Exam 8: Taxes

Exam 1: Getting Started337 Questions

Exam 2: The Usand Global Economies201 Questions

Exam 3: The Economic Problem273 Questions

Exam 4: Demand and Supply322 Questions

Exam 5: Elasticities of Demand and Supply335 Questions

Exam 6: Efficiency and Fairness of Markets352 Questions

Exam 7: Government Actions in Markets239 Questions

Exam 8: Taxes267 Questions

Exam 9: Global Markets in Action276 Questions

Exam 10: Externalities300 Questions

Exam 11: Public Goods and Common Resources177 Questions

Exam 12: Markets With Private Information101 Questions

Exam 13: Consumer Choice and Demand287 Questions

Exam 14: Production and Cost266 Questions

Exam 15: Perfect Competition275 Questions

Exam 16: Monopoly377 Questions

Exam 17: Monopolistic Competition213 Questions

Exam 18: Oligopoly222 Questions

Exam 19: Markets for Factors of Production178 Questions

Exam 20: Economic Inequality155 Questions

Select questions type

The loss to society resulting from a tax includes the

Free

(Multiple Choice)

4.9/5  (43)

(43)

Correct Answer:

A

Suppose that the elasticity of demand for insulin is 0.1, the elasticity of demand for oranges is 1.2, and the elasticity of supply for insulin and oranges is 0.4.If the government imposes a 10 percent tax on both insulin and oranges, the decrease in the quantity of oranges is ________ the decrease in the quantity of insulin.

Free

(Multiple Choice)

4.9/5  (31)

(31)

Correct Answer:

A

To levy a tax based on the benefits principle to pay for a bridge, the government

Free

(Multiple Choice)

4.7/5  (23)

(23)

Correct Answer:

C

A sales tax on cigarettes would likely decrease the quantity demanded by a smaller amount

(Multiple Choice)

4.8/5  (42)

(42)

Why do sellers pay all of a tax when supply is perfectly inelastic?

(Multiple Choice)

4.8/5  (35)

(35)

Joan's income is $60,000 and she pays $6,000 in taxes.Juan's income is $40,000 and he pays $7,000 in taxes.This situation violates

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following types of taxes generates the most revenue for governments in the United States?

(Multiple Choice)

4.8/5  (35)

(35)

Sellers bear the entire incidence of a tax on a good.This outcome can occur if

(Multiple Choice)

4.8/5  (39)

(39)

The tax ________ the price paid by the buyer by ________ per MP3 player.

(Multiple Choice)

4.8/5  (21)

(21)

When a tax is imposed on a good, at the after-tax equilibrium the marginal benefit of the last unit produced ________ the marginal cost.

(Multiple Choice)

4.8/5  (33)

(33)

If there is an income tax levied on labor income, the labor demand curve ________ and the labor supply curve ________.

(Multiple Choice)

4.8/5  (41)

(41)

"For the U.S.personal income tax, the average tax rate is greater than the marginal tax rate." Is the previous statement correct or incorrect?

(Essay)

4.9/5  (44)

(44)

Because the U.S.income tax is a progressive tax, taxing married couples as two single persons can violate

(Multiple Choice)

4.7/5  (35)

(35)

What is the difference between vertical equity and horizontal equity?

(Essay)

5.0/5  (30)

(30)

The benefits principle of fairness of taxes is the proposition that

(Multiple Choice)

4.9/5  (37)

(37)

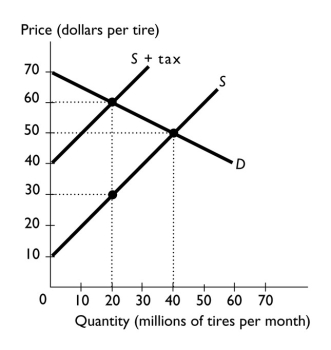

-The figure above shows the market for tires.The figure shows that the government has imposed a tax of ________ per tire and that ________ pay most of the tax.

-The figure above shows the market for tires.The figure shows that the government has imposed a tax of ________ per tire and that ________ pay most of the tax.

(Multiple Choice)

4.8/5  (26)

(26)

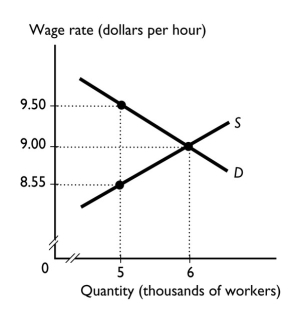

-In the labor market shown in the graph, the government introduces a 10 percent income tax.The employer pays ________ cents of the tax and the employee pays ________ cents of the tax.

-In the labor market shown in the graph, the government introduces a 10 percent income tax.The employer pays ________ cents of the tax and the employee pays ________ cents of the tax.

(Multiple Choice)

4.8/5  (37)

(37)

Showing 1 - 20 of 267

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)