Exam 8: Application: the Costs of Taxation

Exam 1: Ten Principles of Economics218 Questions

Exam 2: Thinking Like an Economist239 Questions

Exam 3: Interdependence and the Gains From Trade207 Questions

Exam 4: The Market Forces of Supply and Demand351 Questions

Exam 5: Elasticity and Its Application230 Questions

Exam 6: Supply, demand, and Government Policies248 Questions

Exam 7: Consumers, producers, and the Efficiency of Markets216 Questions

Exam 8: Application: the Costs of Taxation222 Questions

Exam 9: Application: International Trade182 Questions

Exam 10: Externalities210 Questions

Exam 11: Public Goods and Common Resources173 Questions

Exam 12: The Design of the Tax System200 Questions

Exam 13: The Costs of Production209 Questions

Exam 14: Firms in Competitive Markets261 Questions

Exam 15: Monopoly239 Questions

Exam 16: Monopolistic Competition191 Questions

Exam 17: Oligopoly198 Questions

Exam 18: The Markets for the Factors of Production180 Questions

Exam 19: Earnings and Discrimination167 Questions

Exam 20: Income Inequality and Poverty163 Questions

Exam 21: The Theory of Consumer Choice191 Questions

Exam 22: Frontiers of Microeconomics141 Questions

Select questions type

Suppose that policymakers are considering placing a tax on either of two markets.In Market A,the tax will have a significant effect on the price consumers pay,but it will not affect equilibrium quantity very much.In Market B,the same tax will have only a small effect on the price consumers pay,but it will have a large effect on the equilibrium quantity.In which market will the tax have a larger deadweight loss

Free

(Multiple Choice)

4.8/5  (43)

(43)

Correct Answer:

B

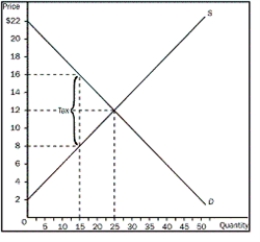

Figure 8-6

-Refer to Figure 8-6.What would consumer surplus be after the tax is levied on the seller

-Refer to Figure 8-6.What would consumer surplus be after the tax is levied on the seller

Free

(Multiple Choice)

4.8/5  (28)

(28)

Correct Answer:

A

John has been in the habit of mowing Willa's lawn each week for $20.John's opportunity cost is $15,and Willa would be willing to pay $25 to have her lawn mowed.What is the maximum tax the government can impose on lawn mowing without discouraging John and Willa from continuing their mutually beneficial arrangement

Free

(Essay)

5.0/5  (38)

(38)

Correct Answer:

If the tax is less than $10,there will exist a price at which both John and Willa will still benefit from the lawn-mowing arrangement.If the tax is $10,a price can be set that will leave both John and Willa neither better nor worse off from the lawn-mowing arrangement.If the tax is greater than $10,all possible prices will leave at least one of the parties worse off from the lawn-mowing arrangement.

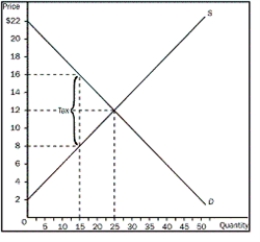

Figure 8-3

-Refer to Figure 8-3.What is the amount of deadweight loss as a result of the tax

-Refer to Figure 8-3.What is the amount of deadweight loss as a result of the tax

(Multiple Choice)

5.0/5  (40)

(40)

What did Ronald Reagan obviously believe about the labour supply curve

(Multiple Choice)

4.9/5  (26)

(26)

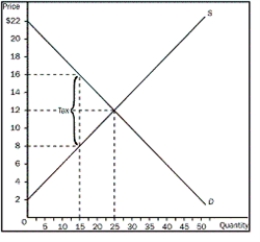

Figure 8-5

-Refer to Figure 8-5.What would happen to total surplus in this market if the tax were imposed on the seller

-Refer to Figure 8-5.What would happen to total surplus in this market if the tax were imposed on the seller

(Multiple Choice)

4.8/5  (33)

(33)

What happens when a tax is levied on the labour force and the labour supply curve is relatively elastic

(Multiple Choice)

4.9/5  (43)

(43)

The more elastic the supply and demand curves in a market,the more taxes in that market distort behaviour,and the more likely it is that a tax cut will raise tax revenue.

(True/False)

5.0/5  (35)

(35)

Often,the tax revenue collected by the government equals the reduced welfare of buyers and sellers caused by the tax.

(True/False)

4.9/5  (36)

(36)

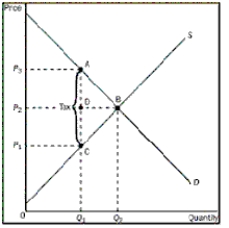

Figure 8-4

-Refer to Figure 8-4.Which area represents the total surplus (consumer,producer,and government) with the tax

-Refer to Figure 8-4.Which area represents the total surplus (consumer,producer,and government) with the tax

(Multiple Choice)

4.8/5  (38)

(38)

Figure 8-6

-Refer to Figure 8-6.What would the total surplus with the tax be

-Refer to Figure 8-6.What would the total surplus with the tax be

(Multiple Choice)

4.7/5  (35)

(35)

Assume that the demand for fries is relatively inelastic and that the demand for poutine is relatively elastic.If the same percentage tax were placed on both goods,the tax on which product would create a larger deadweight loss

(Multiple Choice)

4.9/5  (34)

(34)

Consider the following two statements:

1) “A tax that has no deadweight loss cannot raise any revenue for the government.”

2) “A tax that raises no revenue for the government cannot have any deadweight loss.” Which one, if any, is correct? Explain.

(Essay)

4.8/5  (42)

(42)

If the supply curve is more elastic,all else equal,the deadweight loss from a given tax will be larger.

(True/False)

4.9/5  (29)

(29)

Figure 8-5

-Refer to Figure 8-5.If the tax is imposed on the buyer,what would the producer surplus be

-Refer to Figure 8-5.If the tax is imposed on the buyer,what would the producer surplus be

(Multiple Choice)

4.9/5  (29)

(29)

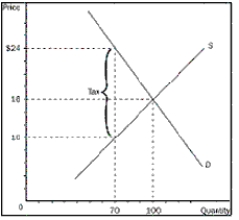

Figure 8-2

-Refer to Figure 8-2.What is the equilibrium price and quantity before the tax

-Refer to Figure 8-2.What is the equilibrium price and quantity before the tax

(Multiple Choice)

4.8/5  (35)

(35)

The more inelastic the demand and supply curves,the greater the deadweight loss of a tax.

(True/False)

4.8/5  (35)

(35)

Figure 8-6

-Refer to Figure 8-6.What would the total surplus with the tax levied on the buyer be

-Refer to Figure 8-6.What would the total surplus with the tax levied on the buyer be

(Multiple Choice)

4.8/5  (27)

(27)

Figure 8-4

-Refer to Figure 8-4.Which area represents the loss in total welfare resulting from the levying of the tax on the seller

-Refer to Figure 8-4.Which area represents the loss in total welfare resulting from the levying of the tax on the seller

(Multiple Choice)

4.8/5  (38)

(38)

Showing 1 - 20 of 222

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)