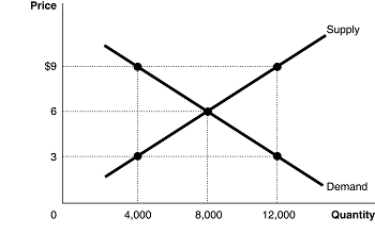

Figure 4.4

-Refer to Figure 4.4.The figure above represents the market for pecans.Assume that this is a competitive market.If the price of pecans is $3

-Refer to Figure 4.4.The figure above represents the market for pecans.Assume that this is a competitive market.If the price of pecans is $3

(Multiple Choice)

4.8/5  (38)

(38)

Table 4.3

Hourly Wage (dollars) Quantity of Labour Supplied Quantity of Labour Demanded \ 7.50 530,000 650,000 8.50 550,000 630,000 9.50 570,000 610,000 10.50 590,000 590,000 11.50 610,000 570,000 12.50 630,000 550,000

Table 4.3 shows the demand and supply schedules for the labour market in the city of Oshawa.

-Refer to Table 4.3.If a minimum wage of $9.50 is mandated there will be a

(Multiple Choice)

4.8/5  (30)

(30)

In a province with rent-controlled apartments, all of the following are true except

(Multiple Choice)

4.7/5  (37)

(37)

Economists have shown that the burden of a tax is the same whether the tax is collected from the buyer or the seller.Why, then, are gasoline and cigarette taxes imposed on sellers?

(Multiple Choice)

4.8/5  (38)

(38)

What is "tax incidence"? What determines tax incidence in a competitive market?

(Essay)

4.9/5  (38)

(38)

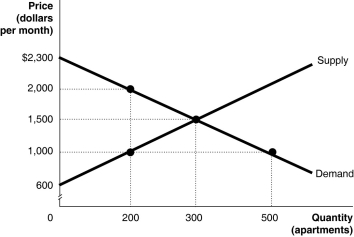

Figure 4.5

Figure 4.5 shows the market for apartments in Springfield. Recently, the government imposed a rent ceiling of $1,000 per month.

-Refer to Figure 4.5.What is the value of producer surplus after the imposition of the ceiling?

Figure 4.5 shows the market for apartments in Springfield. Recently, the government imposed a rent ceiling of $1,000 per month.

-Refer to Figure 4.5.What is the value of producer surplus after the imposition of the ceiling?

(Multiple Choice)

4.8/5  (41)

(41)

Figure 4.4

-Refer to Figure 4.4.The figure above represents the market for pecans.Assume that this is a competitive market.If the price of pecans is $3, what changes in the market would result in an economically efficient output?

-Refer to Figure 4.4.The figure above represents the market for pecans.Assume that this is a competitive market.If the price of pecans is $3, what changes in the market would result in an economically efficient output?

(Multiple Choice)

4.9/5  (34)

(34)

Two economists estimated the benefit people get from visiting Gros Morn Nation Park in Newfoundland and Labrador.The economists found

(Multiple Choice)

4.7/5  (36)

(36)

In cities with rent controls, the actual rents paid can be higher than the legal maximum.One explanation for this is

(Multiple Choice)

4.8/5  (39)

(39)

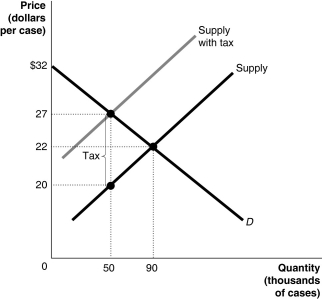

Figure 4.8

Figure 4.8 shows the market for beer. The government plans to impose a unit tax in this market.

-Refer to Figure 4.8.For each unit sold, the price sellers receive after the tax (net of tax)is

Figure 4.8 shows the market for beer. The government plans to impose a unit tax in this market.

-Refer to Figure 4.8.For each unit sold, the price sellers receive after the tax (net of tax)is

(Multiple Choice)

4.8/5  (42)

(42)

Table 4.1

Consumer Willingness to Pay Tom \ 40 Dick 30 Harriet 25

-Refer to Table 4.1.The table above lists the highest prices three consumers, Tom, Dick and Harriet, are willing to pay for a short-sleeved polo shirt.If the price of the shirts falls from $28 to $20

(Multiple Choice)

4.9/5  (39)

(39)

Suppose a price floor on sparkling wine is proposed by the Health Minister of the country of Vinyardia.What will be the likely effect on the market for sparkling wine in Vinyardia?

(Multiple Choice)

4.9/5  (46)

(46)

In order to prevent a massive surplus of milk, the government

(Multiple Choice)

4.9/5  (30)

(30)

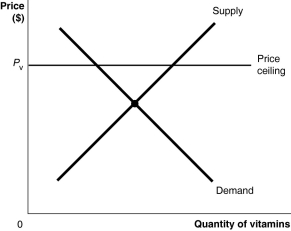

Figure 4.7

-Refer to Figure 4.7 which shows the market for vitamins.Suppose the government imposes a price ceiling of Pᵥ.How will the price ceiling affect the quantity supplied, quantity demanded and quantity exchanged?

-Refer to Figure 4.7 which shows the market for vitamins.Suppose the government imposes a price ceiling of Pᵥ.How will the price ceiling affect the quantity supplied, quantity demanded and quantity exchanged?

(Essay)

4.9/5  (34)

(34)

Showing 1 - 20 of 127

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)