Exam 16: Auditing Operations and Completing the Audit

Exam 1: The Role of the Public Accountant in the American Economy56 Questions

Exam 2: Professional Standards69 Questions

Exam 3: Professional Ethics76 Questions

Exam 4: Legal Liability of Cpas61 Questions

Exam 5: Audit Evidence and Documentation92 Questions

Exam 6: Audit Planning, understanding the Client, assessing Risks, and Responding84 Questions

Exam 7: Internal Control97 Questions

Exam 8: Consideration of Internal Control in an Information Technology Environment76 Questions

Exam 9: Audit Sampling91 Questions

Exam 10: Cash and Financial Investments69 Questions

Exam 11: Accounts Receivable, notes Receivable, and Revenue73 Questions

Exam 12: Inventories and Cost of Goods Sold64 Questions

Exam 13: Property,plant,and Equipment: Depreciation and Depletion46 Questions

Exam 14: Accounts Payable and Other Liabilities57 Questions

Exam 15: Debt and Equity Capital45 Questions

Exam 16: Auditing Operations and Completing the Audit83 Questions

Exam 17: Auditors Reports73 Questions

Exam 18: Integrated Audits of Public Companies49 Questions

Exam 19: Additional Assurance Services: Historical Financial Information65 Questions

Exam 20: Additional Assurance Services: Other Information55 Questions

Exam 21: Internal, operational, and Compliance Auditing51 Questions

Select questions type

Internal control over payroll is enhanced when the personnel department distributes payroll checks.

(True/False)

4.9/5  (30)

(30)

If management fails to list an unasserted claim in the letter of inquiry to a lawyer,the lawyer is not required to inform the auditors of the omission.

(True/False)

4.9/5  (45)

(45)

Auditors have a responsibility to report on all FASB-required supplementary information for publicly-traded companies.

(True/False)

4.8/5  (38)

(38)

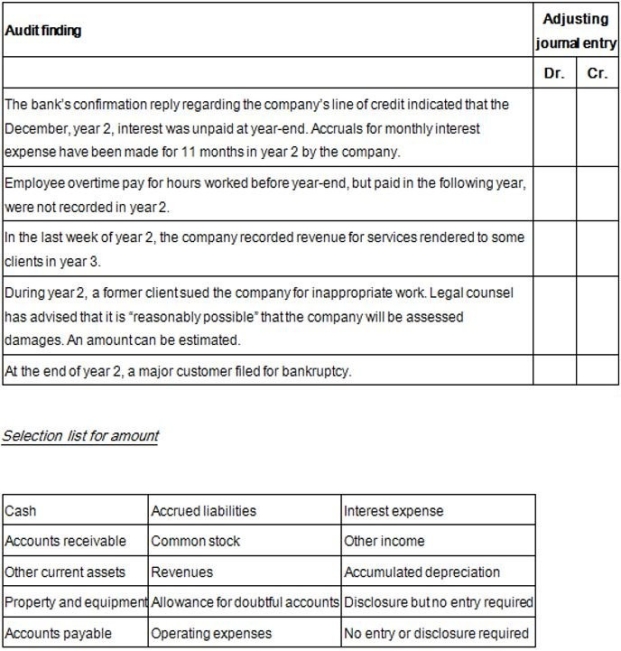

During the course of the year 2 audit of Smithsone Company,the auditor discovered the following situations that may or may not require an adjusting journal entry.Each audit finding is independent of any of the other findings.Select the account or accounts that would comprise the adjusting journal entry,if required,to correct the audit finding.Accounts may be used once,more than once,or not at all.

(Essay)

4.8/5  (28)

(28)

Auditors often request that the audit client send a letter of inquiry to those attorneys who have been consulted with respect to litigation,claims,or assessments.The primary reason for this request is to provide the auditors with:

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following is the best reason why the auditors should consider observing a client's distribution of regular payroll checks?

(Multiple Choice)

4.8/5  (34)

(34)

Management estimates the company's allowance for doubtful accounts as $200,000,and the auditors develop an estimate that suggests that the amount should be between $230,000 and $250,000,with all points in that interval equally likely.The judgmental misstatement in this situation is:

(Multiple Choice)

4.8/5  (39)

(39)

An example of an internal control weakness is to assign the payroll department the responsibility for:

(Multiple Choice)

5.0/5  (45)

(45)

The auditor's primary means of obtaining corroboration of management's information concerning litigation is a:

(Multiple Choice)

4.9/5  (29)

(29)

If,after issuing an audit report,the auditors find that they have failed to perform certain significant audit procedures they should first:

(Multiple Choice)

4.8/5  (42)

(42)

If not adjusted,a situation in which the total of uncorrected misstatements in the financial statements exceeds a material amount is likely to lead to an audit report modification.

(True/False)

4.8/5  (40)

(40)

The date the auditor grants the client permission to use the audit report in connection with the financial statements is the:

(Multiple Choice)

5.0/5  (42)

(42)

Dual-dating of an audit report extends the auditors' liability for disclosure through the later date for all areas of the financial statements.

(True/False)

4.8/5  (39)

(39)

Which of the following subsequent events might require an adjustment to the client's financial statements?

(Multiple Choice)

4.8/5  (36)

(36)

A refusal by a lawyer to furnish information related to litigation included in the letter of inquiry is likely to result in:

(Multiple Choice)

4.9/5  (42)

(42)

Which of the following procedures would an auditor most likely perform prior to the balance sheet date?

(Multiple Choice)

4.9/5  (33)

(33)

Auditors are concerned with the existence of loss contingencies that may affect the client's financial statements.One way that the auditors obtain evidence about existing loss contingencies is through the lawyer's letter.

a.Describe the information that the auditors wish to obtain about the litigation being handled by a lawyer.

b.Describe three other procedures that are used by auditors to discover existing loss contingencies.

(Essay)

4.8/5  (40)

(40)

In auditing the balance sheet,most revenue and expense accounts are also audited.Which accounts are most likely to be audited when auditing Accounts Receivable?

(Multiple Choice)

4.9/5  (44)

(44)

Which of the following information need not be reported in the auditors' report of a nonpublic company if the information is considered to be properly stated after performing appropriate procedures?

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following summarizes the threshold at which auditors are required to request management to record any identified factual misstatements that are:

(Multiple Choice)

4.9/5  (37)

(37)

Showing 41 - 60 of 83

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)