Exam 11: Money, Banks and the Reserve Bank of Australia

Exam 1: Economics: Foundations and Models160 Questions

Exam 2: Choices and Trade Offs in the Market192 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply201 Questions

Exam 4: Gdp: Measuring Total Production, Income and Economic Growth123 Questions

Exam 5: Economic Growth, the Financial System and Business Cycles132 Questions

Exam 6: Long-Run Economic Growth: Sources and Policies118 Questions

Exam 7: Unemployment120 Questions

Exam 8: Inflation110 Questions

Exam 9: Aggregate Expenditure and Output in the Short Run138 Questions

Exam 10: Aggregate Demand and Aggregate Supply Analysis134 Questions

Exam 11: Money, Banks and the Reserve Bank of Australia123 Questions

Exam 12: Monetary Policy116 Questions

Exam 13: Fiscal Policy163 Questions

Exam 14: Macroeconomics in an Open Economy141 Questions

Exam 15: The International Financial System145 Questions

Select questions type

Which of the following is not a function of money?

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

D

When a grocery store accepts your $10 note in exchange for bread and milk, this illustrates that the $10 note is serving as a:

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

A

If, during a deposit expansion, not all money is re-deposited into the banking system and some leaks out as currency, then the real world multiplier is:

(Multiple Choice)

4.8/5  (38)

(38)

If some people who receive bank loans hold part of the amount as currency instead of depositing the full amount, the deposit multiplier to be ________ it would have been if all loans are fully deposited in banks.

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following is used by the Reserve Bank of Australia as the main measure of monetary movements in Australia?

(Multiple Choice)

4.9/5  (36)

(36)

The Reserve Bank of Australia intervenes in the financial markets mostly to stop interest rates from changing.

(True/False)

4.9/5  (42)

(42)

Governments in the world today issue fiat money that cannot be redeemed for gold.

(True/False)

4.9/5  (27)

(27)

What is 'commodity money'? Give an example.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

4.9/5  (35)

(35)

When a worker gets paid weekly but pays his bills at the end of the month, money functions as __________ during the month.

(Multiple Choice)

4.9/5  (33)

(33)

The 'quantity' equation becomes the basis for a theory when we assume that velocity of money is constant.

(True/False)

4.8/5  (28)

(28)

What are the implications of the 'quantity theory of money' for monetary policy and price stability?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

4.9/5  (41)

(41)

The simple deposit multiplier is the ratio of the amount of:

(Multiple Choice)

4.8/5  (31)

(31)

A car dealer sells you a car today in exchange for money in the future. This illustrates which function of money?

(Multiple Choice)

4.8/5  (27)

(27)

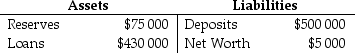

Suppose that the bank has the following balance sheet:

If the bank's reserve ratio is 0.1, what is the maximum the bank can loan out? Suppose that the bank intends to loan out the maximum amount it can. Show the immediate impact of the loan on the bank's balance sheet.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

If the bank's reserve ratio is 0.1, what is the maximum the bank can loan out? Suppose that the bank intends to loan out the maximum amount it can. Show the immediate impact of the loan on the bank's balance sheet.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

4.9/5  (39)

(39)

Explain whether a cash deposit into a bank is an 'asset' or a 'liability' for the bank.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

4.9/5  (34)

(34)

If you transfer all of your currency to your demand deposit account, then initially, M1 will ________ and M3 will ________.

(Multiple Choice)

5.0/5  (47)

(47)

Suppose that you want to buy a new car and so you transfer $10 000 of your funds from a fixed term bank account into your demand deposit account. Carefully explain how this affects M1 and M3.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

(Essay)

4.7/5  (33)

(33)

Showing 1 - 20 of 123

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)